Question: t e of return is expected to increase 11) The stock of ABC, Inc. has a beta or Thema by by 5%. Beta predicts that

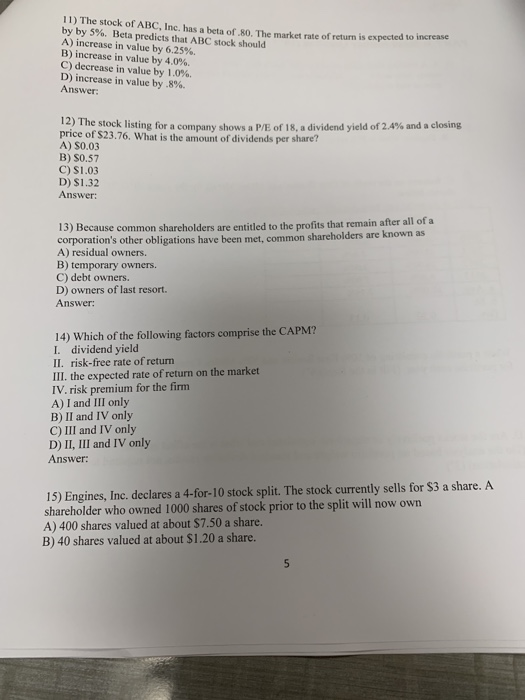

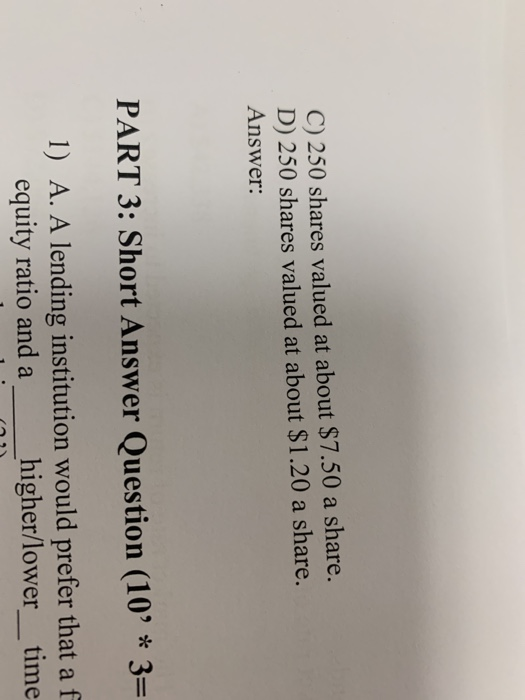

t e of return is expected to increase 11) The stock of ABC, Inc. has a beta or Thema by by 5%. Beta predicts that ABC stock should A) increase in value by 6.25%. B) increase in value by 4.0% C) decrease in value by 1.0%. D) increase in value by .8%. Answer: 12) The stock listing for a company show P /E 18. a dividend yield of 2.4% and a closing price of $23.76. What is the amount of dividends per share? A) S0.03 B) 50.57 C) S1.03 D) $1.32 Answer: 13) Because common shareholders are entitled to the profits that remain after all of a corporation's other obligations have been met common shareholders are known as A) residual owners. B) temporary owners. C) debt owners. D) owners of last resort. Answer: 14) Which of the following factors comprise the CAPM? I dividend yield II. risk-free rate of return III. the expected rate of return on the market IV. risk premium for the firm A) I and III only B) II and IV only C) III and IV only D) II, III and IV only Answer: 15) Engines, Inc. declares a 4-for-10 stock split. The stock currently sells for $3 a share. A shareholder who owned 1000 shares of stock prior to the split will now own A) 400 shares valued at about $7.50 a share. B) 40 shares valued at about $1.20 a share. C) 250 shares valued at about $7.50 a share. D) 250 shares valued at about $1.20 a share. Answer: PART 3: Short Answer Question (10' * 3= 1) A. A lending institution would prefer that a f equity ratio and a higher/lower_time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts