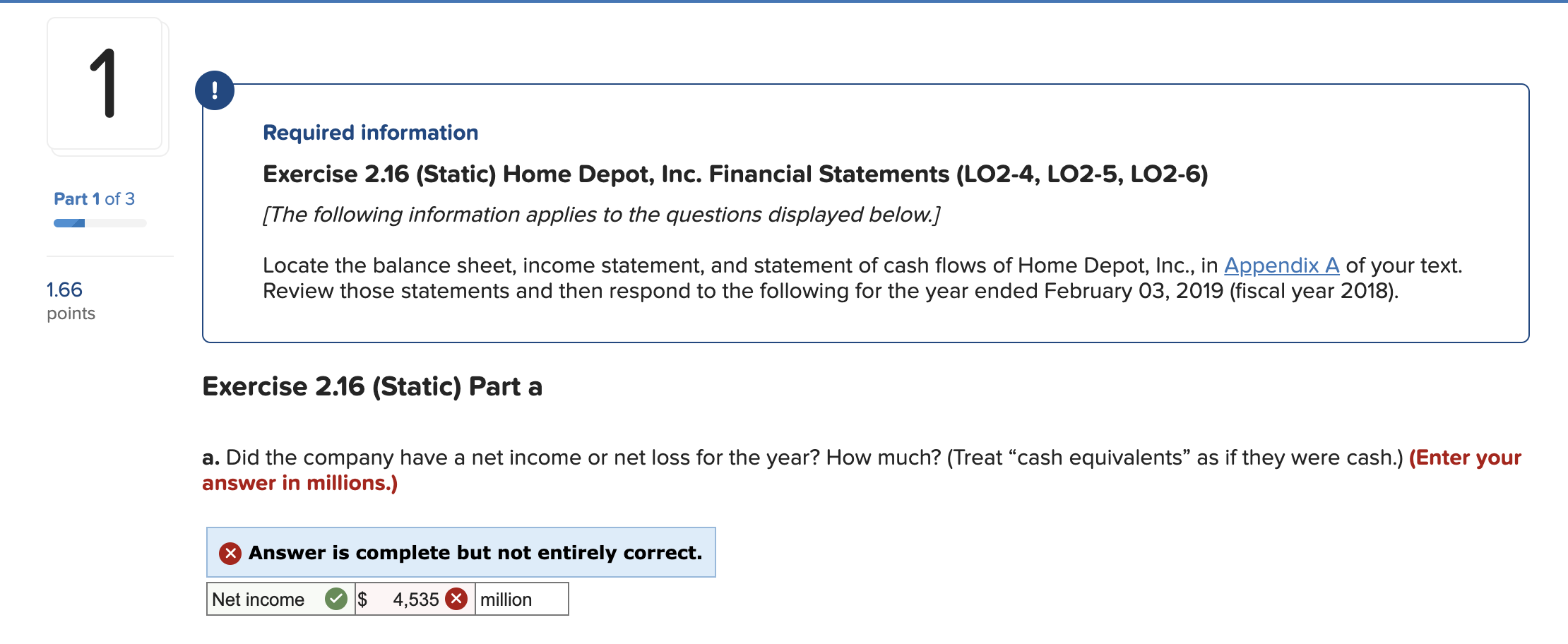

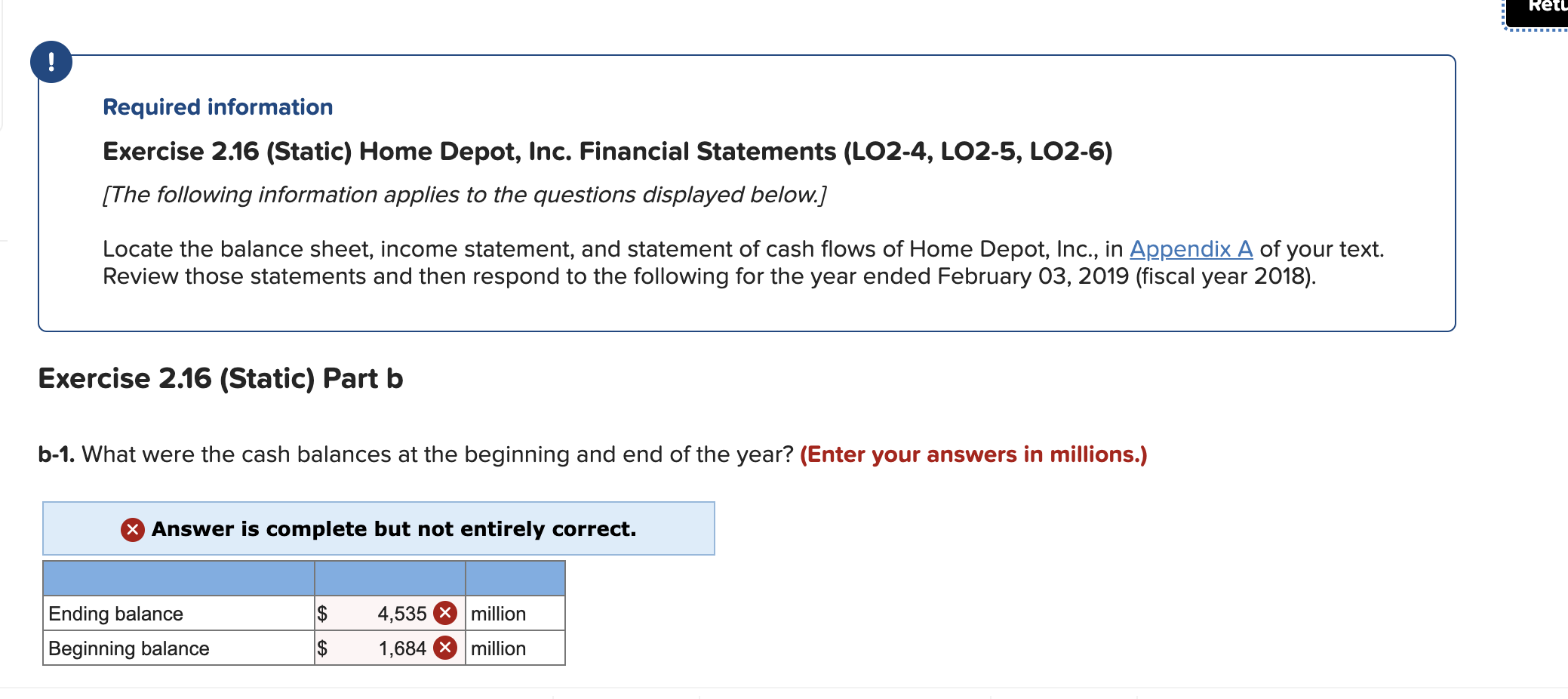

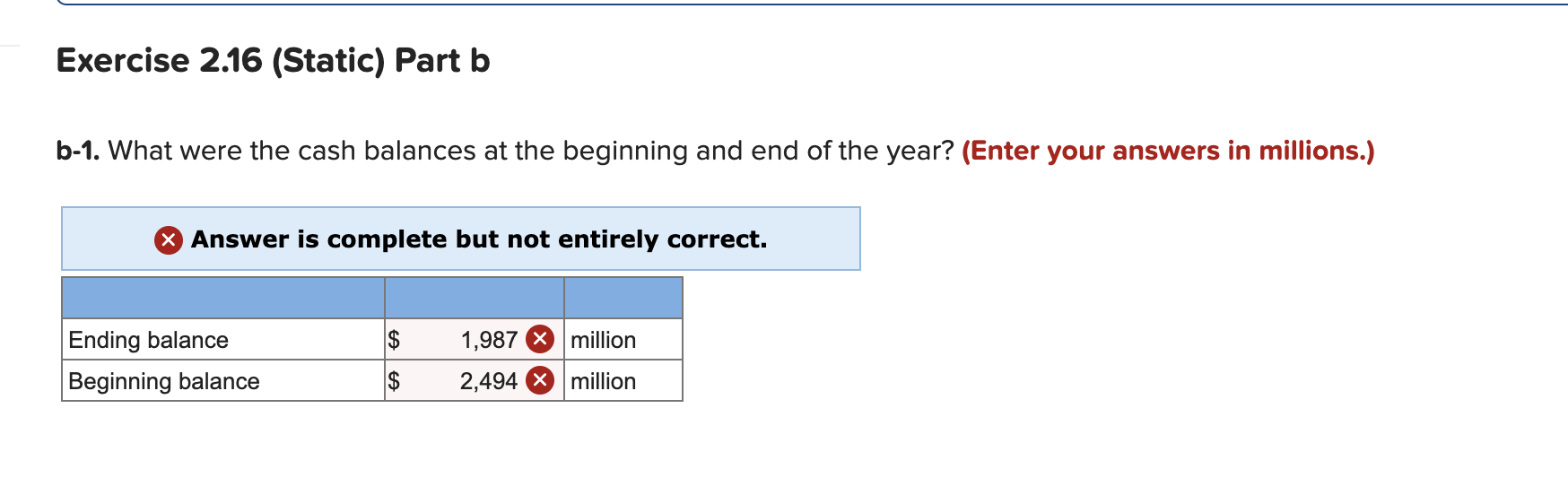

Question: t he answers are wrong ,Please correct the answer APPENDIX A Home Depot 2018 Financial Statements Report of Independent Registered Public Accounting Firm Page A1

the answers are wrong ,Please correct the answer

the answers are wrong ,Please correct the answer

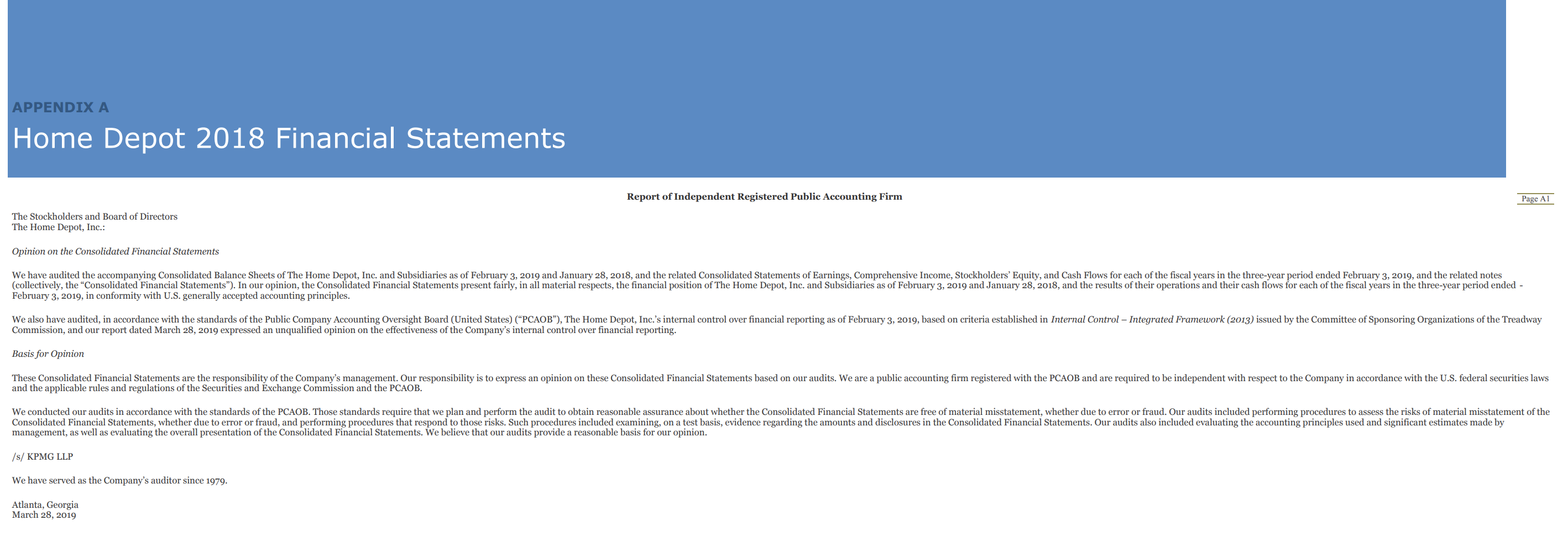

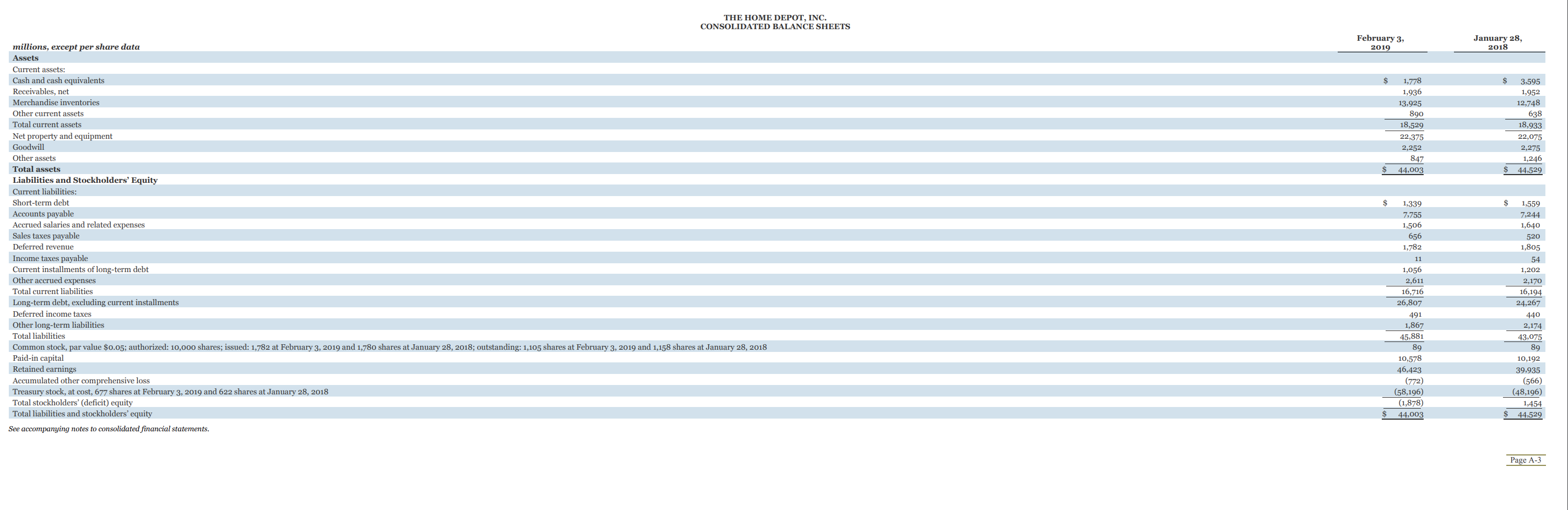

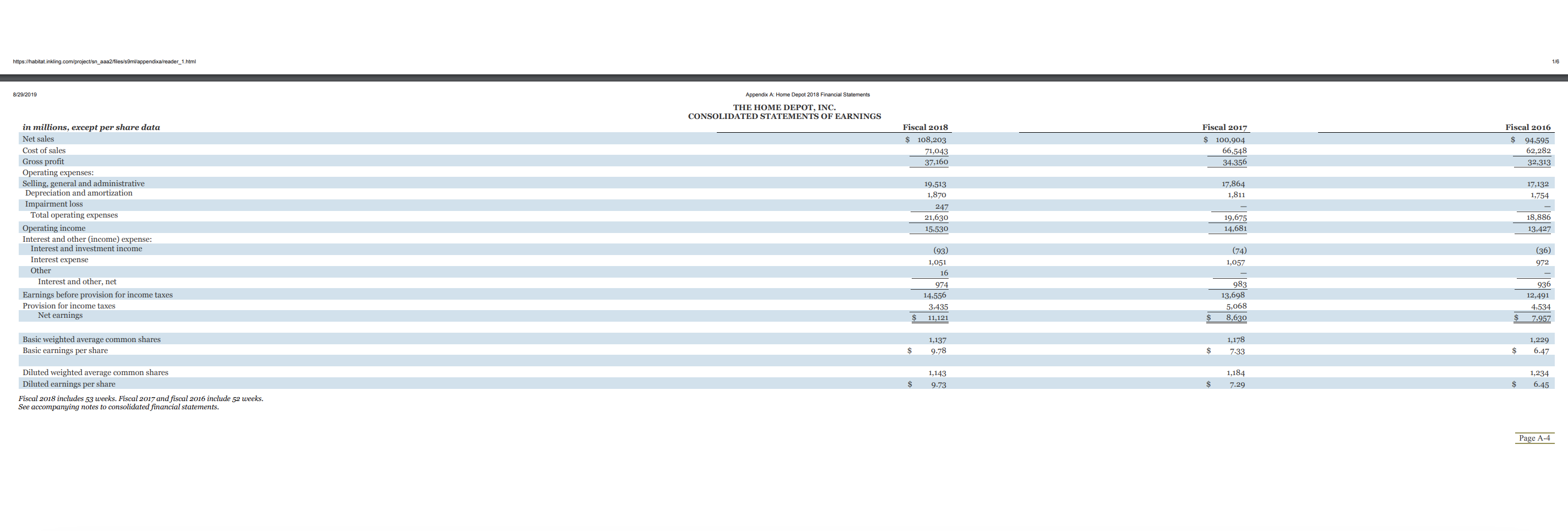

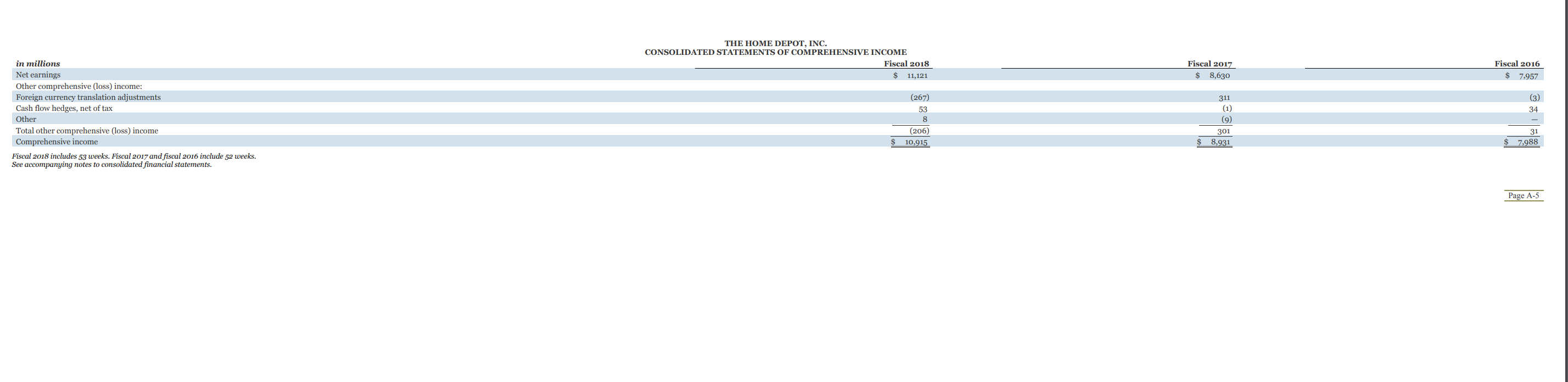

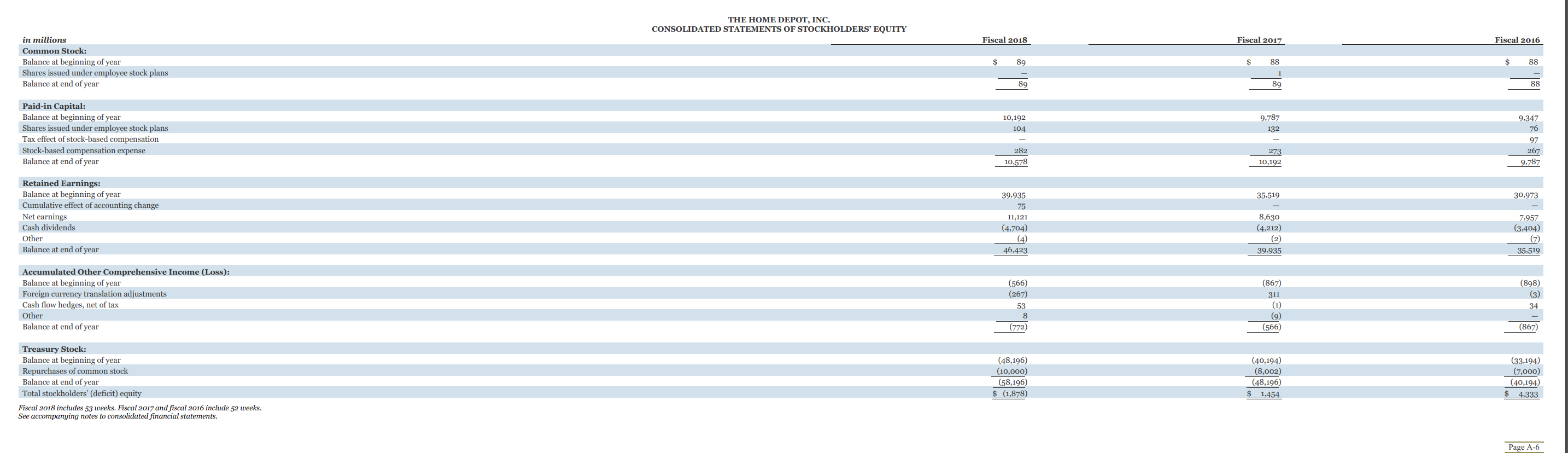

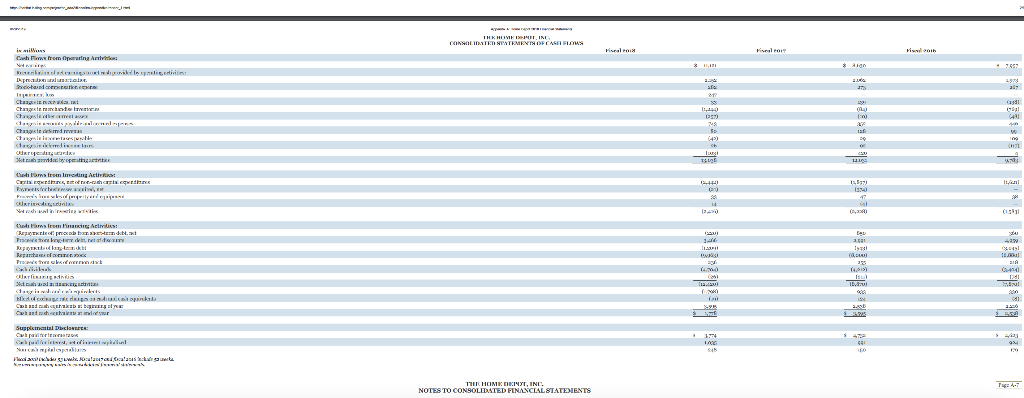

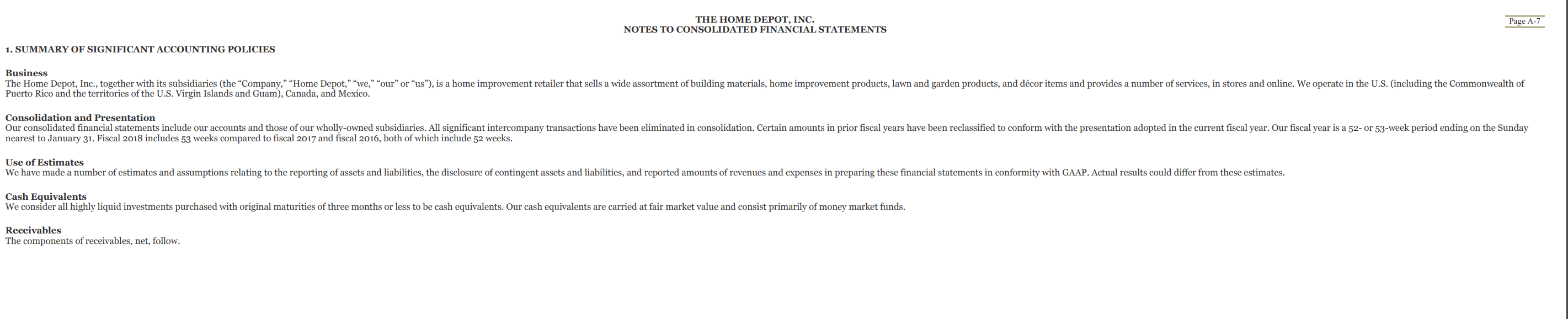

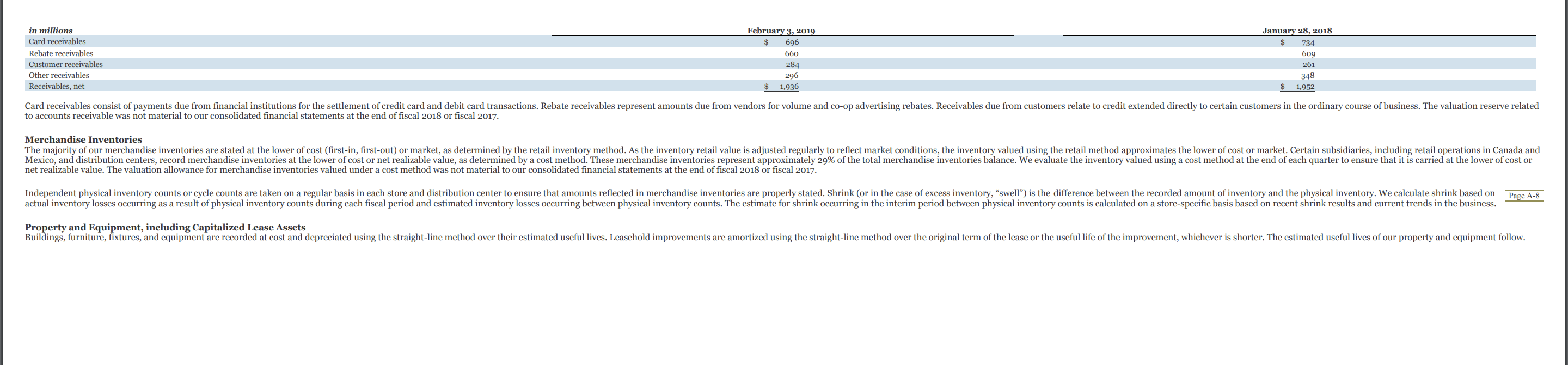

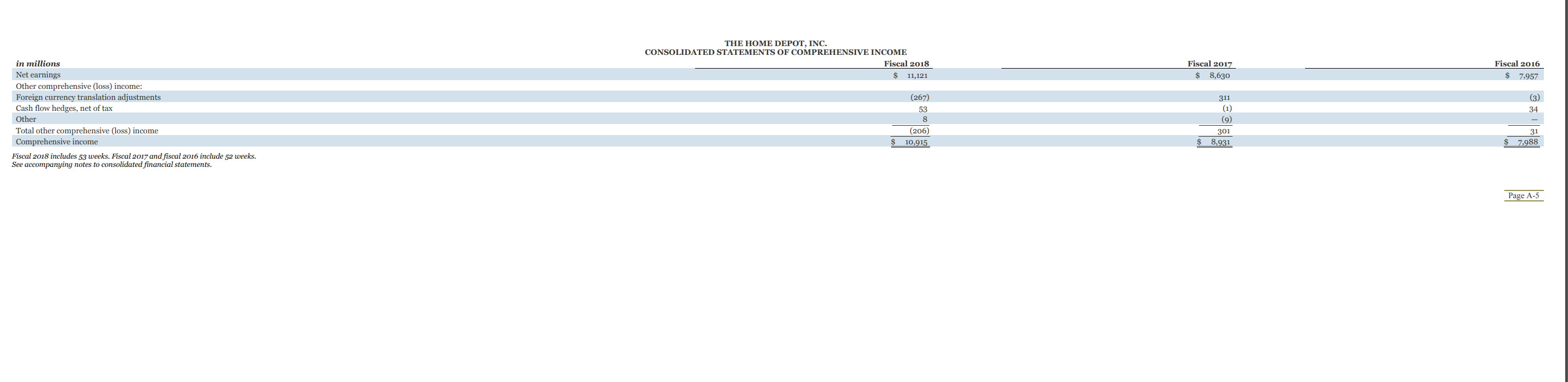

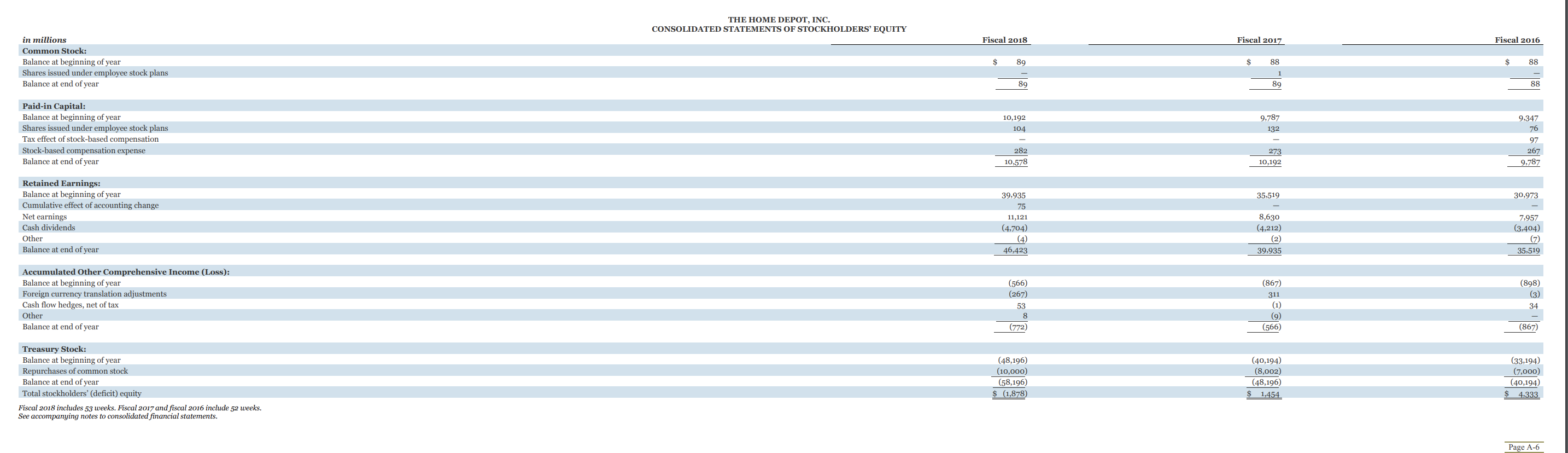

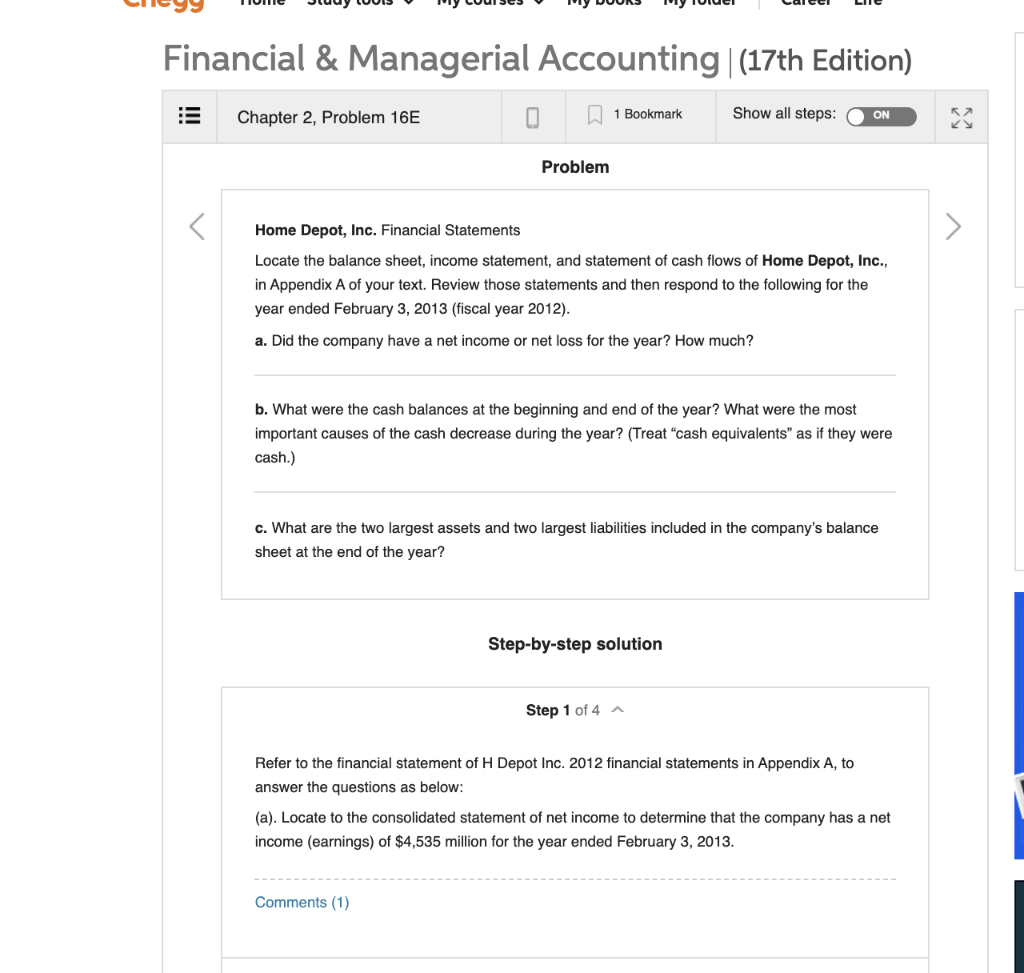

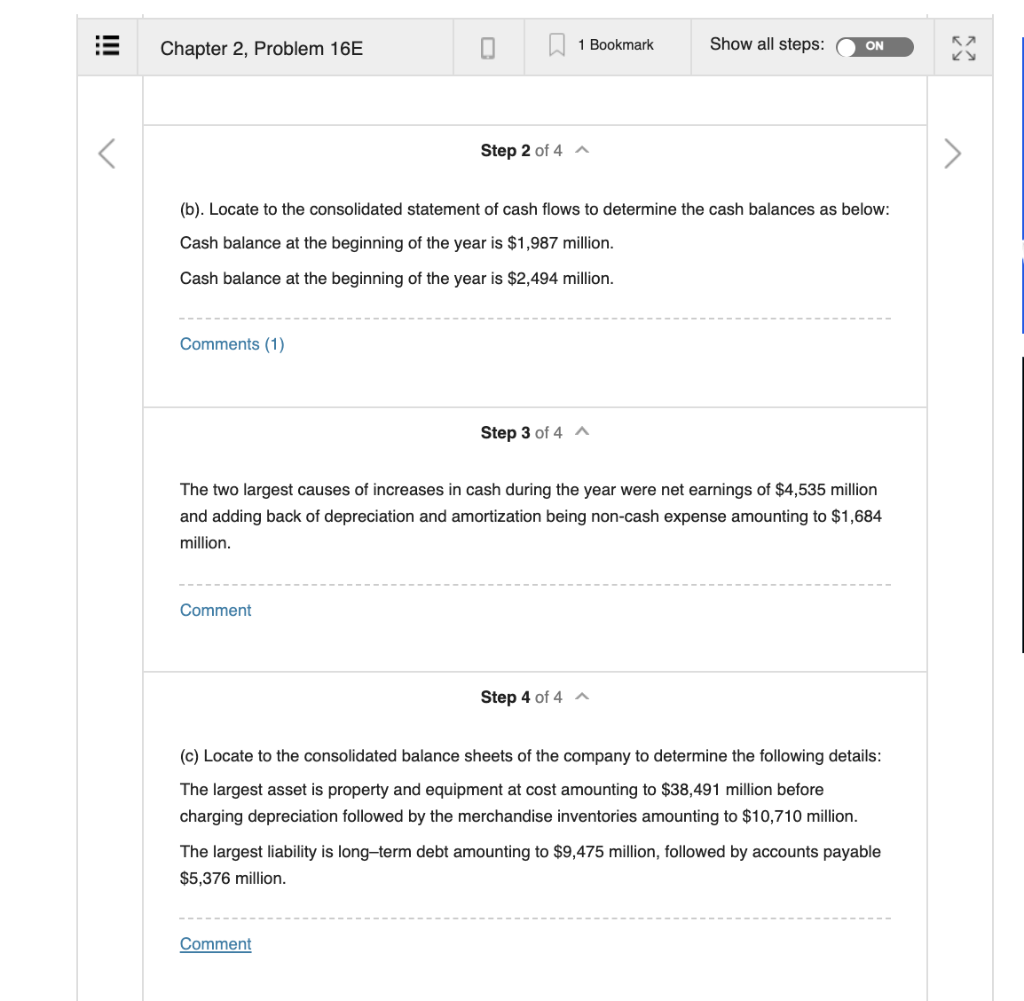

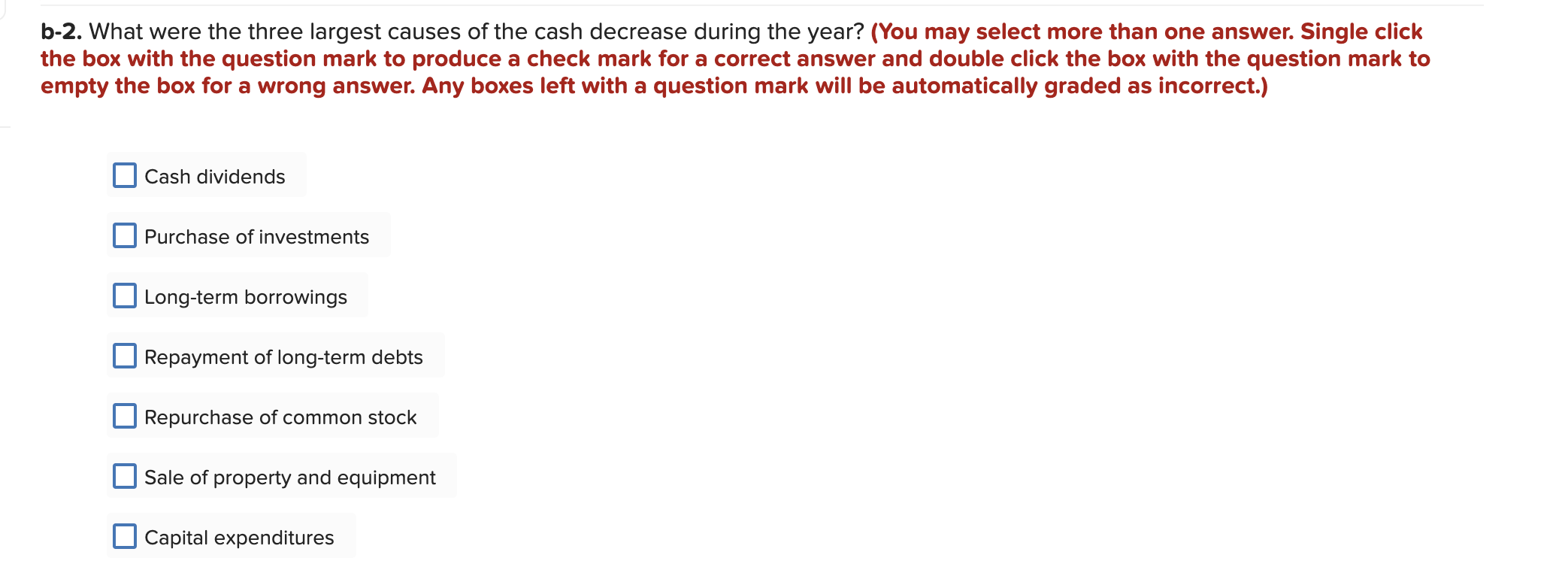

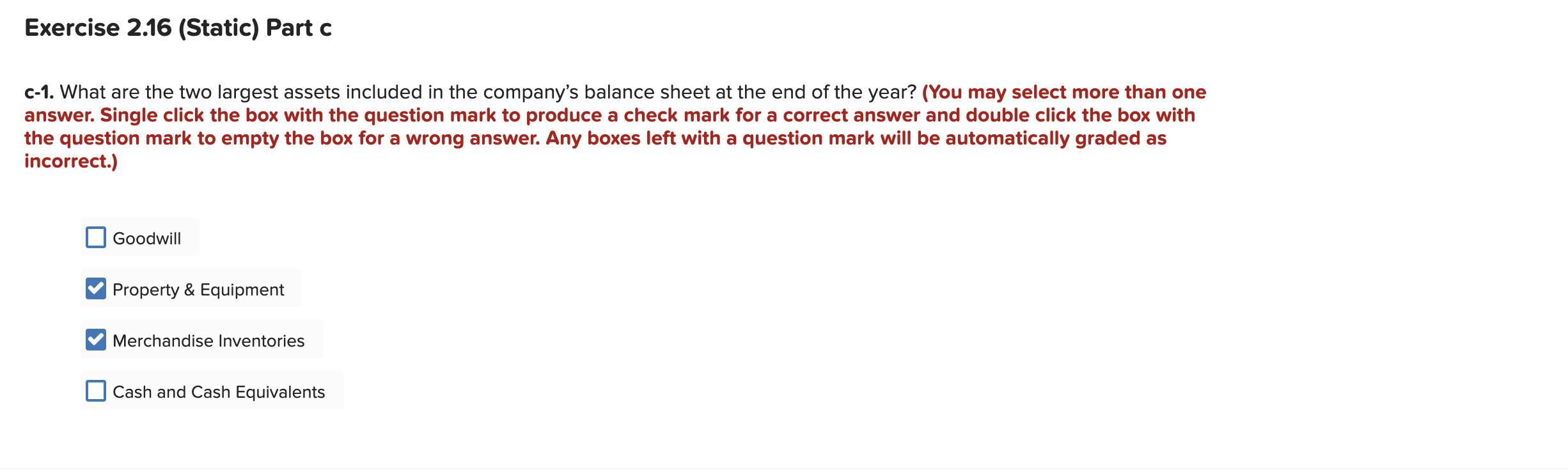

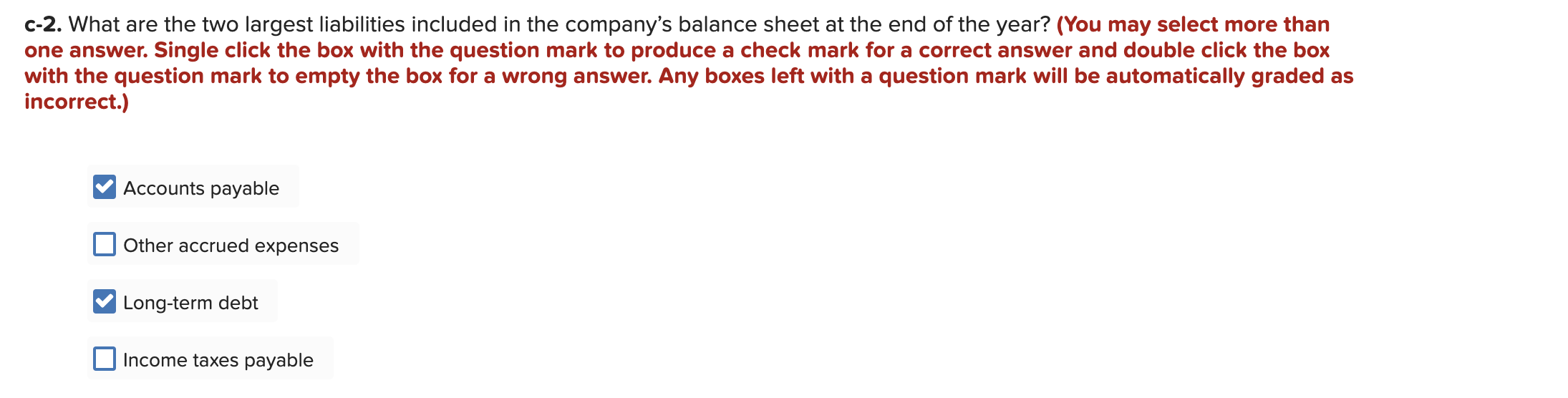

APPENDIX A Home Depot 2018 Financial Statements Report of Independent Registered Public Accounting Firm Page A1 The Stockholders and Board of Directors The Home Depot, Inc.: Opinion on the Consolidated Financial Statements We have audited the accompanying Consolidated Balance Sheets of The Home Depot, Inc. and Subsidiaries as of February 3, 2019 and January 28, 2018, and the related Consolidated Statements of Earnings, Comprehensive Income, Stockholders' Equity, and Cash Flows for each of the fiscal years in the three-year period ended February 3, 2019, and the related notes (collectively, the Consolidated Financial Statements). In our opinion, the Consolidated Financial Statements present fairly, in all material respects, the financial position of The Home Depot, Inc. and Subsidiaries as of February 3, 2019 and January 28, 2018, and the results of their operations and their cash flows for each of the fiscal years in the three-year period ended - February 3, 2019, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), The Home Depot, Inc.'s internal control over financial reporting as of February 3, 2019, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission, and our report dated March 28, 2019 expressed an unqualified opinion on the effectiveness of the Company's internal control over financial reporting. Basis for Opinion These Consolidated Financial Statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these Consolidated Financial Statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the Consolidated Financial Statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the Consolidated Financial Statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the Consolidated Financial Statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the Consolidated Financial Statements. We believe that our audits provide a reasonable basis for our opinion. /s/ KPMG LLP We have served as the Company's auditor since 1979. Atlanta, Georgia March 28, 2019 Excerpts from Home Depot's Financial Statements Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Comprehensive Income Consolidated Statements of Stockholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements - Summary of Significant Accounting Policies; Selected Financial Data A-1 A-2 A-3 A-4 A-5 A-6 A-7-A-14 A-15 THE HOME DEPOT, INC. CONSOLIDATED BALANCE SHEETS February 3, 2019 January 28, 2018 $ $ 1,778 1,936 13,925 890 18,529 22,375 2,252 847 44,003 3,595 1,952 12,748 638 18,933 22,075 2,275 1,246 44,529 $ $ millions, except per share data Assets Current assets: Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Net property and equipment Goodwill Other assets Total assets Liabilities and Stockholders' Equity Current liabilities: Short-term debt Accounts payable Accrued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Other accrued expenses Total current liabilities Long-term debt, excluding current installments Deferred income taxes Other long-term liabilities Total liabilities Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,782 at February 3, 2019 and 1,780 shares at January 28, 2018; outstanding: 1,105 shares at February 3, 2019 and 1,158 shares at January 28, 2018 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 677 shares at February 3, 2019 and 622 shares at January 28, 2018 Total stockholders' (deficit) equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. $ 1,339 7,755 1,506 656 1,782 11 1,056 2,611 16,716 26,807 491 1,867 45,881 89 10,578 46,423 (772) (58,196) (1,878) $ 44,003 $ 1,559 7,244 1,640 520 1,805 54 1,202 2,170 16,194 24,267 440 2,174 43,075 89 10,192 39,935 (566) (48,196) 1,454 $ 44,529 Page A-3 https://habitat.inkling.com/project/sn_aaa2/files/s9ml/appendixalreader_1.html 1/6 8/29/2019 Appendix A: Home Depot 2018 Financial Statements THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS Fiscal 2016 Fiscal 2018 $ 108,203 71,043 37,160 Fiscal 2017 $ 100,904 66,548 34,356 $ 94,595 62,282 32,313 19,513 17,864 1,811 17,132 1,754 1,870 in millions, except per share data Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest and other (income) expense: Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings 247 21,630 15,530 19,675 14,681 18,886 13,427 (74) 1,057 (36) 972 (93) 1,051 16 974 14,556 3,435 11,121 936 983 13,698 5,068 8,630 12,491 4,534 7,957 $ $ Basic weighted average common shares Basic earnings per share 1,137 9.78 1,178 7:33 1,229 6.47 $ $ $ 1,143 9.73 1,184 7.29 1,234 6.45 $ $ $ Diluted weighted average common shares Diluted earnings per share Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. Page A-4 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal 2018 $ 11,121 Fiscal 2017 $ 8,630 Fiscal 2016 $ 7,957 (3) 34 in millions Net earnings Other comprehensive (loss) income: Foreign currency translation adjustments Cash flow hedges, net of tax Other Total other comprehensive (loss) income Comprehensive income Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. (267) 53 8 (206) 10,915 311 (1) (9) 301 8,931 31 7,988 $ $ $ Page A-5 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Fiscal 2018 Fiscal 2017 Fiscal 2016 in millions Common Stock: Balance at beginning of year Shares issued under employee stock plans Balance at end of year S 89 $ 88 88 89 89 88 10,192 104 9,787 132 Paid-in Capital: Balance at beginning of year Shares issued under employee stock plans Tax effect of stock-based compensation Stock-based compensation expense Balance at end of year 9,347 76 97 267 9,787 282 10,578 273 10,192 35,519 30,973 Retained Earnings: Balance at beginning of year Cumulative effect of accounting change Net earnings Cash dividends Other Balance at end of year 39,935 75 11,121 (4,704) (4) 46,423 8,630 (4,212) (2) 39,935 7,957 (3,404) (7) 35,519 Accumulated Other Comprehensive Income (Loss): Balance at beginning of year Foreign currency translation adjustments Cash flow hedges, net of tax Other Balance at end of year (566) (267) 53 8 (772) (867) 311 (1) (9) (566) (898) (3) 34 (867) Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' (deficit) equity Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. (48,196) (10,000) (58,196) $ (1,878 (40,194) (8,002) (48,196) $ 1,454 (33,194) (7,000) (40,194) $ 4,333 Page A-6 com OL SELON 1:piri13er a relas Bes*821 ! ****J1348** ***** *3242 104 Bielony S MODIS SY PORED THE HOME DEPOT, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Page A-7 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Business The Home Depot, Inc., together with its subsidiaries (the Company," "Home Depot," "we, our or us), is a home improvement retailer that sells a wide assortment of building materials, home improvement products, lawn and garden products, and dcor items and provides a number of services, in stores and online. We operate in the U.S. (including the Commonwealth of Puerto Rico and the territories of the U.S. Virgin Islands and Guam), Canada, and Mexico. Consolidation and Presentation Our consolidated financial statements include our accounts and those of our wholly-owned subsidiaries. All significant intercompany transactions have been eliminated in consolidation. Certain amounts in prior fiscal years have been reclassified to conform with the presentation adopted in the current fiscal year. Our fiscal year is a 52- or 53-week period ending on the Sunday nearest to January 31. Fiscal 2018 includes 53 weeks compared to fiscal 2017 and fiscal 2016, both of which include 52 weeks. Use of Estimates We have made a number of estimates and assumptions relating to the reporting of assets and liabilities, the disclosure of contingent assets and liabilities, and reported amounts of revenues and expenses in preparing these financial statements in conformity with GAAP. Actual results could differ from these estimates. Cash Equivalents We consider all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. Our cash equivalents are carried at fair market value and consist primarily of money market funds. Receivables The components of receivables, net, follow. in millions Card receivables Rebate receivables Customer receivables Other receivables Receivables, net February 3, 2019 696 660 284 296 $ January 28, 2018 734 609 261 348 1,952 1,936 Card receivables consist of payments due from financial institutions for the settlement of credit card and debit card transactions. Rebate receivables represent amounts due from vendors for volume and co-op advertising rebates. Receivables due from customers relate to credit extended directly to certain customers in the ordinary course of business. The valuation reserve related to accounts receivable was not material to our consolidated financial statements at the end of fiscal 2018 or fiscal 2017. Merchandise Inventories The majority of our merchandise inventories are stated at the lower of cost (first-in, first-out) or market, as determined by the retail inventory method. As the inventory retail value is adjusted regularly to reflect market conditions, the inventory valued using the retail method approximates the lower of cost or market. Certain subsidiaries, including retail operations in Canada and Mexico, and distribution centers, record merchandise inventories at the lower of cost or net realizable value, as determined by a cost method. These merchandise inventories represent approximately 29% of the total merchandise inventories balance. We evaluate the inventory valued using a cost method at the end of each quarter to ensure that it is carried at the lower of cost or net realizable value. The valuation allowance for merchandise inventories valued under a cost method was not material to our consolidated financial statements at the end of fiscal 2018 or fiscal 2017. Independent physical inventory counts or cycle counts are taken on a regular basis in each store and distribution center to ensure that amounts reflected in merchandise inventories are properly stated. Shrink (or in the case of excess inventory, swell) is the difference between the recorded amount of inventory and the physical inventory. We calculate shrink based on actual inventory losses occurring as a result of physical inventory counts during each fiscal period and estimated inventory losses occurring between physical inventory counts. The estimate for shrink occurring in the interim period between physical inventory counts is calculated on a store-specific basis based on recent shrink results and current trends in the business. Page A-8 Property and Equipment, including Capitalized Lease Assets Buildings, furniture, fixtures, and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives. Leasehold improvements are amortized using the straight-line method over the original term of the lease or the useful life of the improvement, whichever is shorter. The estimated useful lives of our property and equipment follow. THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal 2018 $ 11,121 Fiscal 2017 $ 8,630 Fiscal 2016 $ 7,957 (3) 34 in millions Net earnings Other comprehensive (loss) income: Foreign currency translation adjustments Cash flow hedges, net of tax Other Total other comprehensive (loss) income Comprehensive income Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. (267) 53 8 (206) 10,915 311 (1) (9) 301 8,931 31 7,988 $ $ $ Page A-5 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Fiscal 2018 Fiscal 2017 Fiscal 2016 in millions Common Stock: Balance at beginning of year Shares issued under employee stock plans Balance at end of year S 89 $ 88 88 89 89 88 10,192 104 9,787 132 Paid-in Capital: Balance at beginning of year Shares issued under employee stock plans Tax effect of stock-based compensation Stock-based compensation expense Balance at end of year 9,347 76 97 267 9,787 282 10,578 273 10,192 35,519 30,973 Retained Earnings: Balance at beginning of year Cumulative effect of accounting change Net earnings Cash dividends Other Balance at end of year 39,935 75 11,121 (4,704) (4) 46,423 8,630 (4,212) (2) 39,935 7,957 (3,404) (7) 35,519 Accumulated Other Comprehensive Income (Loss): Balance at beginning of year Foreign currency translation adjustments Cash flow hedges, net of tax Other Balance at end of year (566) (267) 53 8 (772) (867) 311 (1) (9) (566) (898) (3) 34 (867) Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' (deficit) equity Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. (48,196) (10,000) (58,196) $ (1,878 (40,194) (8,002) (48,196) $ 1,454 (33,194) (7,000) (40,194) $ 4,333 Page A-6 Flulla . Fiecal $ Gallen arler| Dupa Other Gost based on Penispum 1 11 2.995 is! 29 the ninnil A We listallella linale-livaliiklubillar of lines who 12 rangi wa walimalluindi la kinyuarat laadi lal yaar karinius, kui inimioara sillandale In.Camry White sexa 347 milioneretain trademarahinter R . Dringfield and method to material story Debt We need any memes Tin GUTER debatter into the camminect there. We are on Twith an ironing-term redheater is the wine the related Porn, and destres artist Geer dan de spectives in the clienti Derivati annet portienter than in not put the painting ano on or bron ancilla at lalu sladdslalan: peida old. The urvis ufurderinline filmes e solis Neque subsidin romanian Wonin Allgenser In urance Wie anal-iswanal literai kontrollit ndalin kility). wickramppali comercial ents. We beli tadaliuzo fix thu sans (and all the locality. The casual balbraitisrundblind bussballs like and arterul cette Weermalerweited witry to rent Imre Istichsther that he cared heas internecimecresh arribarety Terrace-related persone SORA Treasury Stock Trwarderintasartistes capital coct. We the winterpers to determine the towards med, Harry : auundn util line art in uu Fu Jarir ali ul . turtin fux iui Lali u Net On January 20 2018 weedp ASUN 09 using the modified roste traction methods that were difference and post adopter Seventy doplne Foncent-ASUN, 05-09" Now for more information 23 AO Fiscul.2018 und Salent Period. We respectar suks tuli laka Sudan Sri Dr. Til les con arculis was logra palici blibli.cara total de insti. W retratand correspondingdjastant Doctorsis.fororit to racer the good red by the actors, measured at forming arcount of the poodsissary expected recory BOSE. NE Bachireporting date, we see our states of expected nums, ties and retum acets Naslo zastrioting wat uitslui, L., Unail van. luLSE PLUIE SA diata al parece la past, we pride or helpils.luline ended our indicap.Dari ponse provide ouro Porte salatile project and the cor prodos materiales parole salation, but the trial and beindul in scris rece. We are the service for the customer care which ist direct from recognise or the service produse its series anul is week. For press meet heralydre at the point of Barrett liteten. When we meters the chustaken in the honor the orchester UTE de Seither percig person with desired the matter wwfurther det har taleyit et and care the operadores thet are in the Citan besar, which is mimari t-rady and balara, wasimanfaal 35 Weboldal...party tipikes do calcoli. Logo PLC progn. Dus. cage canorou is progres Laimunoscurous for its teads. wypalang dapat service perilus lindas Mul 17 and Meal word. We are still notes, at the time the planetas porno merchandiser warri perbannal. The braketa, ishim binert blant pinil, i odmah sdn birinin Metalnih prerad ihre alt, here and long. In the prepare the contre les drowe material toraxt, and pray med nyheten hengereltherigher comes and the lessons congrarns when we Pharmaata calitate politial sporthallar, Icth the trial and laten indblin D. Within the came Wher premier beter to prevedenie dari bened, the country is end deterd en haar reedscompich We lood drevedere for the sake of cards and this motheredemption of gitmint ses ul. laidos o cliccando cada instaliu focal 2017 a lasu. Financial & Managerial Accounting|(17th Edition) Chapter 2, Problem 16E 1 Bookmark Show all steps: ON Problem Locate the balance sheet, income statement, and statement of cash flows of Home Depot, Inc., in Appendix A of your text. Review those statements and then respond to the following for the year ended February 3, 2013 (fiscal year 2012). a. Did the company have a net income or net loss for the year? How much? b. What were the cash balances at the beginning and end of the year? What were the most important causes of the cash decrease during the year? (Treat "cash equivalents" as if they were cash.) c. What are the two largest assets and two largest liabilities included in the company's balance sheet at the end of the year? Step-by-step solution Step 1 of 4 A Refer to the financial statement of H Depot Inc. 2012 financial statements in Appendix A, to answer the questions as below: (a). Locate to the consolidated statement of net income to determine that the company has a net income (earnings) of $4,535 million for the year ended February 3, 2013. Comments (1) iii Chapter 2, Problem 16E 1 Bookmark Show all steps: ON ?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts