Question: t Page Layout References Review View Section Tools A. A. A 13.9.2 AaBbCoDd Abod AaBbcod AaBbcod Body Defau... List Pa... Table P.. = XA New

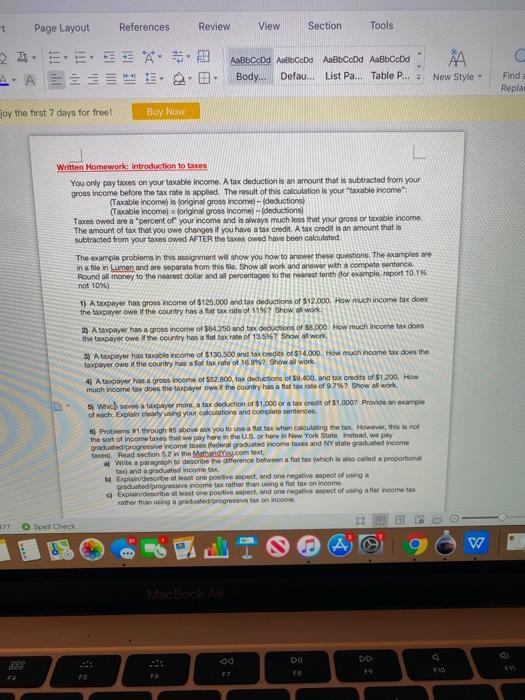

t Page Layout References Review View Section Tools A. A. A 13.9.2 AaBbCoDd Abod AaBbcod AaBbcod Body Defau... List Pa... Table P.. = XA New Style C Find Repla Joy the first 7 days for free! Buy Now Written Homework: Introduction to takes You only pay taxes on your taxable income. A tax deduction is an amount that is subtracted from your gross income before the tax rate is applied. The result of this calculation is your "taxable income (Taxable income is original gross income) - (deduction) (Taxable income original gross income-deductions Taxes Owed are a percent of your income and is always much less that your gross or taxable income The amount of tax that you owe changes if you have a tax credit. A tax credit is an amount that is subtracted from your taxes owed AFTER the taxes owed have been calculated The example problems in this assigment will show you how to answer these questions. The examples are in a file name and are separate from this file. Show all work and answer with a competentence Round al money to the nearest color id al percentagon to the nearest tonth for womple, raport 10.1% not 10%) 1) Ataxpayer has gross income of $125,000 and tax deductions of $12.000 How much income tax does the taxpayer owe if the country has a flat tax rate of 11967 Show at work 2) Ataxpayer has a gross income of $84.250 and tax deductions of $8.000 How much income tax does the taxpayer owe it the country has a flat tax rate of 13597 Show at work 3) Ataxpayer has taxable income of $130.500 and tax credits of $14.000 How much income tax does the taxpayer owe if the country has a fost tax rate of 16.892 Show all work 4) Ataxpayer has a grown income of 552.000, tax deduction of $9.400, and tax credits of $1.200. How much income tax does the taxpayer owe the country has a faf tax rate of 0.797 Show all work 5 Wrecsaves taxpayer moro, a tax deduction of $1.000 or a tax credit of $1.0007 Provide an example of each Explain clearly using your calculations and complete seriences Problems through above you to use a fat tax when calculating the tax However, this is not The son of income taxes we pay here in the US. or here in New York State Instead, we pay graduatedrogressive income taxe foderatorated income true and Nate graduated come * Wite a paragraph to describe the afference between a flat tax which is so called a proportion and and a graduated income tax Explaindescribe at least one positive and one notive pect of using graduate progressive income tax rather than using a flat tax on income Expanderbettone positive aspect, and one negative spect of using an income tax other than using a graduate/progressive tax on income O Sped Check le W Nacecoup DIL DD 2 F t Page Layout References Review View Section Tools A. A. A 13.9.2 AaBbCoDd Abod AaBbcod AaBbcod Body Defau... List Pa... Table P.. = XA New Style C Find Repla Joy the first 7 days for free! Buy Now Written Homework: Introduction to takes You only pay taxes on your taxable income. A tax deduction is an amount that is subtracted from your gross income before the tax rate is applied. The result of this calculation is your "taxable income (Taxable income is original gross income) - (deduction) (Taxable income original gross income-deductions Taxes Owed are a percent of your income and is always much less that your gross or taxable income The amount of tax that you owe changes if you have a tax credit. A tax credit is an amount that is subtracted from your taxes owed AFTER the taxes owed have been calculated The example problems in this assigment will show you how to answer these questions. The examples are in a file name and are separate from this file. Show all work and answer with a competentence Round al money to the nearest color id al percentagon to the nearest tonth for womple, raport 10.1% not 10%) 1) Ataxpayer has gross income of $125,000 and tax deductions of $12.000 How much income tax does the taxpayer owe if the country has a flat tax rate of 11967 Show at work 2) Ataxpayer has a gross income of $84.250 and tax deductions of $8.000 How much income tax does the taxpayer owe it the country has a flat tax rate of 13597 Show at work 3) Ataxpayer has taxable income of $130.500 and tax credits of $14.000 How much income tax does the taxpayer owe if the country has a fost tax rate of 16.892 Show all work 4) Ataxpayer has a grown income of 552.000, tax deduction of $9.400, and tax credits of $1.200. How much income tax does the taxpayer owe the country has a faf tax rate of 0.797 Show all work 5 Wrecsaves taxpayer moro, a tax deduction of $1.000 or a tax credit of $1.0007 Provide an example of each Explain clearly using your calculations and complete seriences Problems through above you to use a fat tax when calculating the tax However, this is not The son of income taxes we pay here in the US. or here in New York State Instead, we pay graduatedrogressive income taxe foderatorated income true and Nate graduated come * Wite a paragraph to describe the afference between a flat tax which is so called a proportion and and a graduated income tax Explaindescribe at least one positive and one notive pect of using graduate progressive income tax rather than using a flat tax on income Expanderbettone positive aspect, and one negative spect of using an income tax other than using a graduate/progressive tax on income O Sped Check le W Nacecoup DIL DD 2 F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts