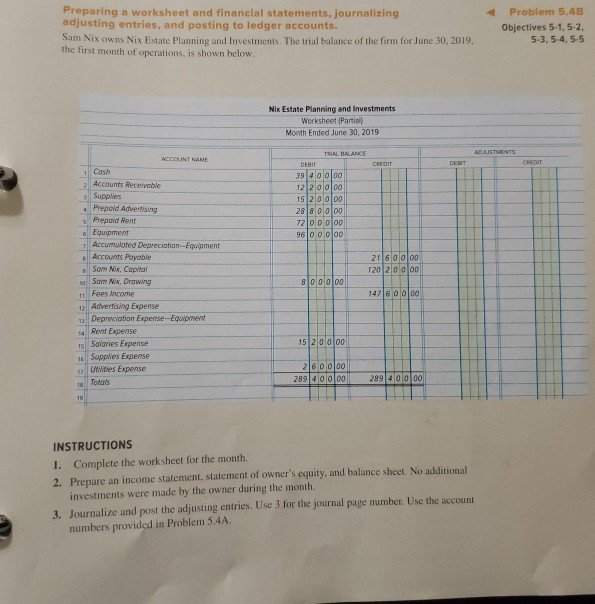

Question: t Preparing a worksheet and financial statements, journalizing adjusting entries, and posting to ledger accounts. Sam Nix owns Nix Estate Planning and Investments. The trial

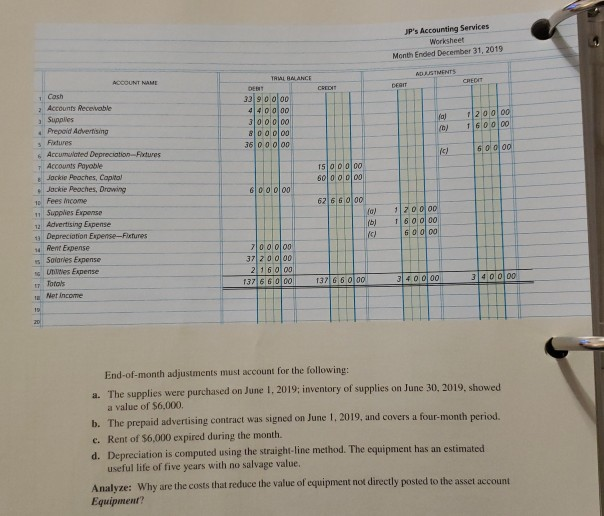

t Preparing a worksheet and financial statements, journalizing adjusting entries, and posting to ledger accounts. Sam Nix owns Nix Estate Planning and Investments. The trial balance of the firm for June 30,2019. the first month of operations, is shown below. Problem 5.48 Objectives 5-1, 5-2, 5-3,5-4,5-5 Nix Estate Planning and investments Worksheet (Partia) Month Ended June 30, 2019 CREOIT Cash 3914 00100 12 200 00 5200 00 28 g 2 00 000 96 000 0 2l Accounts Receivable 3 Supplies Prepoid Advertising Prepaid Rent Equipment Accumulated Depreciatian-Equipment 2 600 00 20 0 oo B Accounts Payable Som Nix. Capital o Sam Nix, Drawing 12 Advertising Expense Rent Expense s Saionies Expense Ell Supplies Expense 11 Fees Nncome 147 60000 5 200 00 tities Expense 289 4 0 o 00 289 40000 a Totans INSTRUCTIONS I. Complete the worksheet for the month. 2. Prepare an income statement, statement of owner's equity, and balance sheet. No additional investments were made by the owner during the month. 3. Journalize and post the adjusting entries. Use 3 for the journal page number. Use the account numbers provided in Problem 5.4A. JP's Accounting Services Worksheet Month Ended December 31, 2019 RIAL BAANCE 1 Cosh 33 900 00 4400 0o a Accounts Recevable a Supplies 200 00 ) 1 600 00 5 0 000 Prepoid Advertising s FRxtures 36 00 000 r Accounts Payoble 15 0 00 00 60 00000 Jockie Praches, Capital Jackie Peoches, Drawing 600000 10 Fees imcome 11 Supples Expense 12 Advertising Expense 62 6 60 00 Depreciotion Expense-Fictures Rent Expense 0010100 37 20 0 00 2116 00 137 6 60 00 s Solarles Expense UhilWes Expense Totols r T 40000 3 400 00 Net Income End-of-month adjustments must account for the following: The supplies were purchased on June 1, 2019; inventory of supplies on June 30, 2019, showed a value of $6.000. The prepaid advertising contract was signed on June 1,2019, and covers a four Rent of $6,000 expired during the month. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of five years with no salvage value. a. b. c. d. y are the costs that reduce the value of equipment not directly posted to the asset account Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts