Question: T T 25 % Texte Figure Donnes multimdias Commenta Insrer Tableau Graphique Zoom Albuter une page CORPORATE FINANCE PROBLEM SET II - SOLUTIONS Part 1:

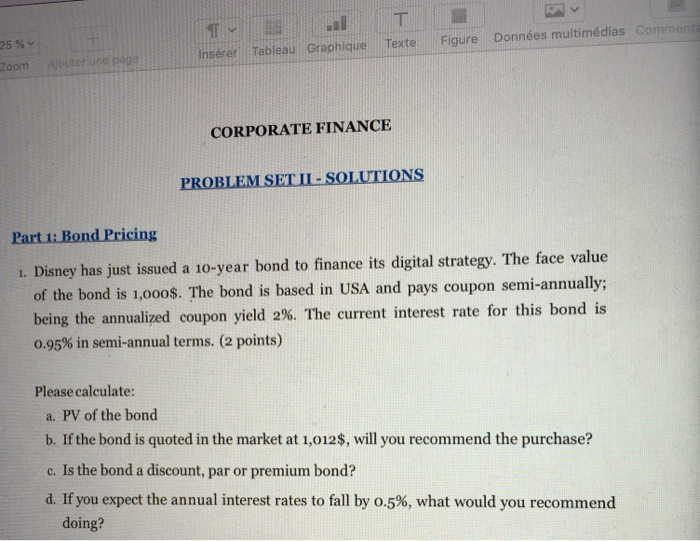

T T 25 % Texte Figure Donnes multimdias Commenta Insrer Tableau Graphique Zoom Albuter une page CORPORATE FINANCE PROBLEM SET II - SOLUTIONS Part 1: Bond Pricing 1. Disney has just issued a 10-year bond to finance its digital strategy. The face value of the bond is 1,000$. The bond is based in USA and pays coupon semi-annually; being the annualized coupon yield 2%. The current interest rate for this bond is 0.95% in semi-annual terms. (2 points) Please calculate: a. PV of the bond b. If the bond is quoted in the market at 1,012$, will you recommend the purchase? c. Is the bond a discount, par or premium bond? d. If you expect the annual interest rates to fall by 0.5%, what would you recommend doing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts