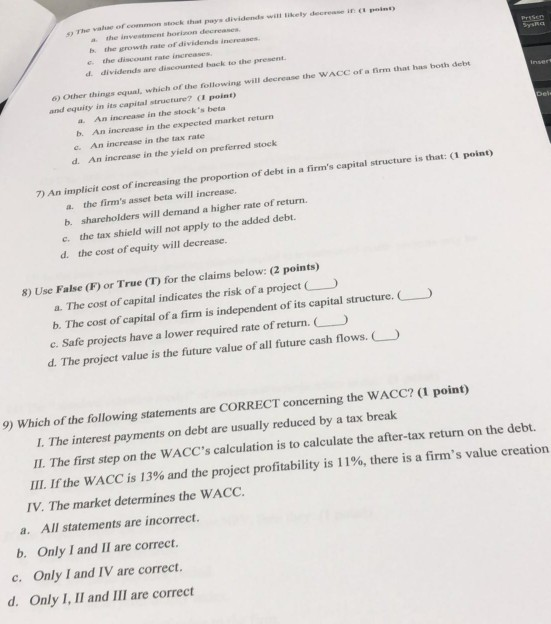

Question: t The w ormon that pays dividends will likely decre the growth rate of dividend in the discount rate increases. dividends are discounted back to

t The w ormon that pays dividends will likely decre the growth rate of dividend in the discount rate increases. dividends are discounted back to the present c) Other things equal, which of the following will decrease the WACC of a firm that has both debit and equity in its capital structure? (1 point) An increase in the stock's beta An increase in the expected market return An increase in the tax rate d. An increase in the yield on preferred stock 7) An implicit cost of increasing the proportion of debt in a firm's capital structure is that: (1 point) the firm's asset beta will increase b. shareholders will demand a higher rate of return c. the tax shield will not apply to the added debt. d. the cost of equity will decrease. 8) Use False (F) or True (T) for the claims below: (2 points) a. The cost of capital indicates the risk of a project b. The cost of capital of a firm is independent of its capital structure. c. Safe projects have a lower required rate of return. d. The project value is the future value of all future cash flows. 9) Which of the following statements are CORRECT concerning the WACC? (1 point) I. The interest payments on debt are usually reduced by a tax break II. The first step on the WACC's calculation is to calculate the after-tax return on the debt. III. If the WACC is 13% and the project profitability is 11%, there is a firm's value creation IV. The market determines the WACC. a. All statements are incorrect. b. Only I and II are correct. c. Only I and IV are correct. d. Only I, II and III are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts