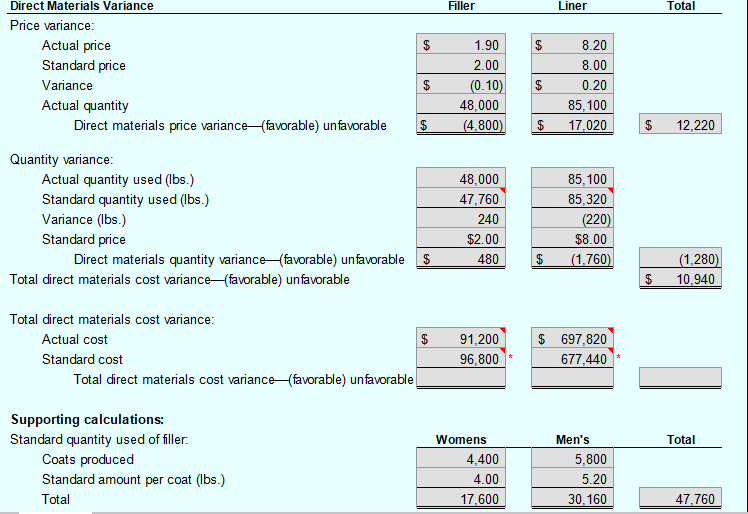

Question: t total direct material cost variance, please help me solve it. Filler Liner Total $ Direct Materials Variance Price variance: Actual price Standard price Variance

t

t

total direct material cost variance, please help me solve it.

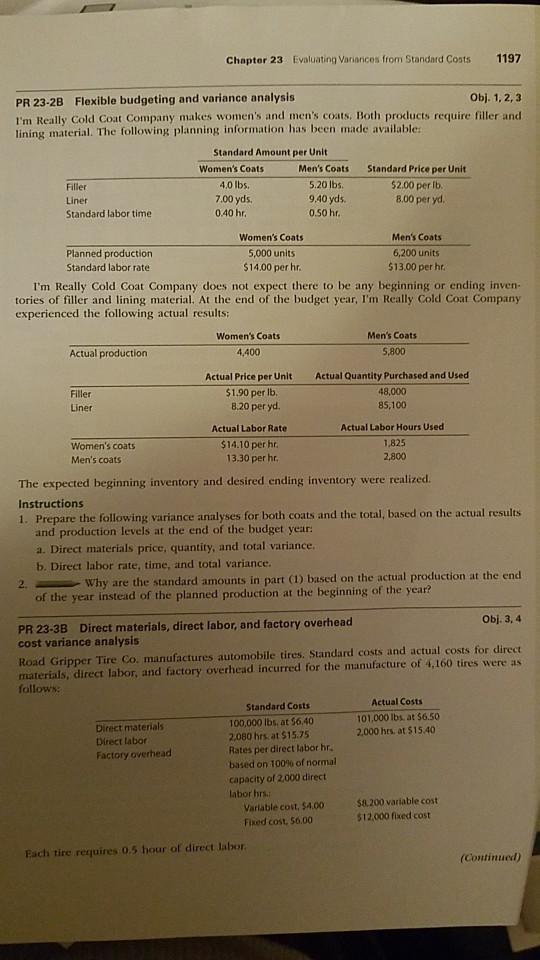

Filler Liner Total $ Direct Materials Variance Price variance: Actual price Standard price Variance Actual quantity Direct materials price variance favorable) unfavorable 1.90 2.00 (0.10) 48,000 (4,800) $ 8.20 8.00 0.20 85,100 17,020 $ $ 12,220 Quantity variance: Actual quantity used (lbs.) Standard quantity used (lbs.) Variance (lbs.) Standard price Direct materials quantity variance favorable) unfavorable $ Total direct materials cost variance(favorable) unfavorable 48,000 47,760 240 $2.00 480 85,100 85,320 (220) $8.00 (1,760) $ (1,280) 10.940 $ Total direct materials cost variance: Actual cost Standard cost Total direct materials cost variance favorable) unfavorable 91,200 96,800 $ 697,820 677,440 Men's Total Supporting calculations: Standard quantity used of filler. Coats produced Standard amount per coat (lbs.) Total Womens 4,400 4.00 17,600 5,800 5.20 30,160 47,760 Chapter 23 Evaluating Variances from Standard Costs 1197 PR 23-2B Flexible budgeting and variance analysis Obj. 1,2,3 I'm Really Cold Coat Company makes women's and men's coats. Both products require filler and lining material. The following planning information has been made available: Filler Liner Standard labor time Standard Amount per Unit Women's Coats Men's Coats 4.0 lbs. 5.20 lbs. 7.00 yds. 9.40 yds. 0.40 hr. 0.50 hr. Standard Price per Unit $2.00 per lb. 8.00 per yd. Women's Coats Men's Coats Planned production 5,000 units 6,200 units Standard labor rate $14.00 per hr. $13.00 per hr. I'm Really Cold Coat Company does not expect there to be any beginning or ending inven- tories of filler and lining material. At the end of the budget year, I'm Really Cold Coat Company experienced the following actual results: Women's Coats Men's Coats Actual production 5,800 Actual Price per Unit Actual Quantity Purchased and Used Filler $1.90 per lb. 48,000 Liner 8.20 per yd. 85,100 Actual Labor Rate Actual Labor Hours Used Women's coats $14.10 per hr. 1,825 Men's coats 13.30 per hr. 2,800 4,400 The expected beginning inventory and desired ending inventory were realized. Instructions 1. Prepare the following variance analyses for both coats and the total, based on the actual results and production levels at the end of the budget year: a. Direct materials price, quantity, and total variance. b. Direct labor rate, time, and total variance. 2. Why are the standard amounts in part (1) based on the actual production at the end of the year instead of the planned production at the beginning of the year? PR 23-3B Direct materials, direct labor, and factory overhead Obj. 3, 4 cost variance analysis Road Gripper Tire Co. manufactures automobile tires. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 tires were as follows: Actual Costs 101,000 lbs at $6.50 2,000 hrs. at $15.40 Direct materials Direct labor Factory overhead Standard Costs 100,000 lbs. at $6.40 2,080 hrs. at $15.75 Rates per direct labor hr. based on 100% of normal capacity of 2000 direct Labor hrs. Variable cost, $4.00 Fixed cost, $6.00 $8.200 variable cost $12,000 fixed cost Each tire requires 0.5 hour of direct labor. (Continued Filler Liner Total $ Direct Materials Variance Price variance: Actual price Standard price Variance Actual quantity Direct materials price variance favorable) unfavorable 1.90 2.00 (0.10) 48,000 (4,800) $ 8.20 8.00 0.20 85,100 17,020 $ $ 12,220 Quantity variance: Actual quantity used (lbs.) Standard quantity used (lbs.) Variance (lbs.) Standard price Direct materials quantity variance favorable) unfavorable $ Total direct materials cost variance(favorable) unfavorable 48,000 47,760 240 $2.00 480 85,100 85,320 (220) $8.00 (1,760) $ (1,280) 10.940 $ Total direct materials cost variance: Actual cost Standard cost Total direct materials cost variance favorable) unfavorable 91,200 96,800 $ 697,820 677,440 Men's Total Supporting calculations: Standard quantity used of filler. Coats produced Standard amount per coat (lbs.) Total Womens 4,400 4.00 17,600 5,800 5.20 30,160 47,760 Chapter 23 Evaluating Variances from Standard Costs 1197 PR 23-2B Flexible budgeting and variance analysis Obj. 1,2,3 I'm Really Cold Coat Company makes women's and men's coats. Both products require filler and lining material. The following planning information has been made available: Filler Liner Standard labor time Standard Amount per Unit Women's Coats Men's Coats 4.0 lbs. 5.20 lbs. 7.00 yds. 9.40 yds. 0.40 hr. 0.50 hr. Standard Price per Unit $2.00 per lb. 8.00 per yd. Women's Coats Men's Coats Planned production 5,000 units 6,200 units Standard labor rate $14.00 per hr. $13.00 per hr. I'm Really Cold Coat Company does not expect there to be any beginning or ending inven- tories of filler and lining material. At the end of the budget year, I'm Really Cold Coat Company experienced the following actual results: Women's Coats Men's Coats Actual production 5,800 Actual Price per Unit Actual Quantity Purchased and Used Filler $1.90 per lb. 48,000 Liner 8.20 per yd. 85,100 Actual Labor Rate Actual Labor Hours Used Women's coats $14.10 per hr. 1,825 Men's coats 13.30 per hr. 2,800 4,400 The expected beginning inventory and desired ending inventory were realized. Instructions 1. Prepare the following variance analyses for both coats and the total, based on the actual results and production levels at the end of the budget year: a. Direct materials price, quantity, and total variance. b. Direct labor rate, time, and total variance. 2. Why are the standard amounts in part (1) based on the actual production at the end of the year instead of the planned production at the beginning of the year? PR 23-3B Direct materials, direct labor, and factory overhead Obj. 3, 4 cost variance analysis Road Gripper Tire Co. manufactures automobile tires. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 tires were as follows: Actual Costs 101,000 lbs at $6.50 2,000 hrs. at $15.40 Direct materials Direct labor Factory overhead Standard Costs 100,000 lbs. at $6.40 2,080 hrs. at $15.75 Rates per direct labor hr. based on 100% of normal capacity of 2000 direct Labor hrs. Variable cost, $4.00 Fixed cost, $6.00 $8.200 variable cost $12,000 fixed cost Each tire requires 0.5 hour of direct labor. (Continued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts