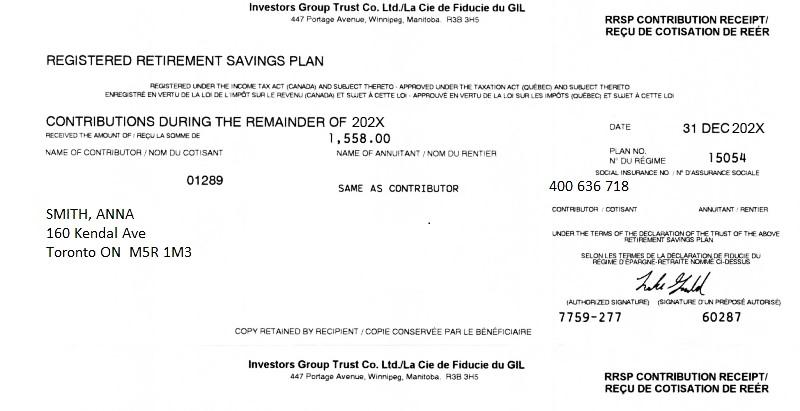

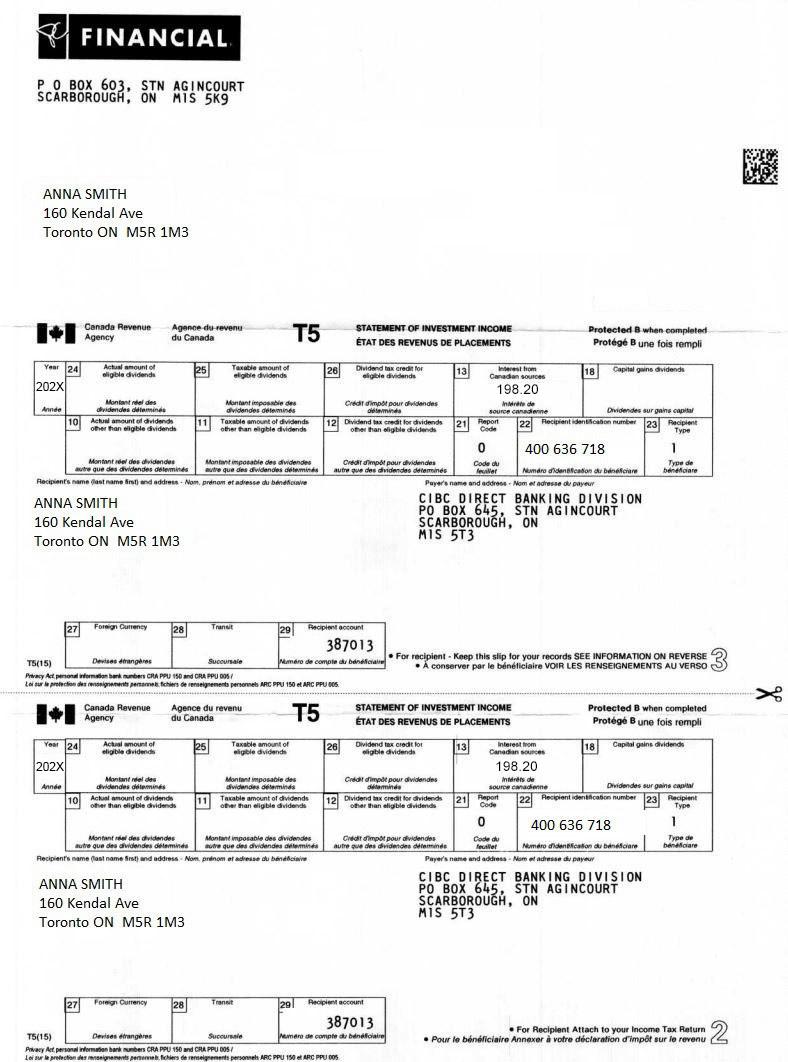

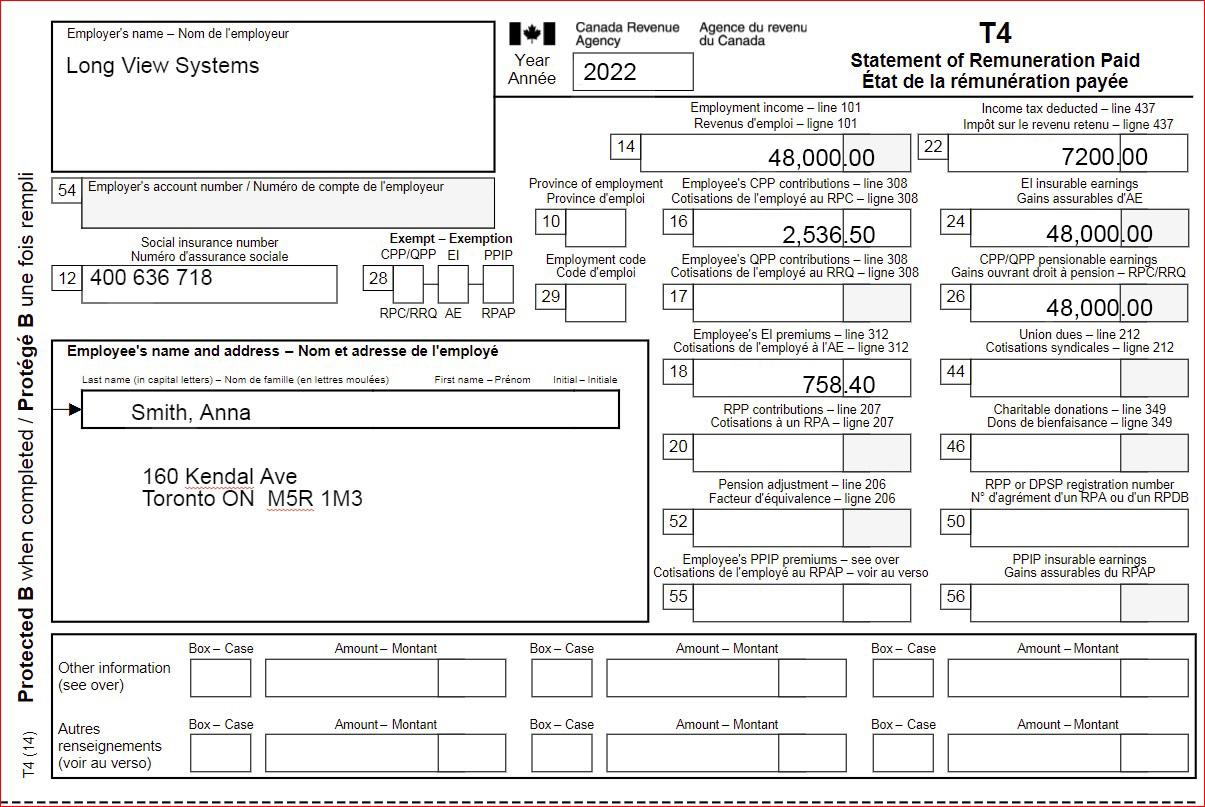

Question: T1 - step 2 - line 31 This is Anna's total income Question T1 - step 3 - line 34 This is the allowable RRSP

T1 - step 2 - line 31

This is Anna's total income

Question

T1 - step 3 - line 34

This is the allowable RRSP deduction Anna can claim, according to the Schedule 7 form

Question

S8 - part 5b - line 54

The tax break Anna will receive to compensate for the employer portion of her CPP contributions on self-employment income

(usually an employer pays half and the employee pays the other half - if you are self-employed the government treats the employer half like a business expense and doesn't tax you on it, therefore it's a deduction)

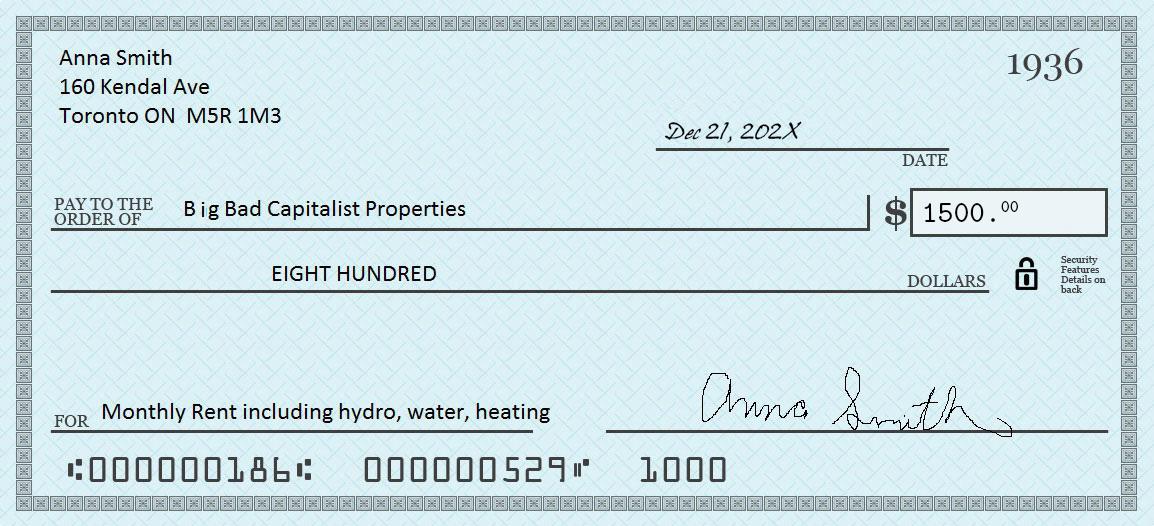

Anna Smith 160 Kendal Ave Toronto ON M5R 1M3 PAY TO THE ORDER OF Big Bad Capitalist Properties EIGHT HUNDRED FOR Monthly Rent including hydro, water, heating 000000186 000000529 Dec 21, 202X DATE 1936 1500.00 Security Features Details on DOLLARS back Anna Smith 1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts