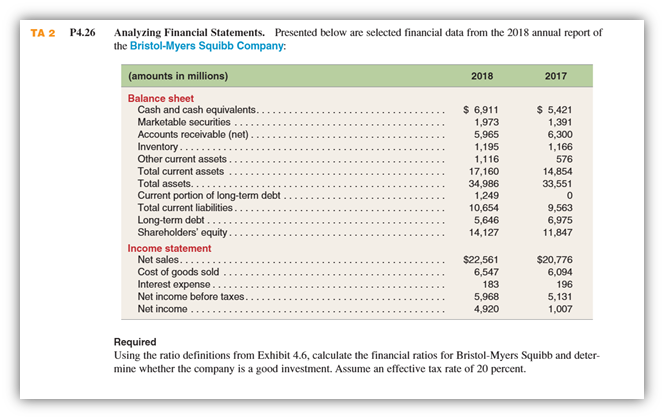

Question: TA 2 P 4 . 2 6 Analyzing Financial Statements. Presented below are selected financial data from the 2 0 1 8 annual report of

TA P Analyzing Financial Statements. Presented below are selected financial data from the annual report of the BristolMyers Squibb Company:

begintabularccc

hline amounts in millions & &

hline multicolumnlBalance sheet

hline Cash and cash equivalents. & $ & $

hline Marketable securities & &

hline Accounts receivable net & &

hline Inventory. & &

hline Other current assets. & &

hline Total current assets & &

hline Total assets. & &

hline Current portion of longterm debt & &

hline Total current liabilities & &

hline Longterm debt. & &

hline Shareholders' equity. & &

hline multicolumnlIncome statement

hline Net sales. & $ & $

hline Cost of goods sold & &

hline Interest expense. & &

hline Net income before taxes. & &

hline Net income & &

hline

endtabular

Required

Using the ratio definitions from Exhibit calculate the financial ratios for BristolMyers Squibb and determine whether the company is a good investment. Assume an effective tax rate of percent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock