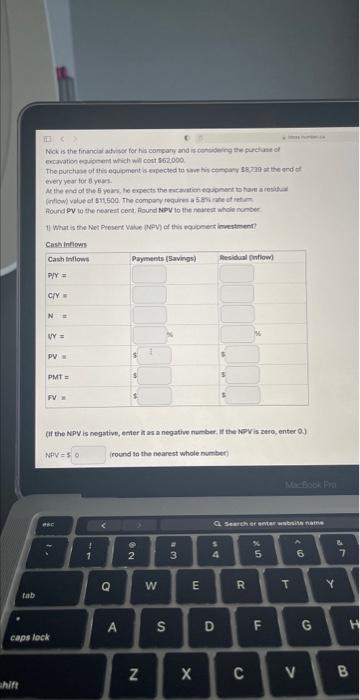

Question: tab shift 113 ( Nick is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $62,000 The

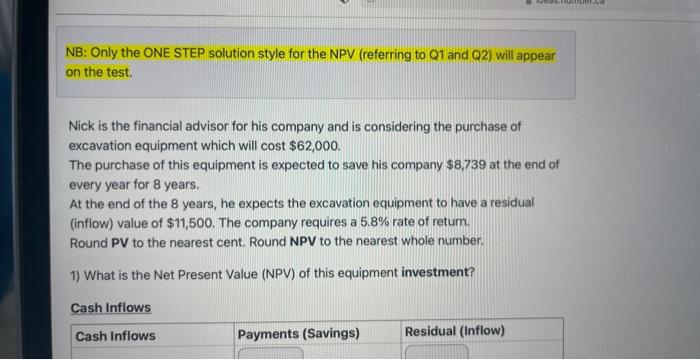

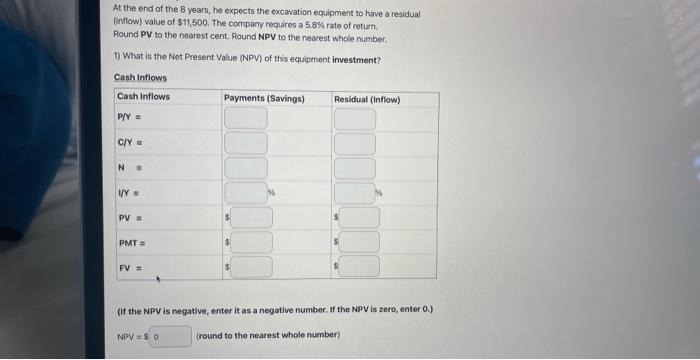

tab shift 113 ( Nick is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $62,000 The purchase of this equipment is expected to save his company $8,739 at the end of every year for 8 years At the end of the 5 years, he expects the excavation equipment to have a residual (inflow) value of $11,500. The company requires a 58% rate of retu Round PV to the nearest cent. Round NPV to the nearest whole number 1) What is the Net Present Value (NPV) of this equipment investment? Cash inflows Cash Inflows P/Y = C/Y= N VY= PV PMT= FV NPV=50 (If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.) (round to the nearest whole number esc caps lock ! 1 Q Payments (Savings) A NO 2 N W 43 E 44 X Residual (flow) S D 4 Search or enter website name R C % MacBook Pro 5 T A 6 F G & L9 Y 7 H V B NB: Only the ONE STEP solution style for the NPV (referring to Q1 and Q2) will appear on the test. Nick is the financial advisor for his company and is considering the purchase of excavation equipment which will cost $62,000. The purchase of this equipment is expected to save his company $8,739 at the end of every year for 8 years. At the end of the 8 years, he expects the excavation equipment to have a residual (inflow) value of $11,500. The company requires a 5.8% rate of return. Round PV to the nearest cent. Round NPV to the nearest whole number. 1) What is the Net Present Value (NPV) of this equipment investment? Cash Inflows Cash Inflows wicas.number.ca Payments (Savings) Residual (Inflow) At the end of the 8 years, he expects the excavation equipment to have a residual (inflow) value of $11,500. The company requires a 5.8 % rate of return. Round PV to the nearest cent. Round NPV to the nearest whole number. 1) What is the Net Present Value (NPV) of this equipment investment? Cash Inflows Cash Inflows P/Y = C/Y = N B VY= PV = PMT= FV = Payments (Savings) NPV = $0 Residual (Inflow) (If the NPV is negative, enter it as a negative number. If the NPV is zero, enter 0.) (round to the nearest whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts