Question: Tab Window Help phpflockdown 30 1 drive 23 of 30 GIA - W2 Shats Unsure P *A WeyPLUS Fantasy Seeperbe TV 1:56:35 Suppose someone offered

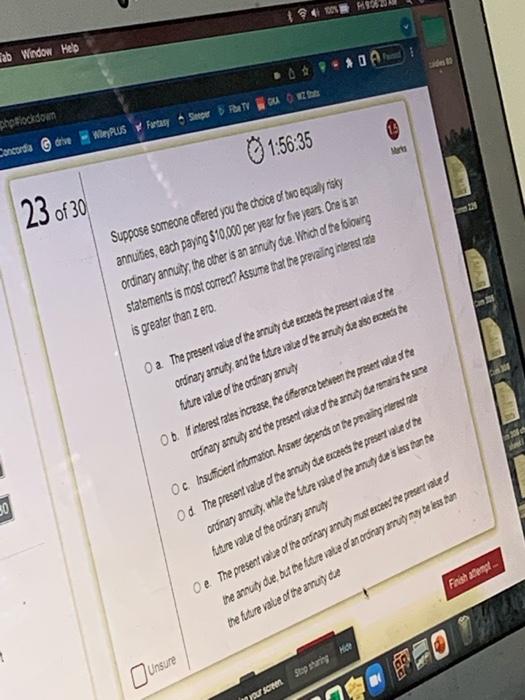

Tab Window Help phpflockdown 30 1 drive 23 of 30 GIA - W2 Shats Unsure P *A WeyPLUS Fantasy Seeperbe TV 1:56:35 Suppose someone offered you the choice of two equally risky annuities, each paying $10,000 per year for five years. One is an ordinary annuity, the other is an annuity due. Which of the following statements is most correct? Assume that the prevailing interest rate is greater than zero. O a. The present value of the annuity due exceeds the present value of the ordinary annuity, and the future value of the annuty due also exceeds the future value of the ordinary annuity O b. If interest rates increase, the difference between the present value of the ordinary annuity and the present value of the annuty due remains the same Oc. Insufficient information Answer depends on the prevailing interest rate Od. The present value of the annuity due exceeds the present value of the ordinary annuity, while the future value of the annuty due is less than the future value of the ordinary annuity Oe. The present value of the ordinary annuty must exceed the present value of the annuity due, but the future value of an ordinary annuity may be less than the future value of the annuity due Finish attempt your screen Stop sharing Hide Marks de 12 Can 304 200 c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts