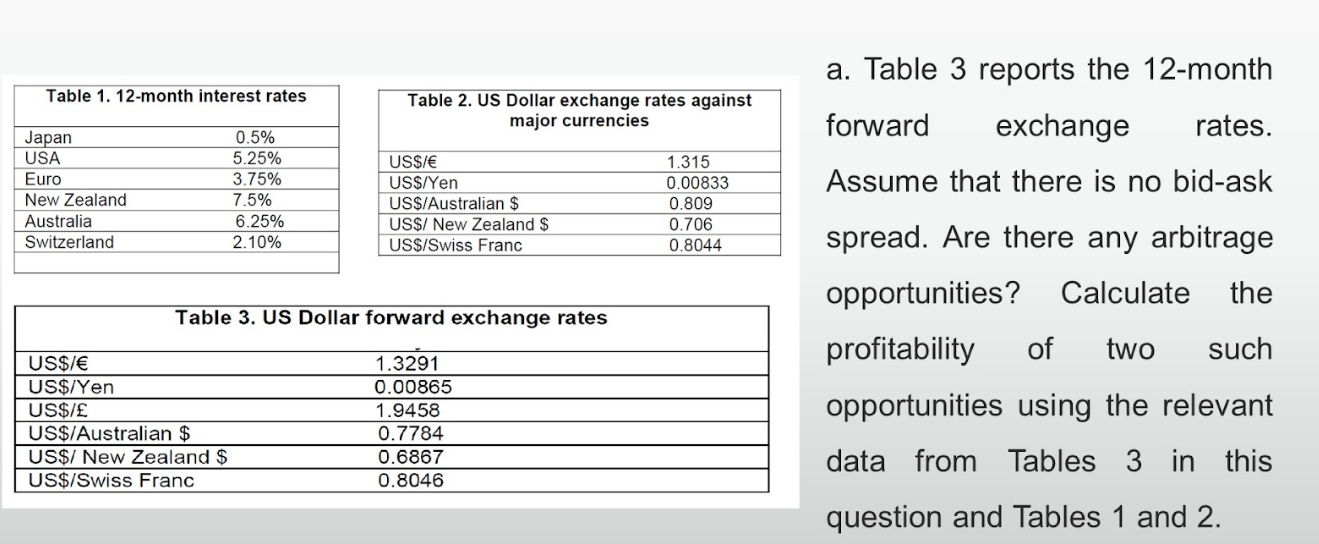

Question: Table 1. 12-month interest rates Table 2. US Dollar exchange rates against major currencies a. Table 3 reports the 12-month forward exchange rates. Assume that

Table 1. 12-month interest rates Table 2. US Dollar exchange rates against major currencies a. Table 3 reports the 12-month forward exchange rates. Assume that there is no bid-ask Japan USA Euro New Zealand Australia Switzerland 0.5% 5.25% 3.75% 7.5% 6.25% 2.10% US$/ US$/Yen US$/Australian $ US$/ New Zealand $ US$/Swiss Franc 1.315 0.00833 0.809 0.706 0.8044 Table 3. US Dollar forward exchange rates spread. Are there any arbitrage opportunities? Calculate the profitability of two such opportunities using the relevant data from Tables 3 in this US$/ US$/Yen US$/ US$/Australian $ US$/ New Zealand $ US$/Swiss Franc 1.3291 0.00865 1.9458 0.7784 0.6867 0.8046 question and Tables 1 and 2. Table 1. 12-month interest rates Table 2. US Dollar exchange rates against major currencies a. Table 3 reports the 12-month forward exchange rates. Assume that there is no bid-ask Japan USA Euro New Zealand Australia Switzerland 0.5% 5.25% 3.75% 7.5% 6.25% 2.10% US$/ US$/Yen US$/Australian $ US$/ New Zealand $ US$/Swiss Franc 1.315 0.00833 0.809 0.706 0.8044 Table 3. US Dollar forward exchange rates spread. Are there any arbitrage opportunities? Calculate the profitability of two such opportunities using the relevant data from Tables 3 in this US$/ US$/Yen US$/ US$/Australian $ US$/ New Zealand $ US$/Swiss Franc 1.3291 0.00865 1.9458 0.7784 0.6867 0.8046 question and Tables 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts