Question: Table 1 and Table 2 are extracted from the Lime team performance report for the period ending 14/06/2004. Coupons for all the bonds are paid

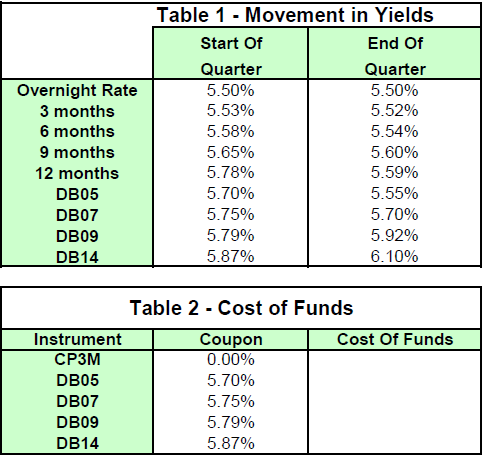

Table 1 and Table 2 are extracted from the Lime team performance report for the period ending 14/06/2004. Coupons for all the bonds are paid semi-annually, in March and September. All the bonds have a face value of $1mil, respectively, and they mature in the month of March (e.g. DB09 matures in March 2009).

Required:

a. [2 marks] What is the annualized cost of funds for CP3M for the quarter which ends in June 2004? No calculation is required.

b. [4 marks] What is the annualized cost of funds for DB05 for the quarter which ends in June 2004?

c. [4 marks] What is the annualized cost of funds for DB07 for the quarter which ends in June 2004?

Table 1 - Movement in Yields Start Of End Of Overnight Rate 3 months 6 months Quarter 5.50% 5.53% Quarter 5.50% 5.52% 5.54% 5.58% 9 months 12 months DB05 5.65% 5.78% 5.60% 5.59% 5.70% 5.55% DB07 5.75% 5.70% DB09 5.79% 5.92% DB14 5.87% 6.10% Table 2 - Cost of Funds Instrument CP3M Cost Of Funds DB05 Coupon 0.00% 5.70% 5.75% 5.79% DB07 DB09 DB14 5.87% Table 1 - Movement in Yields Start Of End Of Overnight Rate 3 months 6 months Quarter 5.50% 5.53% Quarter 5.50% 5.52% 5.54% 5.58% 9 months 12 months DB05 5.65% 5.78% 5.60% 5.59% 5.70% 5.55% DB07 5.75% 5.70% DB09 5.79% 5.92% DB14 5.87% 6.10% Table 2 - Cost of Funds Instrument CP3M Cost Of Funds DB05 Coupon 0.00% 5.70% 5.75% 5.79% DB07 DB09 DB14 5.87%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts