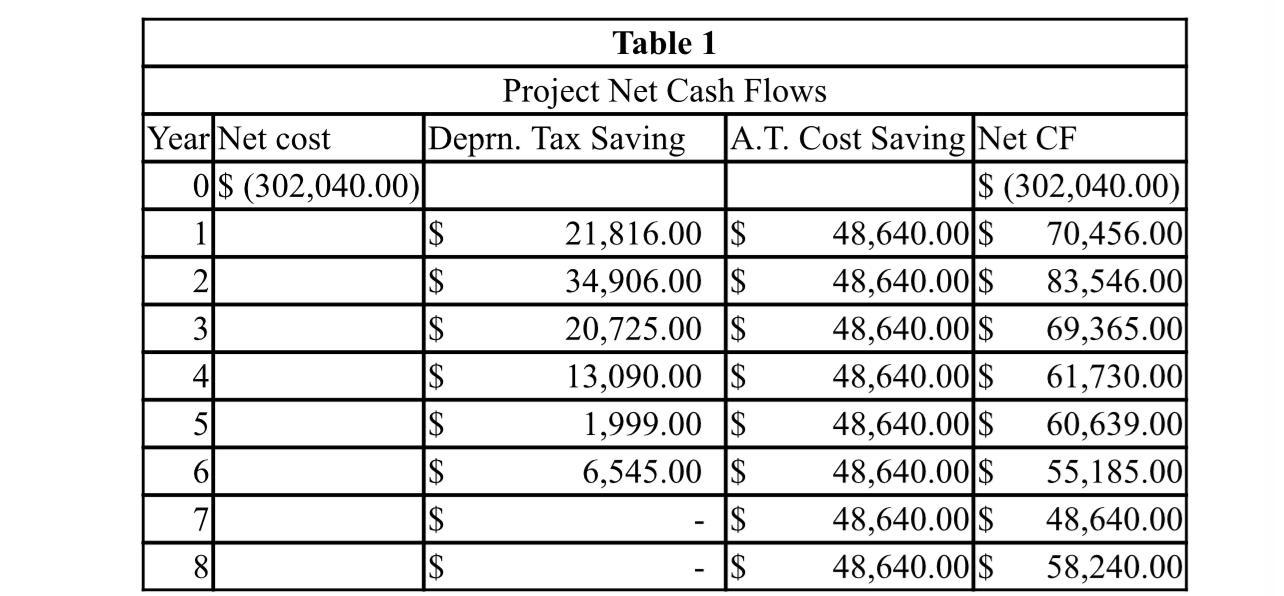

Question: Table 1 contains the complete cash flow analysis based on GP Manufacturings basic information. Explain the inputs into 1) the net initial investment outlay at

Table 1 contains the complete cash flow analysis based on GP Manufacturing’s basic information. Explain the inputs into 1) the net initial investment outlay at year 0, 2) the depreciation tax savings in each year of the project’s economic life, and 3) the project’s incremental cash flows?

Year Net cost 0$ (302,040.00) 1 2 3 5 6 7 8 Table 1 Project Net Cash Flows Deprn. Tax Saving A.T. Cost Saving Net CF $ $ $ $ $ $ $ $ 21,816.00 $ 34,906.00 $ 20,725.00 $ 13,090.00 $ 1,999.00 $ 6,545.00 $ $ $ $ (302,040.00)| 70,456.00 83,546.00 69,365.00 61,730.00 60,639.00 55,185.00 48,640.00 58,240.00 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $

Step by Step Solution

3.29 Rating (146 Votes )

There are 3 Steps involved in it

1 Net Initial Investment Outlay at Year 0 The net initial investment outlay at year 0 represents the ... View full answer

Get step-by-step solutions from verified subject matter experts