Question: Table 1 shows the estimated early start direct cost distribution of a simple project performed under a lump sum contract for 4 months. The project

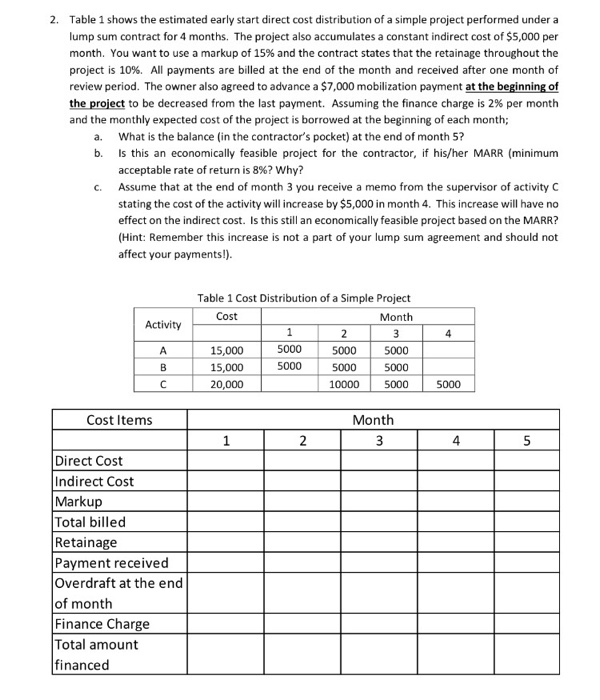

Table 1 shows the estimated early start direct cost distribution of a simple project performed under a lump sum contract for 4 months. The project also accumulates a constant indirect cost of $5, 000 per month. You want to use a markup of 15% and the contract states that the retainage throughout the project is 10%. All payments are billed at the end of the month and received after one month of review period. The owner also agreed to advance a 57, 000 mobilization payment at the beginning of the project:o be decreased from the last payment Assuming the finance charge is 2% per month and the monthly expected cost of the project is borrowed at the beginning of each month; What is the balance (in the contractor's pocket) at the end of month 5? Is this an economically feasible project for the contractor, if his/her MARR (minimum acceptable rate of return is 8%? Why? Assume that at the end of month 3 you receive a memo from the supervisor of activity C stating the cost of the activity will increase by $5, 000 in month 4. This increase will have no effect on the indirect cost. Is this still an economically feasible project based on the MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts