Question: Table 1: Table 2: Table 3: Table 4: Bond Premium, Entries for Bonds Payable Transactions payable semiannually on December 31 and June 30 . The

Table 1:

Table 2:

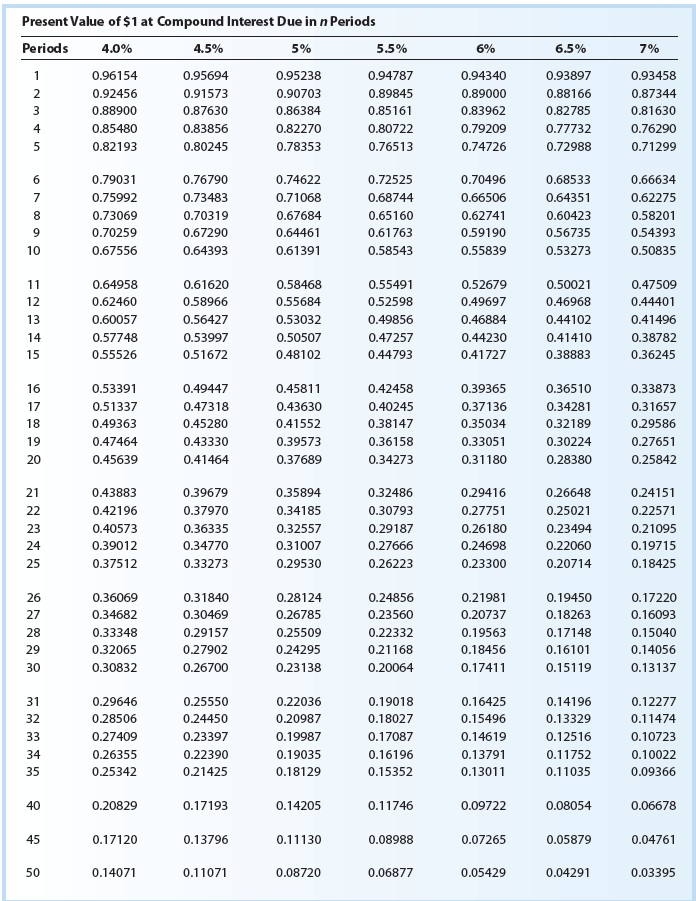

Table 3:

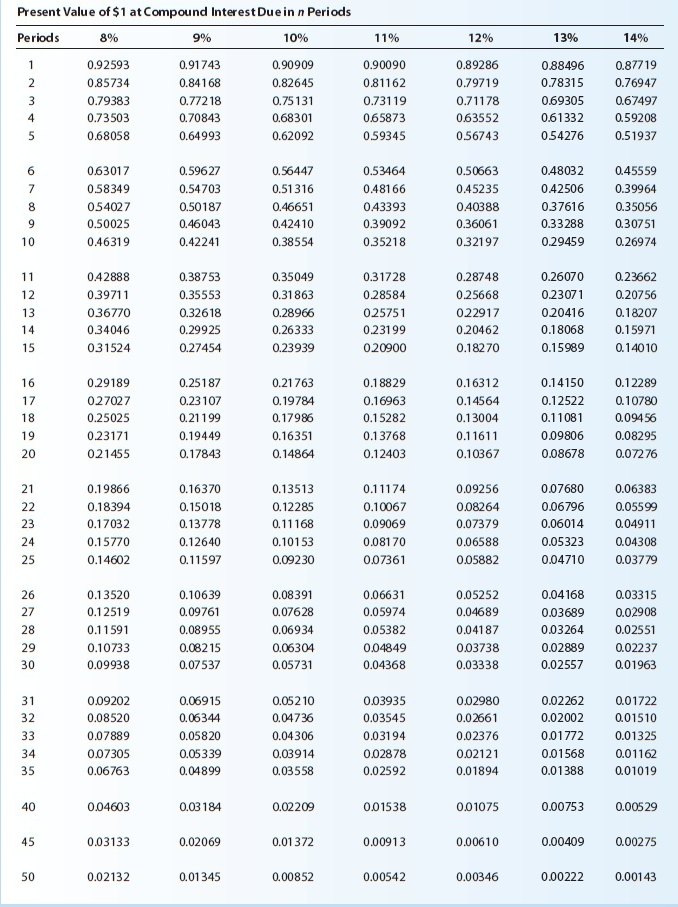

Table 4:

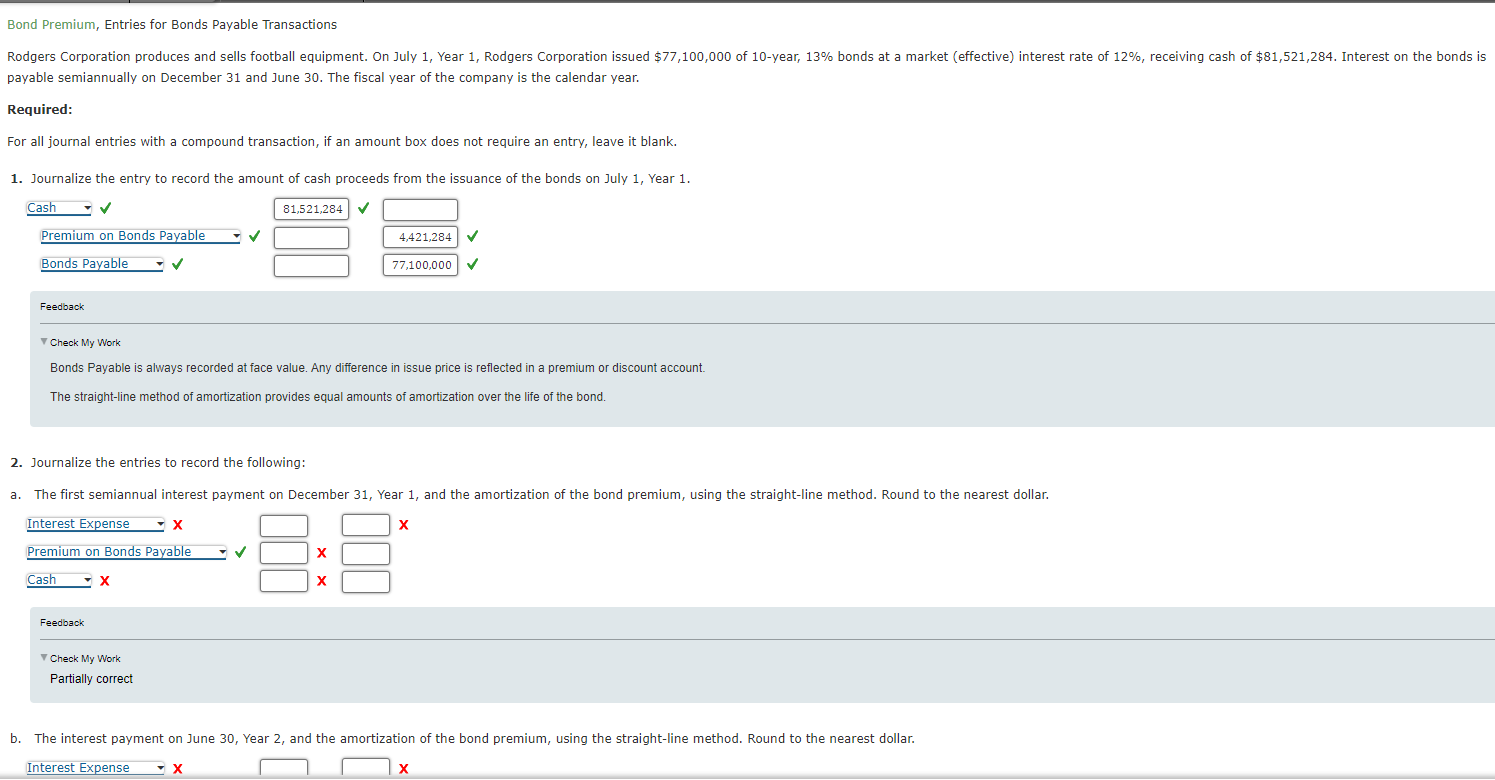

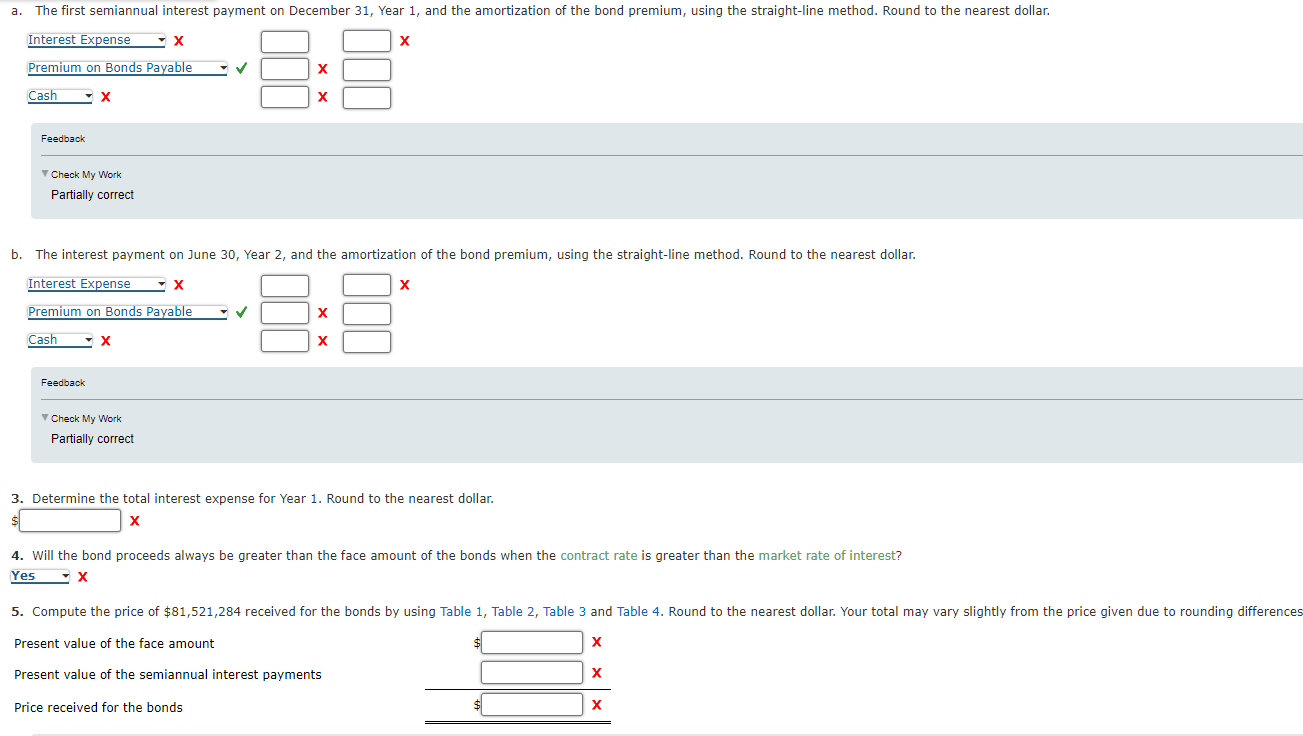

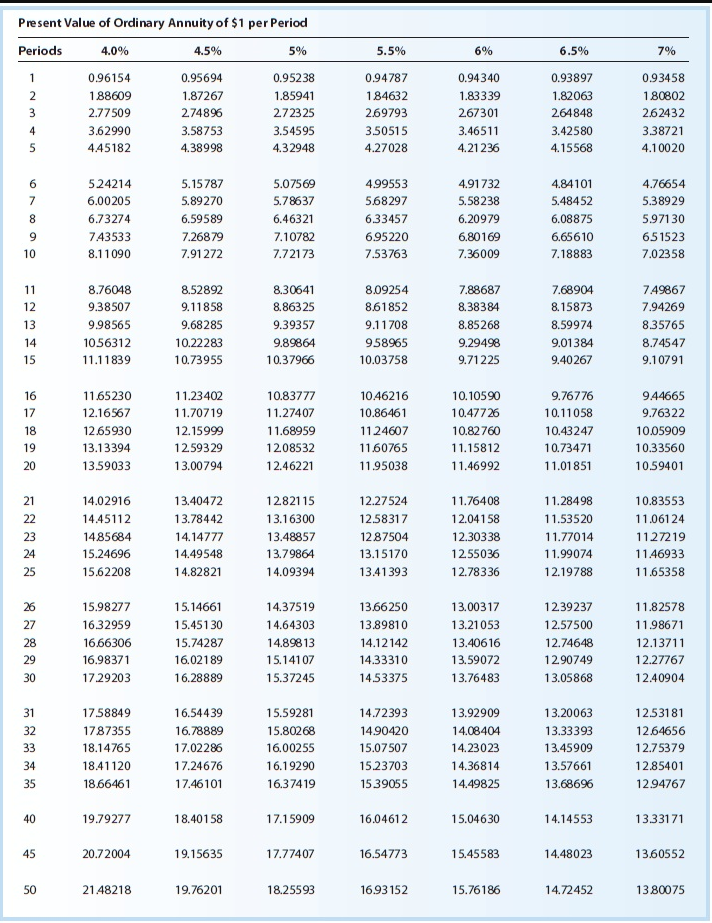

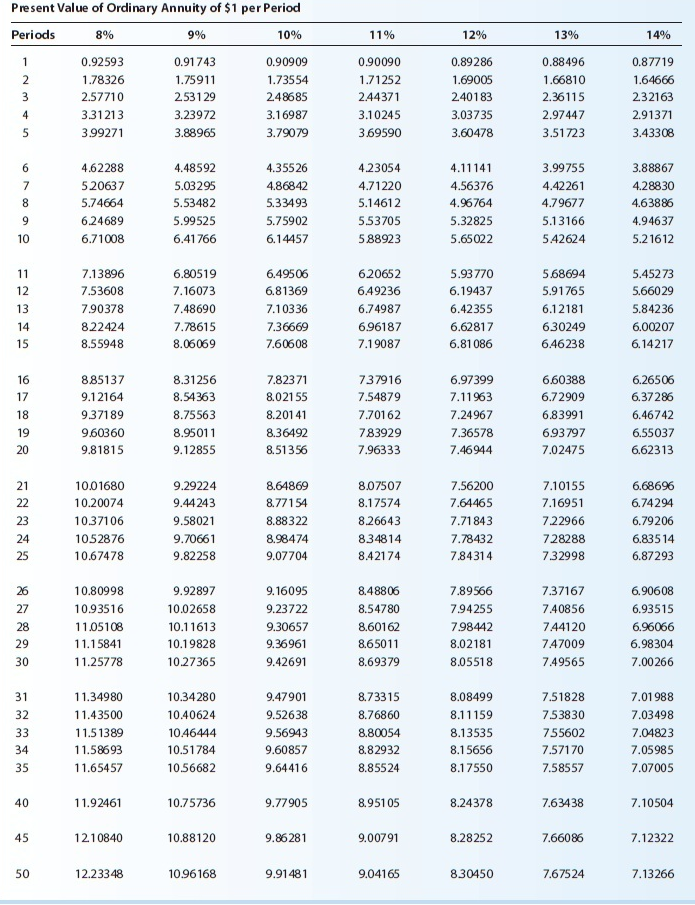

Bond Premium, Entries for Bonds Payable Transactions payable semiannually on December 31 and June 30 . The fiscal year of the company is the calendar year. Required: For all journal entries with a compound transaction, if an amount box does not require an entry, leave it blank. 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1 , Year 1. Feedback Check My Work Bonds Payable is always recorded at face value. Any difference in issue price is reflected in a premium or discount account. The straight-line method of amortization provides equal amounts of amortization over the life of the bond. 2. Journalize the entries to record the following: Check My Work Partially correct b. The interest payment on June 30 , Year 2, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. Determine the total interest expense for Year 1. Round to the nearest dollar. X 1. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is greater than the market rate of interest? X Present Value of $1 at Compound Interest Due in n Periods Present Value of $1 at Compound Interest Due in n Periods Present Value of Ordinary Annuity of $1 per Period Present Value of Ordinary Annuity of $1 per Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts