Question: Table 1: Table 2: Table 3: Table 4: Table 5: Required information [The following information applies to the questions displayed below.] On February 9 of

![information [The following information applies to the questions displayed below.] On February](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717dc293649a_9366717dc28c3df4.jpg)

Table 1:

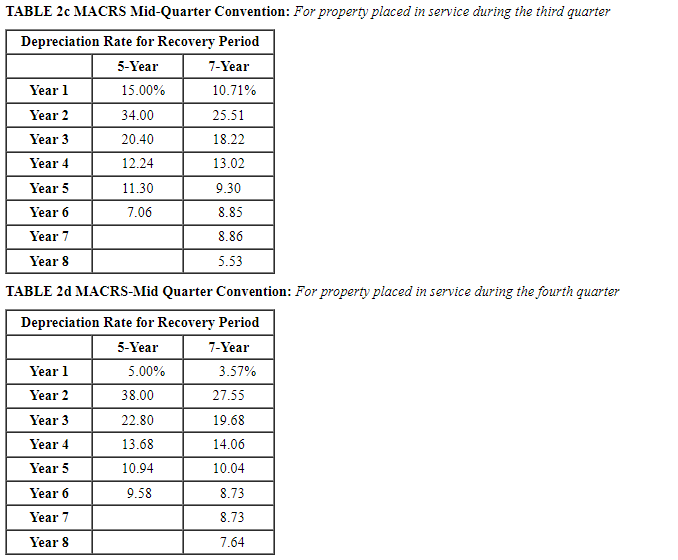

Table 2:

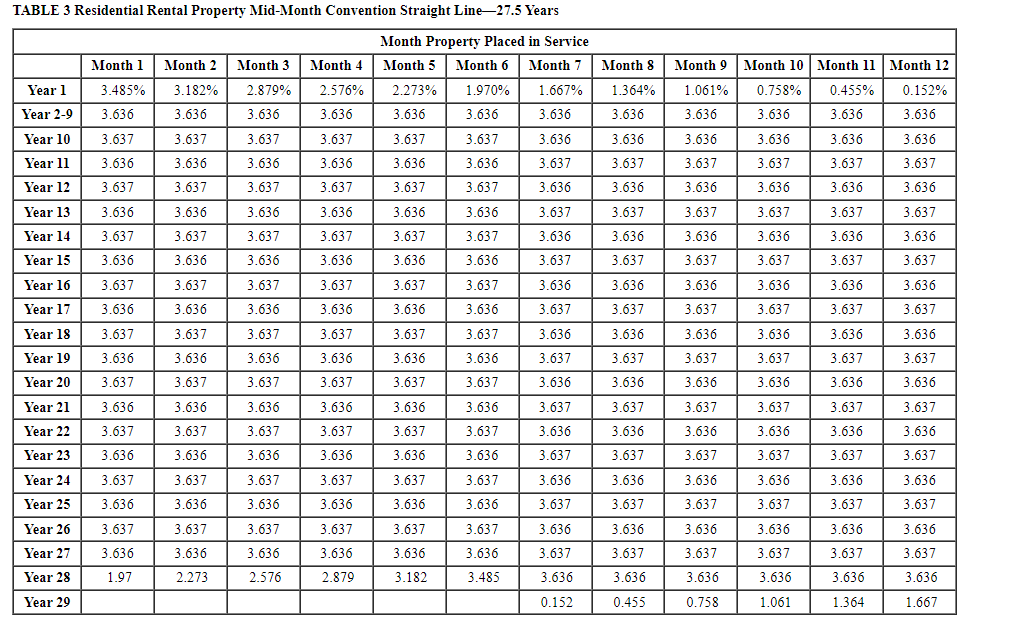

Table 3:

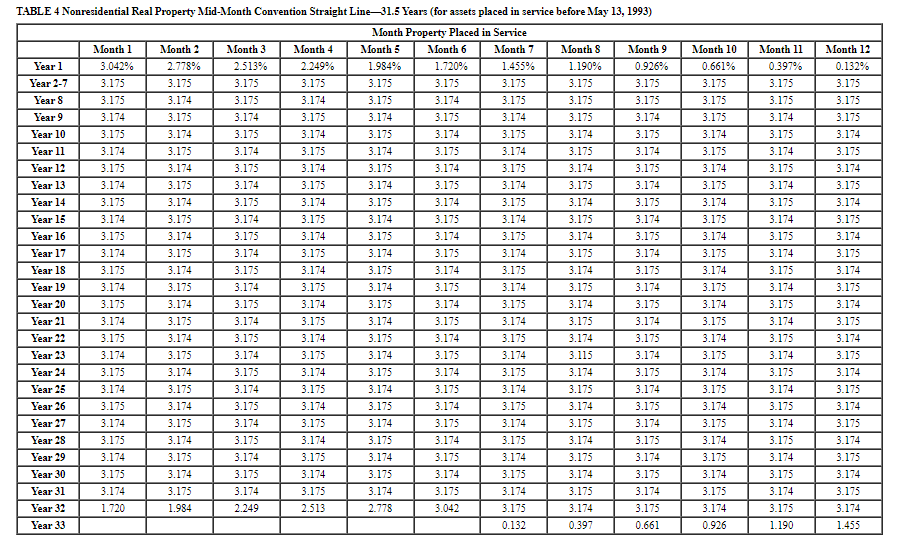

Table 4:

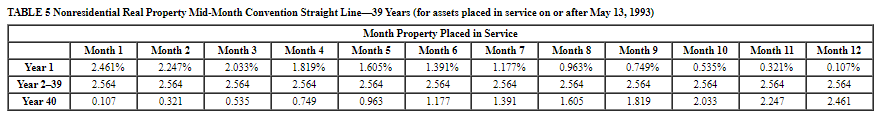

Table 5:

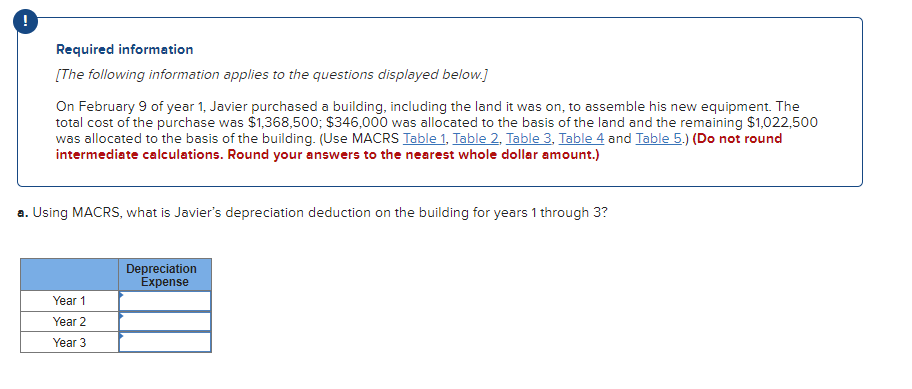

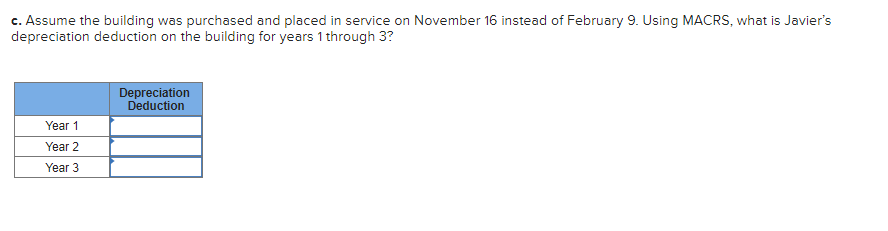

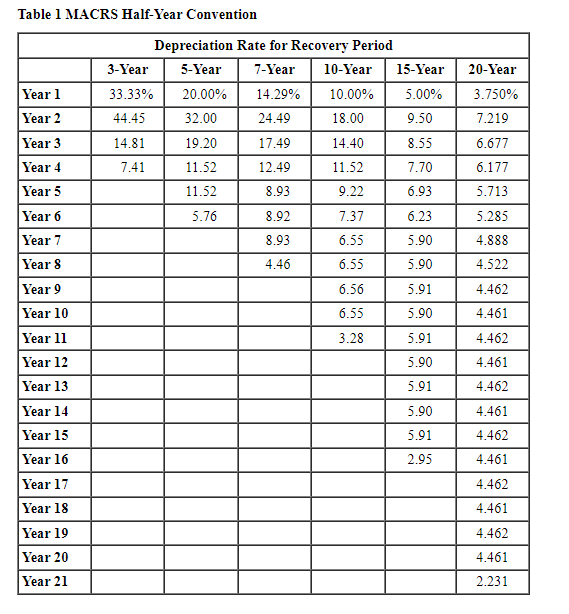

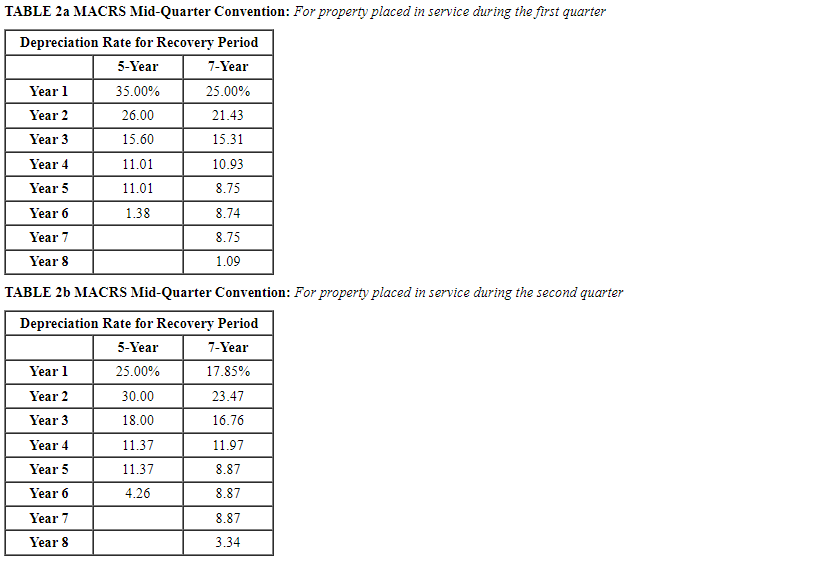

Required information [The following information applies to the questions displayed below.] On February 9 of year 1 , Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $1,368,500;$346,000 was allocated to the basis of the land and the remaining $1,022,500 was allocated to the basis of the building. (Use MACRS Table 1, Table 2, Table 3 , Table 4 and (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) a. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3 ? b. What would be the year 3 depreciation deduction if the building was sold on April 27 of year 3 ? c. Assume the building was purchased and placed in service on November 16 instead of February 9. Using MACRS, what is Javier's depreciation deduction on the building for years 1 through 3 ? Table 1 MACRS Half-Year Convention \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3-Year & 5-Year & 7-Year & 10-Year & 15-Year & 20-Year \\ \hline Year 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% & 3.750% \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 8.55 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 6.93 & 5.713 \\ \hline Year 6 & & 5.76 & 8.92 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 5.91 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 5.91 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2.231 \\ \hline \end{tabular} TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter CABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13, 1993) TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts