Question: Table 1 Today is April 1 , 2 0 2 4 . Shares of Conway, Inc. are currently priced at $ 5 0 ? share.

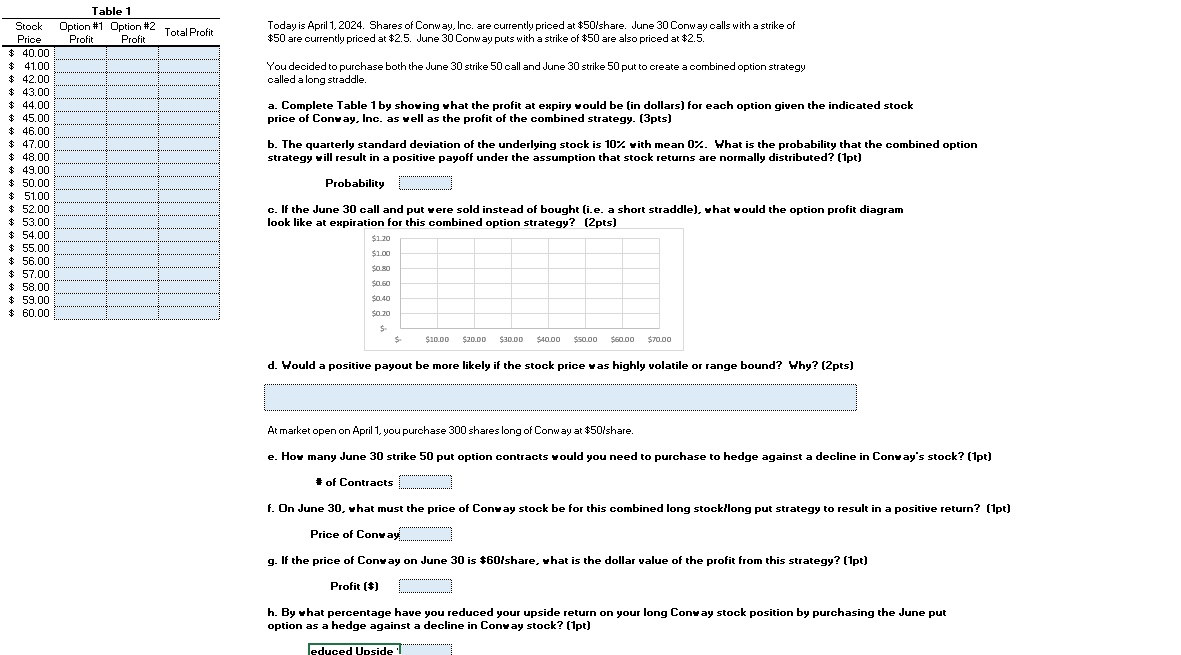

Table

Today is April Shares of Conway, Inc. are currently priced at $ share. June Conway calls with a strike of $ are

currently priced at $ June Conway puts with a strike of $ are also priced at $

You decided to purchase both the June strike call and June strike put to create a combined option strategy

called a long straddle.

a Complete Table by showing what the profit at expiry would be in dollars for each option given the indicated stock

price of Conway, Inc. as well as the profit of the combined strategy. pts

b The quarterly standard deviation of the underlying stock is with mean What is the probability that the combined option

strategy will result in a positive payoff under the assumption that stock returns are normally distributed? pt

Probability

c If the June call and put were sold instead of bought ie a short straddle what would the option profit diagram

look like at expiration for thic rnmhined antinn etrateou? ntelTable

Today is April Shares of Conw ay Inc. are currently priced at $ ishare. June Conw ay calls with a strike of

$ are currently priced at $ June Conw ay puts with a strike of $ are also priced at $

You decided to purchase both the June strike call and June strike put to ereate a combined option strategy

called a long straddle.

a Complete Table by showing what the profit at expiry would be in dollars for each option given the indicated stock

price of Conway, Inc. as well as the profit of the combined strategy. pts

b The quarterly standard deviation of the underlying stock is with mean What is the probability that the combined option

strategy will result in a positive payoff under the assumption that stock returns are normally distributed? pt

Probability

c If the June call and put were sold instead of bought ie a short straddle what would the option profit diagram

look like at expiration for this combined option strategy? pts

d Hould a positive payout be more likely if the stock price was highly volatile or range bound? Why? pts

At market open on April you purchase shares long of Conw ay at $ ishare.

e How many June strike put option contracts would you need to purchase to hedge against a decline in Conway's stock? pt

& of Contracts

f On June what must the price of Conway stock be for this combined long stockllong put strategy to result in a positive return? pt

Price of Conway:

g If the price of Conway on June is $ share, what is the dollar value of the profit from this strategy? pt

Profit $

h By what percentage have you reduced your upside return on your long Conway stock position by purchasing the June put

option as a hedge against a decline in Conway stock? pt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock