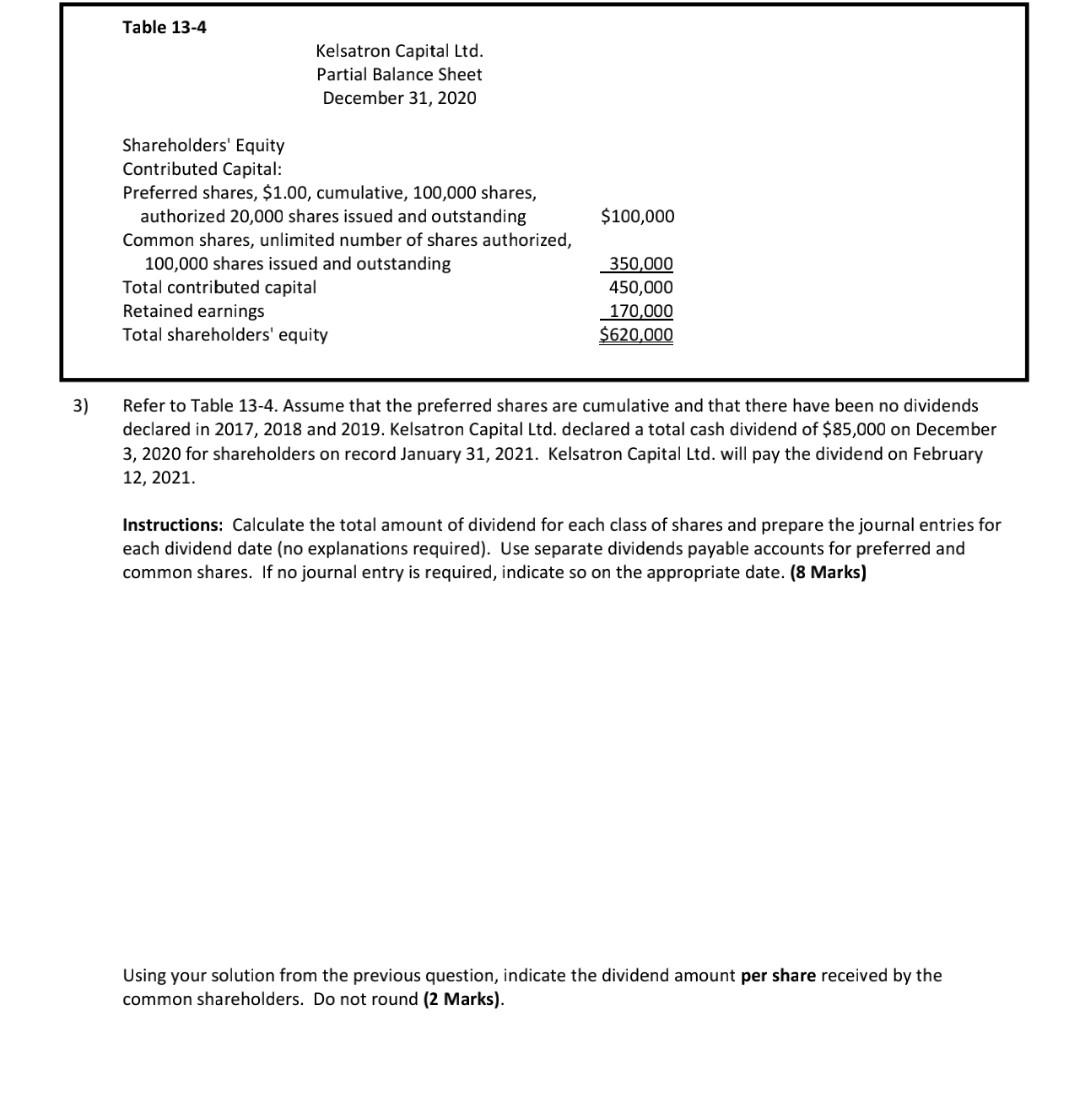

Question: Table 13-4 Kelsatron Capital Ltd. Partial Balance Sheet December 31, 2020 $100,000 Shareholders' Equity Contributed Capital: Preferred shares, $1.00, cumulative, 100,000 shares, authorized 20,000 shares

Table 13-4 Kelsatron Capital Ltd. Partial Balance Sheet December 31, 2020 $100,000 Shareholders' Equity Contributed Capital: Preferred shares, $1.00, cumulative, 100,000 shares, authorized 20,000 shares issued and outstanding Common shares, unlimited number of shares authorized, 100,000 shares issued and outstanding Total contributed capital Retained earnings Total shareholders' equity 350,000 450,000 170,000 $620.000 3) Refer to Table 13-4. Assume that the preferred shares are cumulative and that there have been no dividends declared in 2017, 2018 and 2019. Kelsatron Capital Ltd. declared a total cash dividend of $85,000 on December 3, 2020 for shareholders on record January 31, 2021. Kelsatron Capital Ltd. will pay the dividend on February 12, 2021. Instructions: Calculate the total amount of dividend for each class of shares and prepare the journal entries for each dividend date (no explanations required). Use separate dividends payable accounts for preferred and common shares. If no journal entry is required, indicate so on the appropriate date. (8 Marks) Using your solution from the previous question, indicate the dividend amount per share received by the common shareholders. Do not round (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts