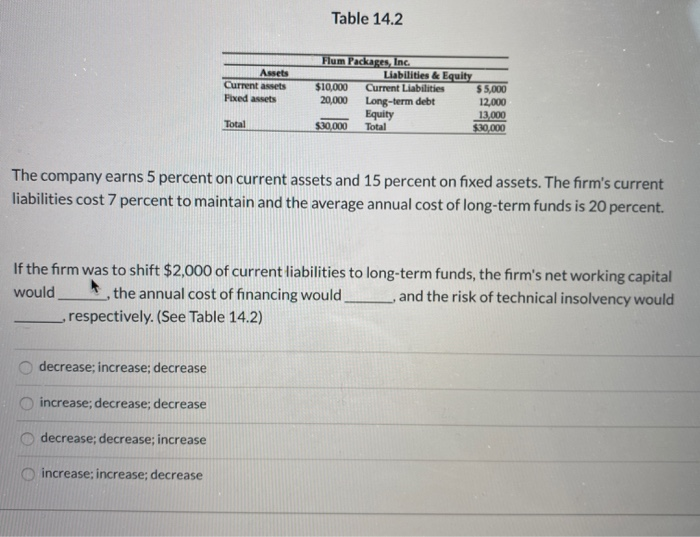

Question: Table 14.2 Assets Current assets Fixed assets Flum Packages, Inc. Liabilities & Equity $10,000 Current Liabilities $5,000 20,000 Long-term debt 12,000 Equity 13.000 $30,000 Total

Table 14.2 Assets Current assets Fixed assets Flum Packages, Inc. Liabilities & Equity $10,000 Current Liabilities $5,000 20,000 Long-term debt 12,000 Equity 13.000 $30,000 Total $10.000 Total The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent. If the firm was to shift $2,000 of current liabilities to long-term funds, the firm's net working capital would , the annual cost of financing would and the risk of technical insolvency would respectively. (See Table 14.2) decrease; increase; decrease increase; decrease; decrease decrease; decrease; increase increase; increase; decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts