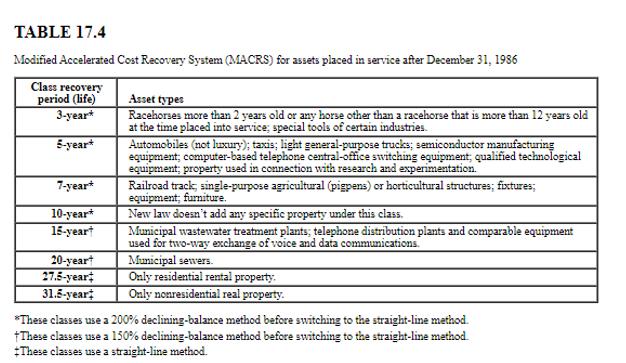

Question: TABLE 17.4 Modified Accelerated Cost Recovery System (MACRS) for assets placed in service after December 31, 1986 Class recovery period (life) 3-year* 5-year 7-year*

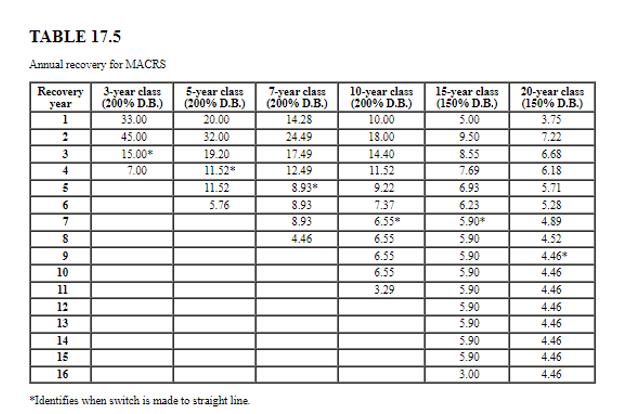

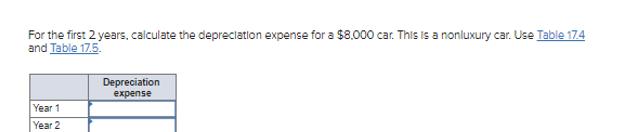

TABLE 17.4 Modified Accelerated Cost Recovery System (MACRS) for assets placed in service after December 31, 1986 Class recovery period (life) 3-year* 5-year 7-year* 10-year* 15-year 20-yeart 27.5-year 31.5-year Asset types Racehorses more than 2 years old or any horse other than a racehorse that is more than 12 years old at the time placed into service; special tools of certain industries. Automobiles (not luxury); taxis; light general-purpose trucks; semiconductor manufacturing equipment; computer-based telephone central-office switching equipment; qualified technological equipment; property used in connection with research and experimentation. Railroad track; single-purpose agricultural (pigpens) or horticultural structures; fixtures; equipment; furniture. New law doesn't add any specific property under this class. Municipal wastewater treatment plants; telephone distribution plants and comparable equipment used for two-way exchange of voice and data communications. Municipal sewers. Only residential rental property. Only nonresidential real property. *These classes use a 200% declining-balance method before switching to the straight-line method. These classes use a 150% declining-balance method before switching to the straight-line method. *These classes use a straight-line method. TABLE 17.5 Annual recovery for MACRS Recovery 3-year class 5-year class 7-year class 10-year class 15-year class 20-year class year (200% D.B.) (200% D.B.) (200% D.B.) (200% D.B.) (150% D.B.) (150% D.B.) 1 33.00 20.00 14.28 10.00 5.00 3.75 2 45.00 32.00 24.49 18.00 9.50 7.22 3 15.00* 19.20 17.49 14.40 8.55 6.68 4 7.00 11.52 12.49 11.52 7.69 6.18 5 11.52 8.93 9.22 6.93 5.71 6 5.76 8.93 7.37 6.23 5.28 7 8.93 6.55* 5.90* 4.89 S 4.46 6.55 5.90 4.52 9 6.55 5.90 4.46* 10 6.55 5.90 4.46 11 3.29 5.90 4.46 12 5.90 4.46 13 5.90 4.46 14 5.90 4.46 15 5.90 4.46 3.00 4.46 16 *Identifies when switch is made to straight line. For the first 2 years, calculate the depreciation expense for a $8,000 car. This is a nonluxury car. Use Table 17.4 and Table 17.5. Year 1 Year 2 Depreciation expense

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

ANSWER Solution As per the table givenC... View full answer

Get step-by-step solutions from verified subject matter experts