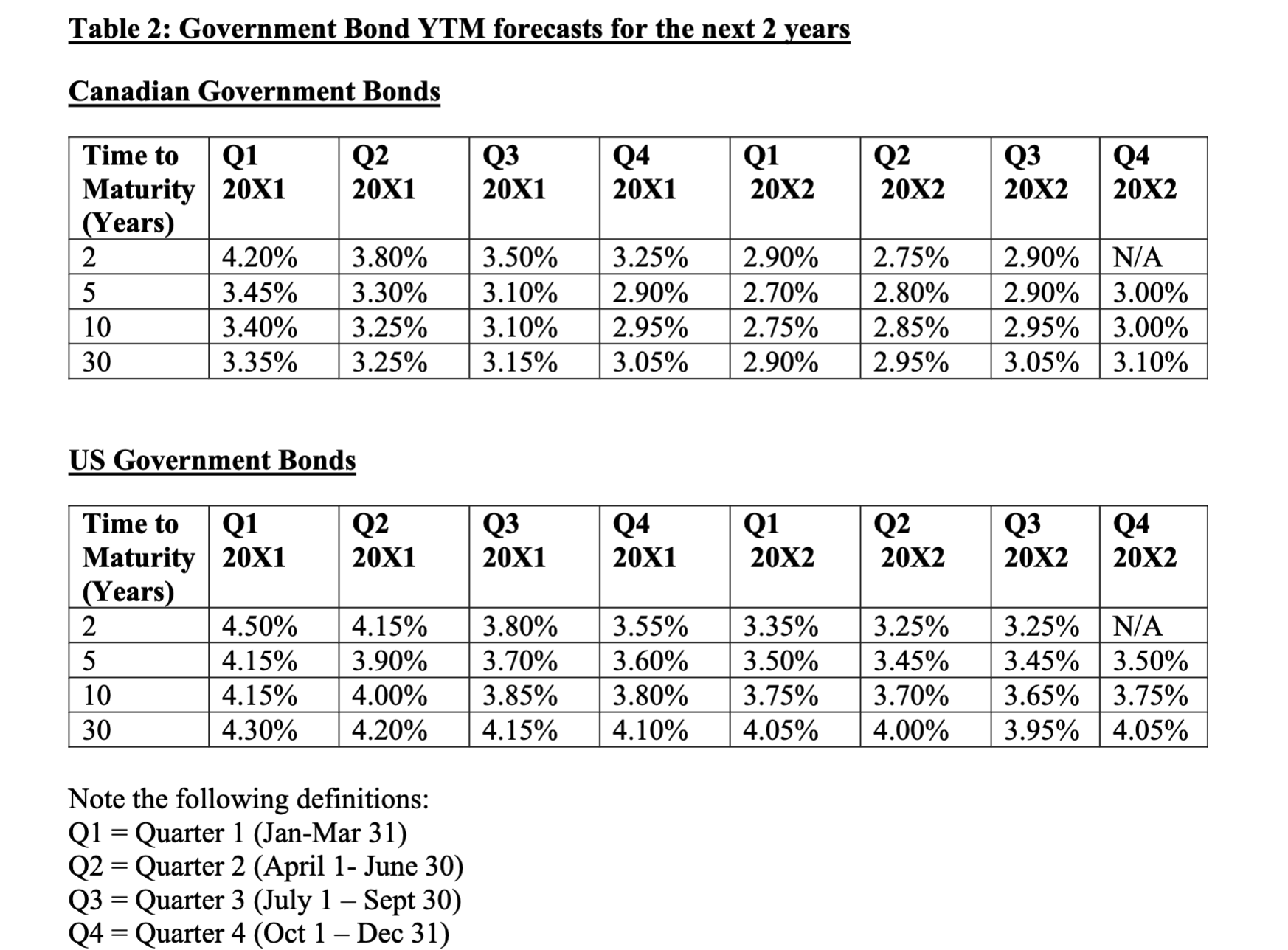

Question: Table 2 : Government Bond YTM forecasts for the next 2 years Canadian Government Bonds US Government Bonds Note the following definitions: Q 1 =

Table : Government Bond YTM forecasts for the next years

Canadian Government Bonds

US Government Bonds

Note the following definitions:

Q Quarter JanMar

Q Quarter April June

Q Quarter July Sept

Q Quarter Oct Dec

Assume you hold a Canadian bond portfolio comprised of government bonds and corporate bonds at the beginning of X that has an average maturity of years. Your portfolio currently has a mixture of bonds of various maturities. Assume you do not want to change the weighting of government vs corporate bonds. What would be a good investment strategy? Explain briefly. does the approach remain the same

explain further on what the steps to solve are.

i want to do this in excel using the PV functions.But How do i go representing itWhat steps do i take to solve this comprehensively

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock