Question: Table 2 Probability ,Price 0.05, 3.50 0.10, 7.00 0.35, 12.50 0.35, 13.90 0.10, 19.40 0.05, 22.90 Case 22 Precision Tool Company Topic Investment Banking 1.Using

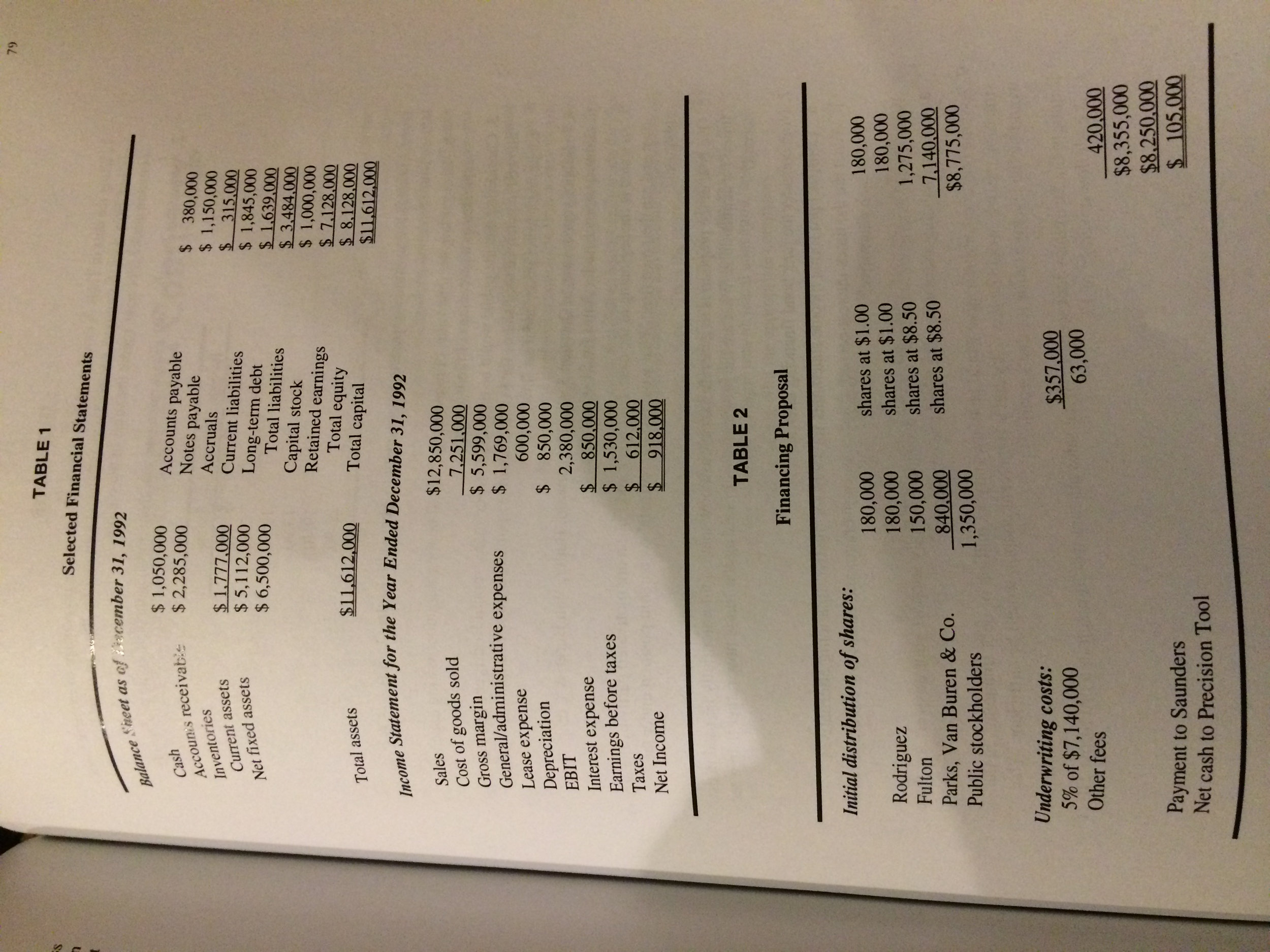

Table 2

Probability ,Price

0.05, 3.50

0.10, 7.00

0.35, 12.50

0.35, 13.90

0.10, 19.40

0.05, 22.90

Case 22 Precision Tool Company Topic Investment Banking

1.Using the data in Table 2, calculate the total flotation costs as a percentage of external funds raised. How does this amount compare with published averages for the cost of selling new common stock?

Flotation = underwriting. 420,000 / 8,415,000 (1,275,000 + 7,140,000) = 5% (answer). Published average for $2-10 million new common stock = 13%

5. As stated at the beginning of the case, Rodriguez and Fulton are motivated partly by the urge to own and run their own firm. What would be the partners ownership position under the proposal?

7.Now consider the junk food financing alternative.

Construct a pro forma income statements for 1993 for the two financing alternatives.

What are the times-interest-earned, fixed charge coverage, and cash flow coverage ratios under each alternative?

8.What should Rodriguez and Fultons final decision be? Fully support your answer. Are there any other financing alternatives that should be considered?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts