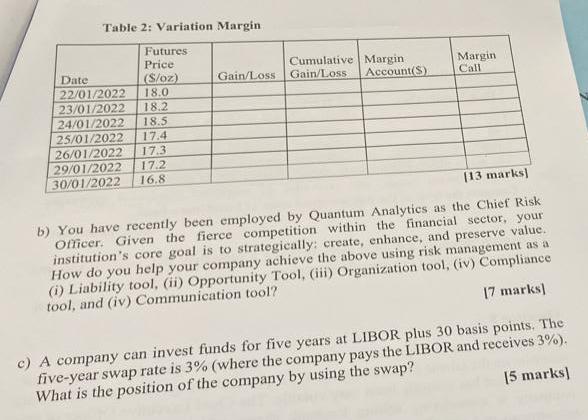

Question: Table 2: Variation Margin Cumulative Margin Gain/Loss Account(S) Margin Call Gain/Loss Date 22/01/2022 23/01/2022 24/01/2022 25/01/2022 26/01/2022 29/01/2022 30/01/2022 Futures Price (S/oz) 18.0 18.2 18.5

Table 2: Variation Margin Cumulative Margin Gain/Loss Account(S) Margin Call Gain/Loss Date 22/01/2022 23/01/2022 24/01/2022 25/01/2022 26/01/2022 29/01/2022 30/01/2022 Futures Price (S/oz) 18.0 18.2 18.5 17.4 17.3 17.2 16,8 113 marks) b) You have recently been employed by Quantum Analytics as the Chief Risk Officer. Given the fierce competition within the financial sector, your institution's core goal is to strategically create, enhance, and preserve value. How do you help your company achieve the above using risk management as a (i) Liability tool, (ii) Opportunity Tool, (iii) Organization tool, (iv) Compliance tool, and (iv) Communication tool? 17 marks) c) A company can invest funds for five years at LIBOR plus 30 basis points. The five-year swap rate is 3% (where the company pays the LIBOR and receives 3%). What is the position of the company by using the swap? 15 marks) Table 2: Variation Margin Cumulative Margin Gain/Loss Account(S) Margin Call Gain/Loss Date 22/01/2022 23/01/2022 24/01/2022 25/01/2022 26/01/2022 29/01/2022 30/01/2022 Futures Price (S/oz) 18.0 18.2 18.5 17.4 17.3 17.2 16,8 113 marks) b) You have recently been employed by Quantum Analytics as the Chief Risk Officer. Given the fierce competition within the financial sector, your institution's core goal is to strategically create, enhance, and preserve value. How do you help your company achieve the above using risk management as a (i) Liability tool, (ii) Opportunity Tool, (iii) Organization tool, (iv) Compliance tool, and (iv) Communication tool? 17 marks) c) A company can invest funds for five years at LIBOR plus 30 basis points. The five-year swap rate is 3% (where the company pays the LIBOR and receives 3%). What is the position of the company by using the swap? 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts