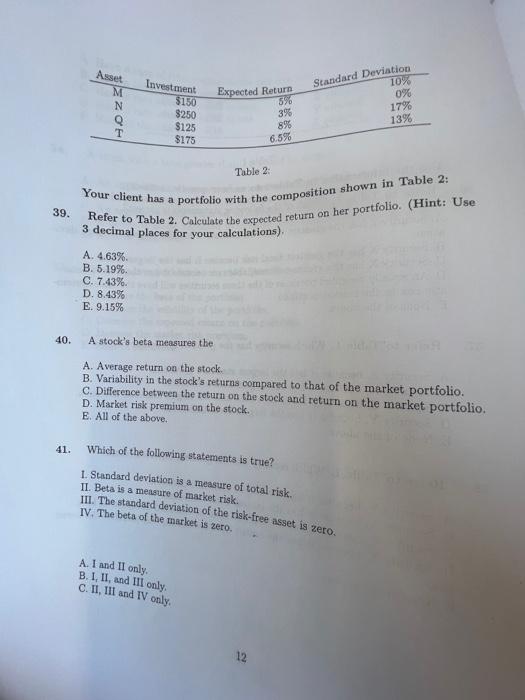

Question: Table 2: Your client has a portfolio with the composition shown in Table 2: 39. Refer to Table 2. Calculate the expected return on her

Table 2: Your client has a portfolio with the composition shown in Table 2: 39. Refer to Table 2. Calculate the expected return on her portfolio. (Hint: Use 3 decimal places for your calculations). A. 4.63%. B. 5.19%. C. 7.43% D. 8.43% E. 9.15% 40. A stock's beta measures the A. Average return on the stock. B. Variability in the stock's returns compared to that of the market portfolio. C. Difference between the return on the stoek and return on the market portfolio. D. Market risk prem E. All of the above. 41. Which of the following statements is true? 1. Standard deviation is a measure of total risk. II. Beta is a measure of market risk. III. The standard deviation of the risk-free asset is zero. A. I and II only. B. I, II, and III only. C. II, III and IV only, D. I, II, III and IV. E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts