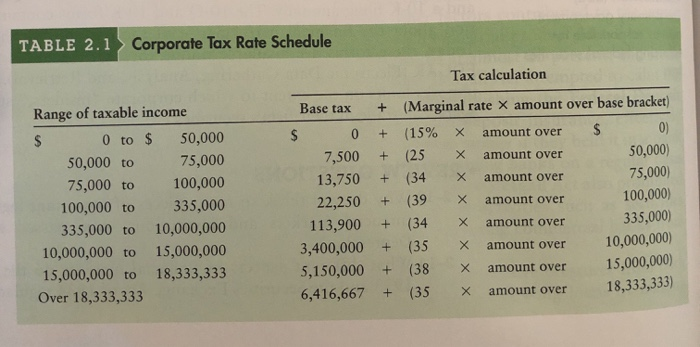

Question: TABLE 2.1 Corporate Tax Rate Schedule + + + + Range of taxable income 0 to $ 50,000 50,000 to 75,000 75,000 to 100,000 100,000

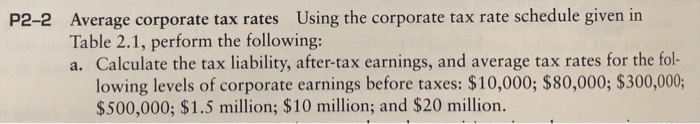

TABLE 2.1 Corporate Tax Rate Schedule + + + + Range of taxable income 0 to $ 50,000 50,000 to 75,000 75,000 to 100,000 100,000 to 335,000 335,000 to 10,000,000 10,000,000 to 15,000,000 15,000,000 to 18,333,333 Over 18,333,333 Base tax $ 0 7,500 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667 Tax calculation (Marginal rate X amount over base bracket) (15% X amount over $ 0) (25 X amount over 50,000) (34 X amount over 75,000 amount over 100,000) amount over 335,000) amount over 10,000,000) (38 amount over 15,000,000) (35 X amount over 18,333,333) + + + + + P2-2 Average corporate tax rates Using the corporate tax rate schedule given in Table 2.1, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the fol- lowing levels of corporate earnings before taxes: $10,000; $80,000; $300,000; $500,000; $1.5 million; $10 million; and $20 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts