Question: Table 23.2 below Please answer all parts. Thank you! Suppose you purchase the July 2020 put option on corn futures with a strike price of

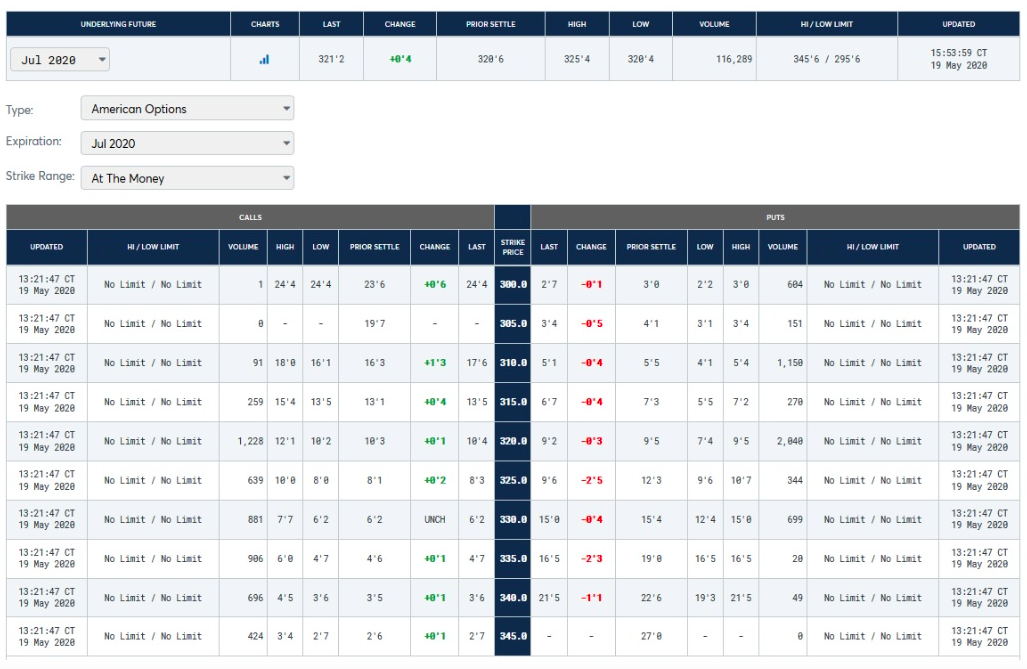

Table 23.2 below

Please answer all parts. Thank you!

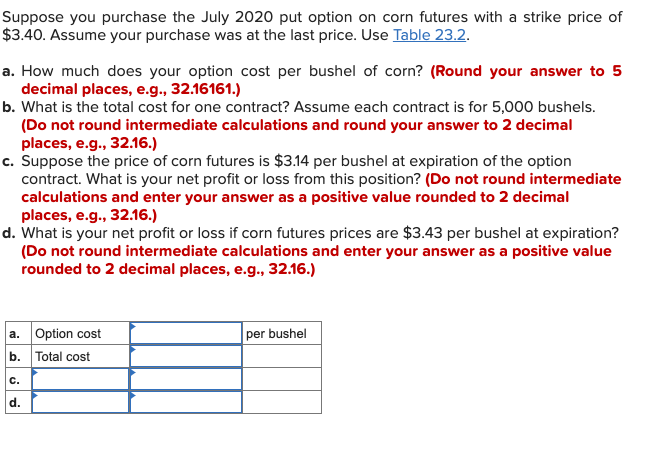

Suppose you purchase the July 2020 put option on corn futures with a strike price of \$3.40. Assume your purchase was at the last price. Use Table 23.2. a. How much does your option cost per bushel of corn? (Round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost for one contract? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn futures is $3.14 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $3.43 per bushel at expiration? (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) Type: American Options Expiration: Jul 2020 Strike Range: At The Money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts