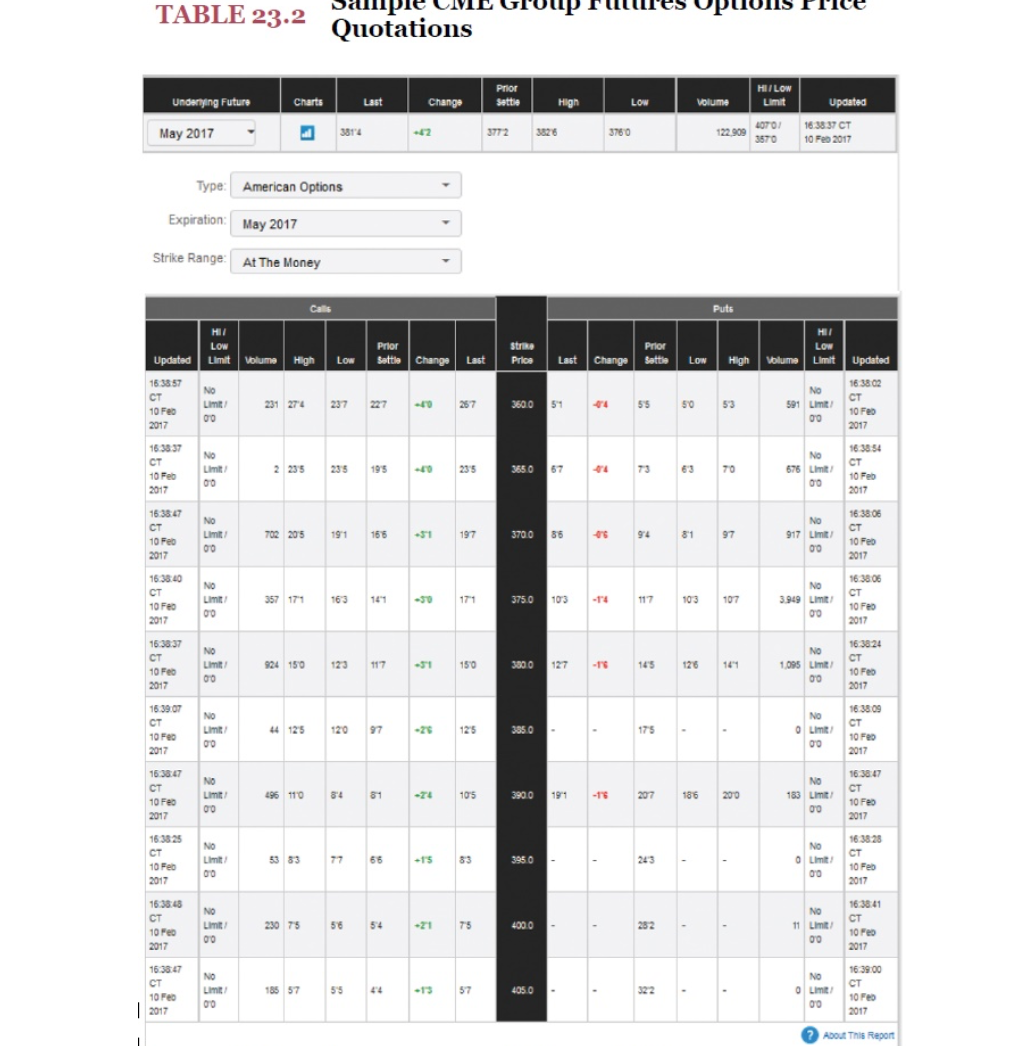

Question: TABLE 23.2 Pons Price Quotations Indenying Future May 2017 . 3814 3772 3760 Type: American Options Expiration: May 2017 Strike Range: At The Money Low

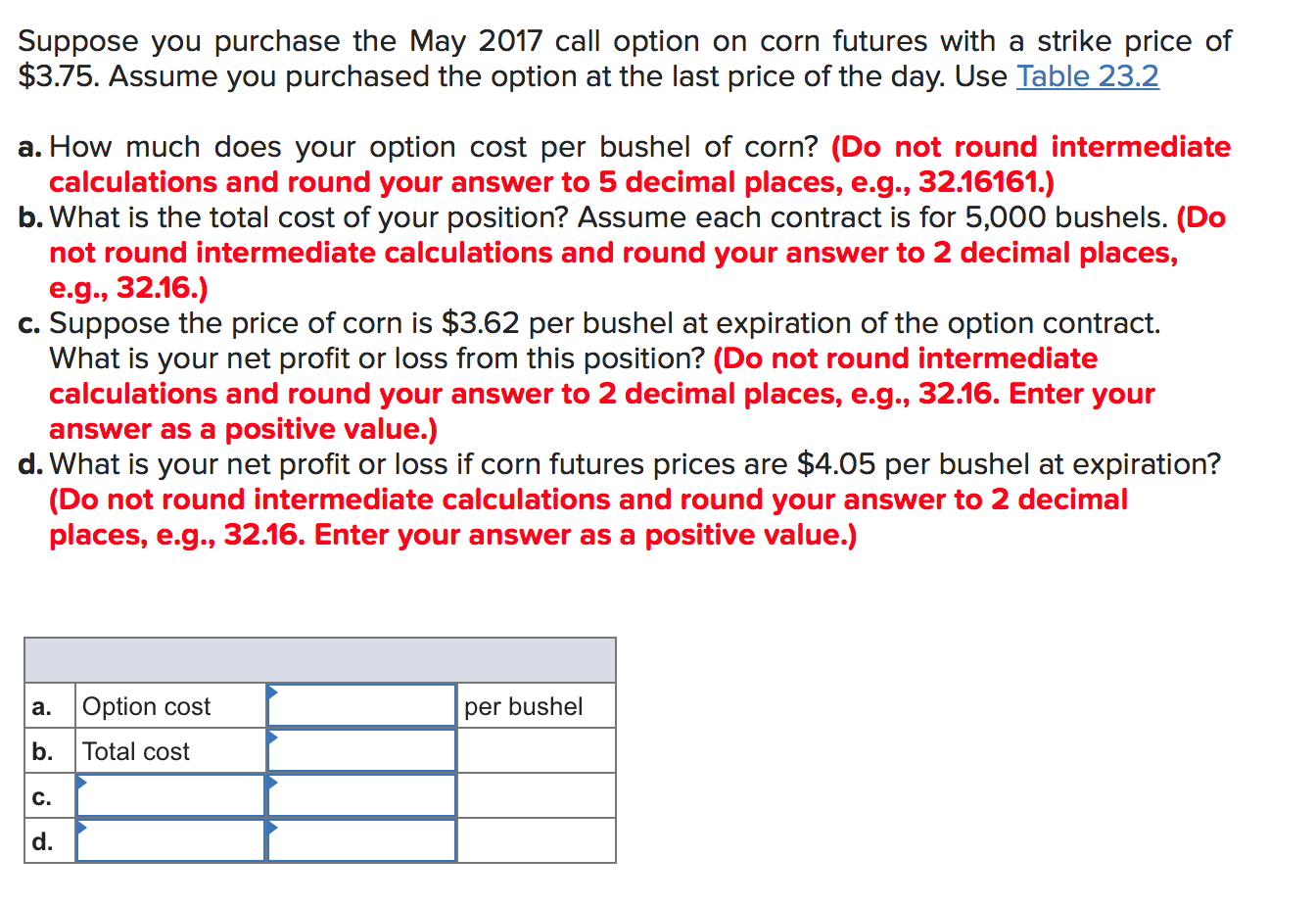

TABLE 23.2 Pons Price Quotations Indenying Future May 2017 . 3814 3772 3760 Type: American Options Expiration: May 2017 Strike Range: At The Money Low Updated Limit Volume Hig Battle Change Las Bree Last Low Volume Updated Low 237 231 272 227 -40 267 3600 59 44 55 50 53 No 591 Lime 223 195 40 67 73 TO NO 676 Lim 00 05 102 203 165 197 370 86 94 07 No 917 LIM 889 201 357 17 14 -50 171 No 3949 m 375.0 103 CT 201 17 -14 10 117 CT 200 924 150 117 150 380 127 re 1 120 141 NA 1.095 Lim 00 0522 8 44 125 91 125 - 175 . NO OL Od 30 258 196 110 54 51 -24 191 5PS -18 186 207 NO 183 Lt oo 5o 77 -15 33 243 No 0 Lim 230 75 56 -21 75 282 - 1 Limi 185 57 55 +4 -15 405.0 122 201 Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.75. Assume you purchased the option at the last price of the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn is $3.62 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if corn futures prices are $4.05 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) a. Option cost per bushel b. Total cost C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts