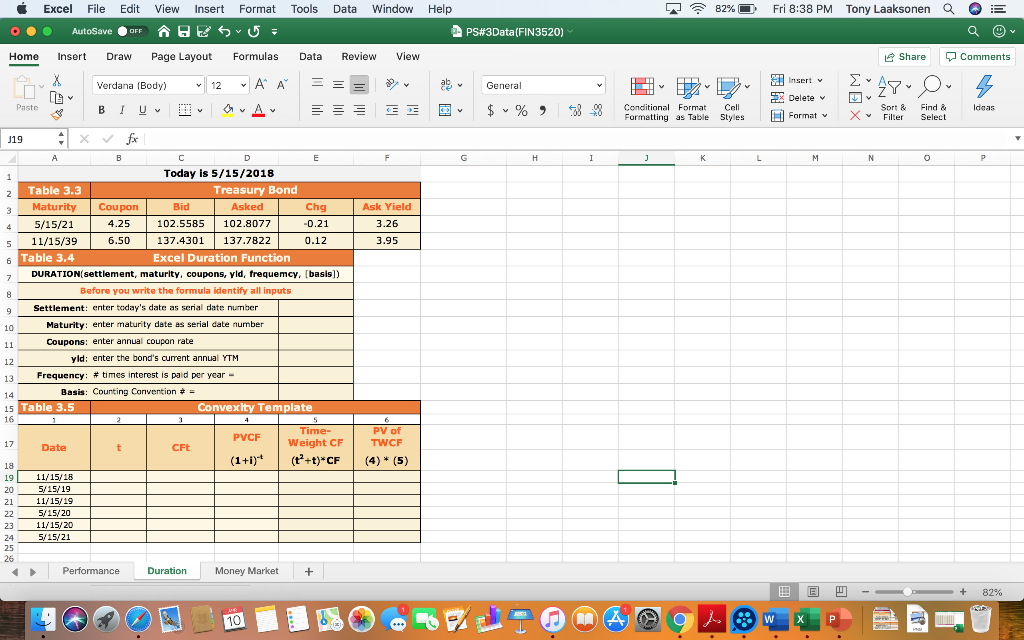

Question: Table 3 . 3 - Table 3 . 5 Today : 15 - May - 2018 By how much will the 11/15/39 T-bond price change

Table 3.3 - Table 3.5

Table 3.3 - Table 3.5

Today: 15-May-2018

By how much will the 11/15/39 T-bond price change if io increases by 102 bps? (3pt)

a) The new yield, in = %

b) The new bond price is = %

c) The total LaTeX: \Delta B =

Format Tools Data Window Help 82% O Fri 8:38 PM Tony Laaksonen Q E Excel File AutoSave Edit OFF View Insert A ES O PS#3Data(FIN3520) Home View Share Comments Formulas A A A Data = Review = = Insert Draw Page Layout Verdana (Body) 12 BI U D x fx aby General $ % X Delete 28-28 Sort Filter Find & Select Ideas Formatting as Table Styles Format X V Paste 119 Ask Yield 3.26 3.95 Today is 5/15/2018 Table 3.3 Treasury Bond Maturity Coupon Bid Asked Chg 5/15/21 4.25 102.5585 102.8077 -0.21 11/15/39 6.50 137.4301 137.7822 0.12 Table 3.4 Excel Duration Function DURATION(settlement, maturity, coupons, yld, frequemcy, (basis) Before you write the formula identify all inputs Settlement: enter today's date as serial date number Maturity: enter maturity date as serial date number Coupons: enter annual coupon rate yld: enter the bond's current annual YTM Frequency: # times interest is paid per year - Basis: Counting Convention # = Table 3.5 Convexity Template 11 PVCF Date CFt Time- Weight CF (t?+t)*CF PV of TWCF (4) * (5) (1+i) 11/15/18 5/15/19 11/15/19 5/15/20 11/15/20 5/15/21 22 23 24 Performance Duration Money Market + E B - - + 82% Format Tools Data Window Help 82% O Fri 8:38 PM Tony Laaksonen Q E Excel File AutoSave Edit OFF View Insert A ES O PS#3Data(FIN3520) Home View Share Comments Formulas A A A Data = Review = = Insert Draw Page Layout Verdana (Body) 12 BI U D x fx aby General $ % X Delete 28-28 Sort Filter Find & Select Ideas Formatting as Table Styles Format X V Paste 119 Ask Yield 3.26 3.95 Today is 5/15/2018 Table 3.3 Treasury Bond Maturity Coupon Bid Asked Chg 5/15/21 4.25 102.5585 102.8077 -0.21 11/15/39 6.50 137.4301 137.7822 0.12 Table 3.4 Excel Duration Function DURATION(settlement, maturity, coupons, yld, frequemcy, (basis) Before you write the formula identify all inputs Settlement: enter today's date as serial date number Maturity: enter maturity date as serial date number Coupons: enter annual coupon rate yld: enter the bond's current annual YTM Frequency: # times interest is paid per year - Basis: Counting Convention # = Table 3.5 Convexity Template 11 PVCF Date CFt Time- Weight CF (t?+t)*CF PV of TWCF (4) * (5) (1+i) 11/15/18 5/15/19 11/15/19 5/15/20 11/15/20 5/15/21 22 23 24 Performance Duration Money Market + E B - - + 82%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts