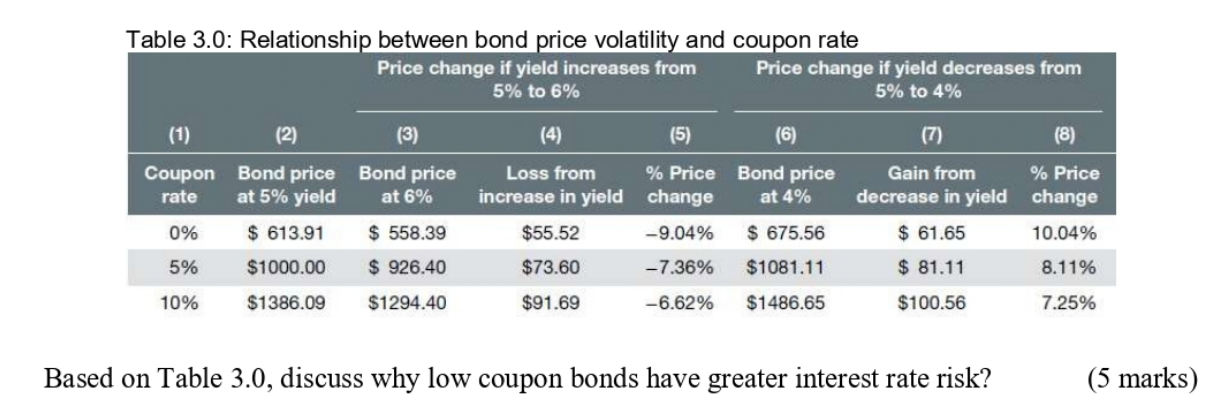

Question: Table 3.0: Relationship between bond price volatility and coupon rate Price change if yield increases from Price change if yield decreases from 5% to 6%

Table 3.0: Relationship between bond price volatility and coupon rate Price change if yield increases from Price change if yield decreases from 5% to 6% 5% to 4% (1) (2) (3) (4) (5) (6) (7) (8) Coupon Bond price Bond price rate at 5% yield at 6% 0% $ 613.91 $ 558.39 5% $1000.00 $ 926.40 Loss from % Price Bond price increase in yield change at 4% $55.52 -9.04% $ 675.56 $73.60 -7.36% $1081.11 Gain from % Price decrease in yield change $ 61.65 10.04% $ 81.11 8.11% 10% $1386.09 $1294.40 $91.69 -6.62% $1486.65 $100.56 7.25% Based on Table 3.0, discuss why low coupon bonds have greater interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts