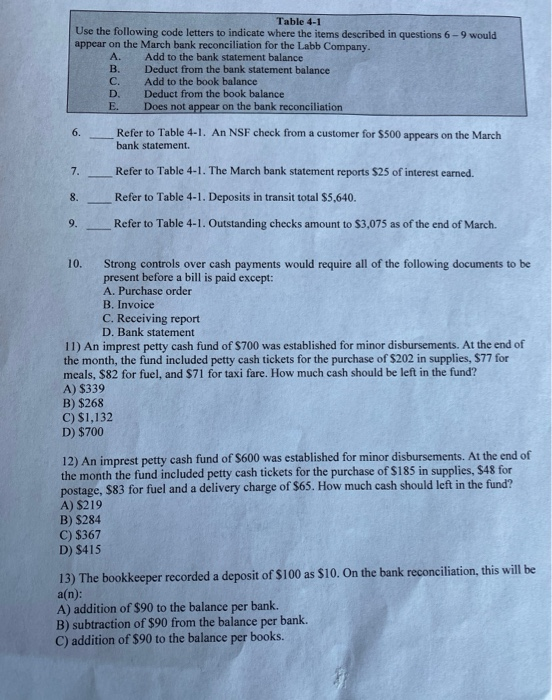

Question: Table 4-1 Use the following code letters to indicate where the items described in questions 6-9 would appear on the March bank reconciliation for the

Table 4-1 Use the following code letters to indicate where the items described in questions 6-9 would appear on the March bank reconciliation for the Labb Company. A Add to the bank statement balance Deduct from the bank statement balance C. Add to the book balance D Deduct from the book balance E. Does not appear on the bank reconciliation B Refer to Table 4-1. An NSF check from a customer for $500 appears on the March bank statement. Refer to Table 4-1. The March bank statement reports $25 of interest earned. Refer to Table 4-1. Deposits in transit total $5,640. Refer to Table 4-1. Outstanding checks amount to $3,075 as of the end of March. 10. Strong controls over cash payments would require all of the following documents to be present before a bill is paid except: A. Purchase order B. Invoice C. Receiving report D. Bank statement 11) An imprest petty cash fund of S700 was established for minor disbursements. At the end of the month, the fund included petty cash tickets for the purchase of $202 in supplies, $77 for meals, $82 for fuel, and $71 for taxi fare. How much cash should be left in the fund? A) $339 B) $268 C) $1,132 D) $700 12) An imprest petty cash fund of $600 was established for minor disbursements. At the end of the month the fund included petty cash tickets for the purchase of S185 in supplies, $48 for postage, $83 for fuel and a delivery charge of $65. How much cash should left in the fund? A) $219 B) $284 C) $367 D) $415 13) The bookkeeper recorded a deposit of $100 as $10. On the bank reconciliation, this will be an): A) addition of $90 to the balance per bank. B) subtraction of $90 from the balance per bank. C) addition of $90 to the balance per books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts