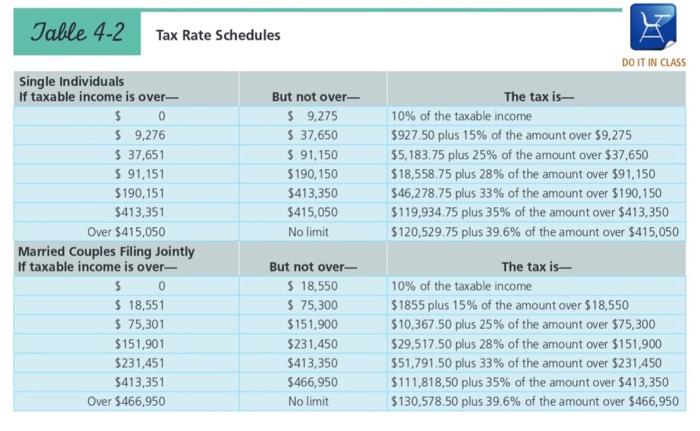

Question: Table 4-2 Tax Rate Schedules DO IT IN CLASS But not over- $ 9,275 $ 37,650 $ 91,150 $190,150 $413,350 $415,050 No limit Single Individuals

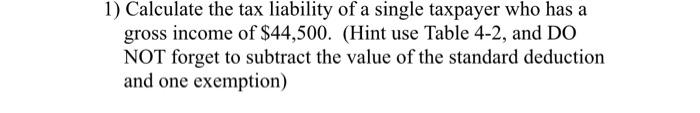

Table 4-2 Tax Rate Schedules DO IT IN CLASS But not over- $ 9,275 $ 37,650 $ 91,150 $190,150 $413,350 $415,050 No limit Single Individuals If taxable income is over- $ 0 $ 9,276 $ 37,651 $ 91,151 $190,151 $413,351 Over $415,050 Married couples Filing Jointly If taxable income is over- $ 0 $ 18,551 $ 75,301 $151,901 $231,451 $413,351 Over $466,950 The tax is 10% of the taxable income $927.50 plus 15% of the amount over $9,275 $5,183.75 plus 25% of the amount over $37,650 $18,558.75 plus 28% of the amount over $91,150 $46,278.75 plus 33% of the amount over $190,150 $119,934.75 plus 35% of the amount over $413,350 $120,529.75 plus 39.6% of the amount over $415,050 But not over- $ 18,550 $ 75,300 $151,900 $231,450 $413,350 $466,950 No limit The tax is- 10% of the taxable income $1855 plus 15% of the amount over $18,550 $10,367.50 plus 25% of the amount over $75,300 $29,517.50 plus 28% of the amount over $151,900 $51,791.50 plus 33% of the amount over $231,450 $111,818,50 plus 35% of the amount over $413,350 $130.578.50 plus 39.6% of the amount over $466,950 1) Calculate the tax liability of a single taxpayer who has a gross income of $44,500. (Hint use Table 4-2, and DO NOT forget to subtract the value of the standard deduction and one exemption)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts