Question: Table 6.0 Current interest Scenario rate Canada A 2% B 3% C 5% D 4% = = Current interest rate - Japan 4% 6% 2%

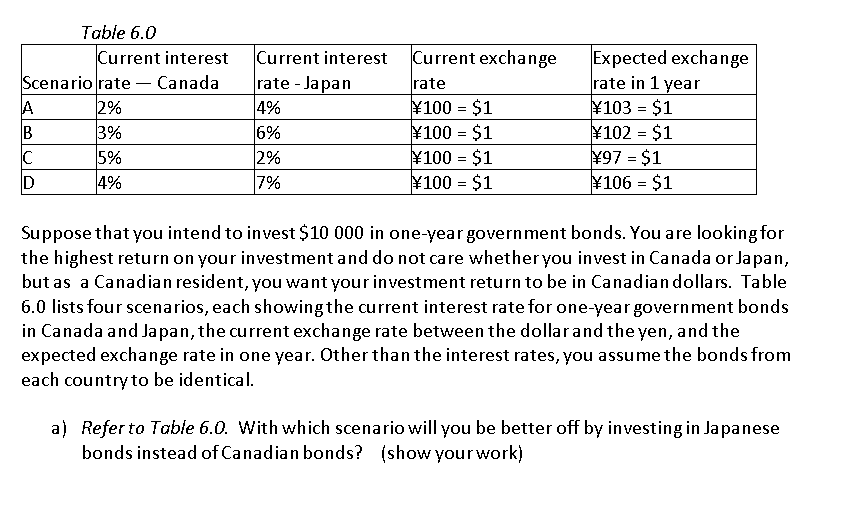

Table 6.0 Current interest Scenario rate Canada A 2% B 3% C 5% D 4% = = Current interest rate - Japan 4% 6% 2% 7% Current exchange rate 100 = $1 100 = $1 100 = $1 100 = $1 Expected exchange rate in 1 year 103 = $1 102 = $1 97 = $1 106 = $1 = = = Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 6.0 lists four scenarios, each showingthe current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical. a) Refer to Table 6.0. With which scenario will you be better off by investing in Japanese bonds instead of Canadian bonds? (show your work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts