Question: Table 6.2 highlights 6 considerations that are important for evaluating privacy concerns. Which of these do you think is the most vulnerable or liable to

Table 6.2 highlights 6 considerations that are important for evaluating privacy concerns. Which of these do you think is the most vulnerable or liable to manipulation in our current economic environment? What might be a mitigation strategy against the abuse of this information?

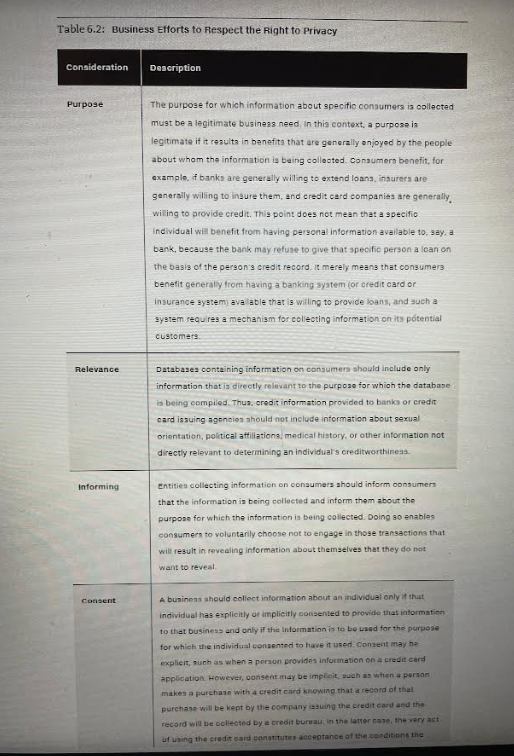

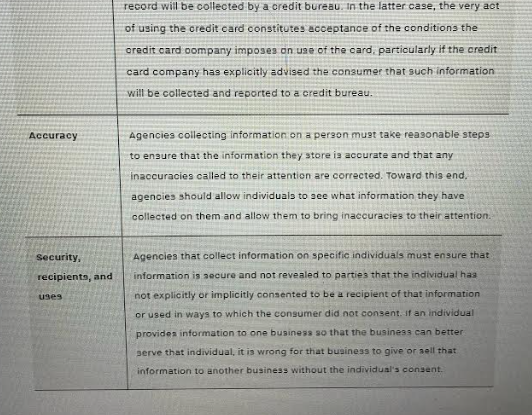

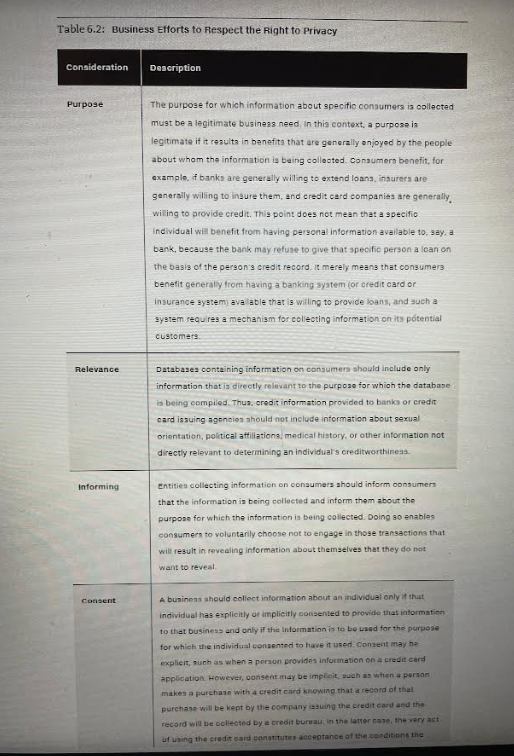

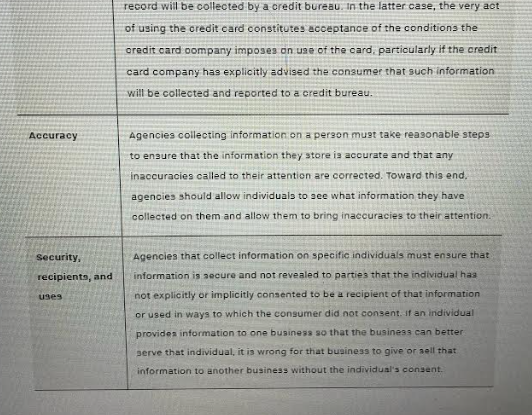

Table 6.2: Business Efforts to Respect the Right to Privacy Consideration Description Purpose The purpose for which information about specific consumers is collected must be a legitimate business need. In this context, a purpose is legitimate it it resulta in benefits that are generally enjoyed by the people about whom the information is being collected. Consumer benefit, for example, if banks are generally willing to extend loans, insurers are generally wiling to insure them, and credit card companies are generally willing to provide credit. This point does not mean that a specific individual will benefit from having personal information available to say, a bank, because the bank may refuse to give that specific person a loan on the basis of the person's credit record, it merely means that consumers benefit generally from having a banking system (or credit card or insurance system avalable that is willing to provide loans, and such a system requires a mechanism for collecting information on its potential customers Relevance Databases containing information on consumers should include only information that is directly relevant to the purpose for which the database is being compiled. Thus, credit information provided to banks or credit card issuing agencies should not include information about sexual orientation, political affiliations, medical history, or other information not directly relevant to determining an individual's creditworthineas. Informing Entities collecting information on consumers should inform consumers that the information is being collected and inform them about the purpose for which the information is being collected. Doing so enables consumers to voluntarily choose not to engage in those transactions that will result in revealing information about themselves that they do not want to reveal consent A business should collect information about an individual only if that individual has explicitly or implicitly consented to provide that information to that business and only if the information is to be used for the purpose for which the individual consented to have it used. Content may be explicit, such as when a person provides information on a credit card application. However, consent may be implicit, such as when a person makes a purchase with a credit card knowing that a record of that purchase will be kept by the company issuing the credit card and the record will be collected by a credit bureau in the latter case, the very act of using the credit card constitutes acceptance of the conditions the record will be collected by a credit bureau. In the latter case, the very act of using the credit card constitutes acceptance of the conditions the credit card company imposes on use of the card, particularly if the credit card company has explicitly advised the consumer that such information will be collected and reported to a credit bureau. Accuracy Agencies collecting information on a person must take reasonable steps to ensure that the information they store is accurate and that any inaccuracies called to their attention are corrected. Toward this end. agencies should allow individuals to see what information they have collected on them and allow them to bring inaccuracies to their attention. Security recipients, and uses Agencies that collect information on specific individuals must ensure that information is secure and not revealed to parties that the individual has not explicitly or implicitly consented to be a recipient of that information or used in ways to which the consumer did not consent of an individual provides information to one business so that the business can better serve that individual, it is wrong for that business to give or sell that information to another business without the individual's consent