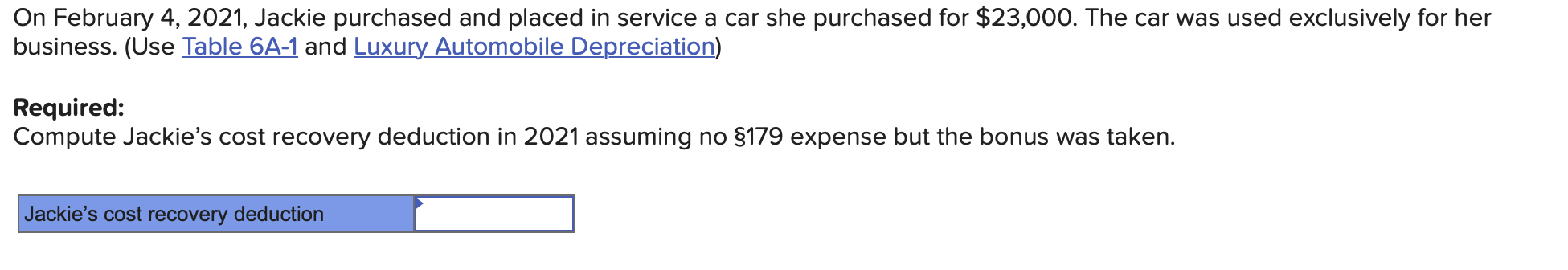

Question: TABLE 6A-1 General Depreciation System: 200 or ( mathbf{1 5 0 %} ) Declining Balance Switching to Straight-Line* On February 4,2021 , Jackie purchased and

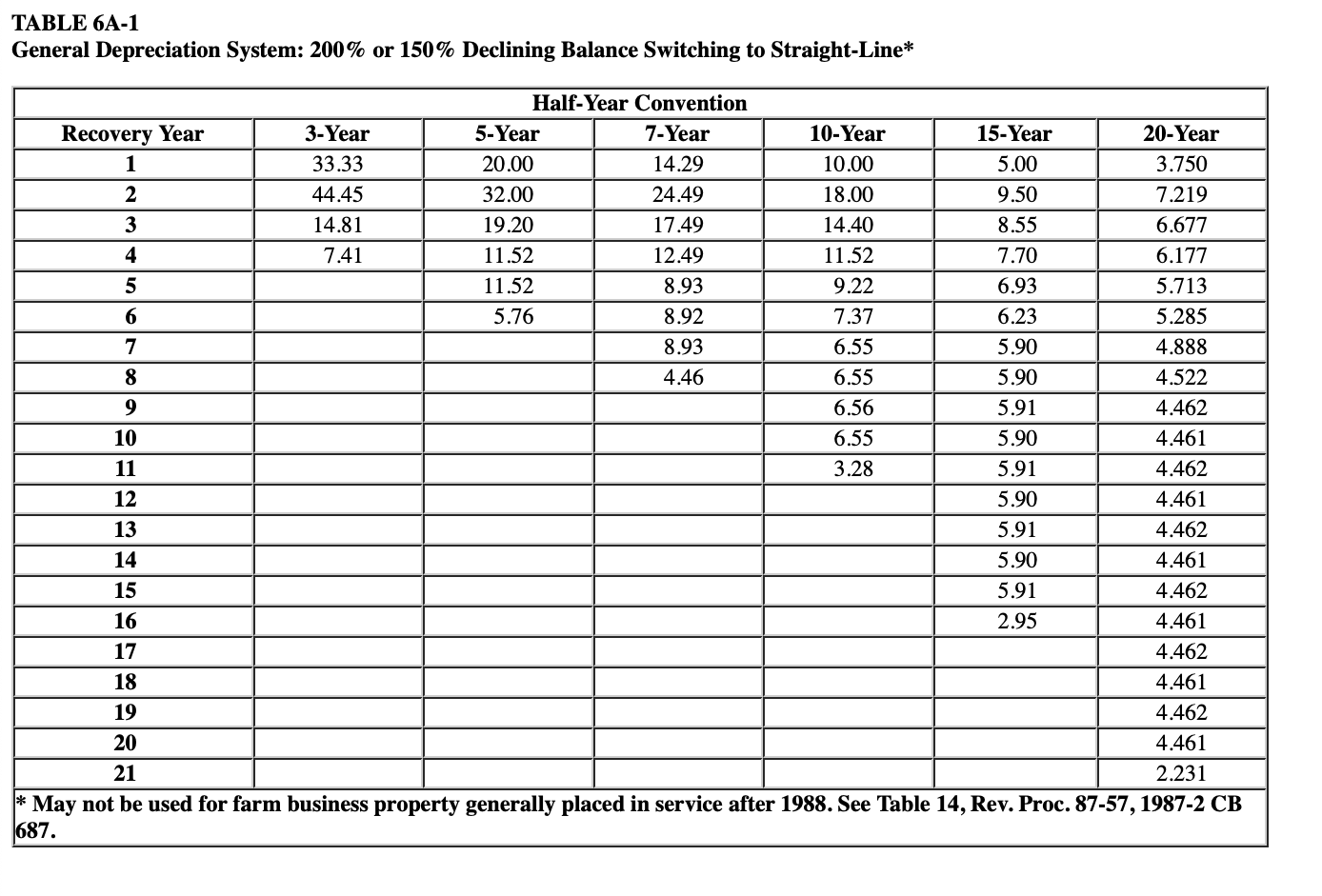

TABLE 6A-1 General Depreciation System: \200 or \\( \\mathbf{1 5 0 \\%} \\) Declining Balance Switching to Straight-Line* On February 4,2021 , Jackie purchased and placed in service a car she purchased for \\( \\$ 23,000 \\). The car was used exclusively for her business. (Use Table 6A-1 and Luxury Automobile Depreciation) Required: Compute Jackie's cost recovery deduction in 2021 assuming no \\( \\$ 179 \\) expense but the bonus was taken. uxury Automobile Limitations han 6,000 pounds. \\( { }^{31} \\) Light trucks do not have a separate limit as they have had in the past. \\( { }^{32} \\) The depreciation expense limits for luxury autos and light trucks placed in service in tax year 2021 follow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts