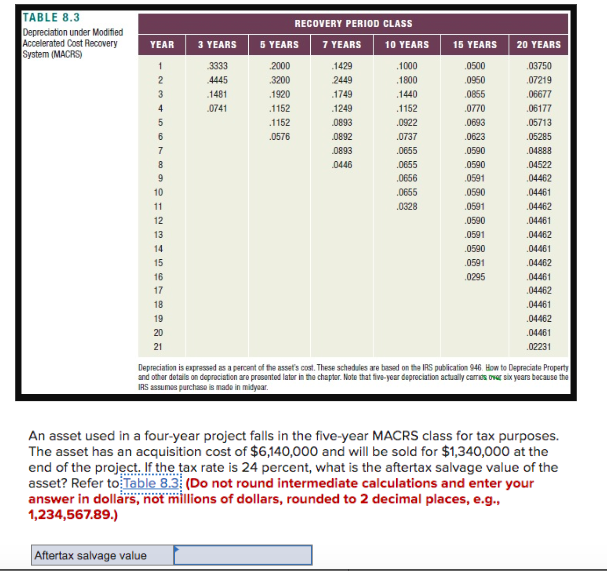

Question: TABLE 8.3 Depreciation under Modified Accelerated Cost Recovery System (MACRS) 3 YEARS 3333 4445 RECOVERY PERIOD CLASS 7 YEARS .1429 2449 .1749 .1249 0893 0892

TABLE 8.3 Depreciation under Modified Accelerated Cost Recovery System (MACRS) 3 YEARS 3333 4445 RECOVERY PERIOD CLASS 7 YEARS .1429 2449 .1749 .1249 0893 0892 0893 0446 YEAR 15 YEARS 20 YEARS 1 .0500 .03750 2 .0950 .07219 3 .0855 .06677 4 .0770 .06177 5 .0693 .05713 6 0623 05285 7 .0590 .04888 8 .0590 04522 9 .0591 04462 10 .0590 .04461 11 .0591 .04462 12 .0590 .04461 13 0591 .04462 14 .0590 .04461 15 .0591 04462 16 0295 .04461 17 04462 18 .04461 19 .04462 20 .04461 21 .02231 Depreciation is expressed as a percent of the asset's cost. These schedules are based on the IRS publication 946. How to Depreciate Property and other details on depreciation are presented later in the chapter. Note that five-year depreciation actually carries over six years because the IRS assumes purchase is made in midyear. An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,140,000 and will be sold for $1,340,000 at the end of the project. If the tax rate is 24 percent, what is the aftertax salvage value of the asset? Refer to Table 8.3 (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Aftertax salvage value .1481 0741 5 YEARS 2000 3200 .1920 .1152 .1152 .0576 10 YEARS .1000 .1800 1440 .1152 .0922 .0737 .0655 .0655 .0656 .0655 .0328

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts