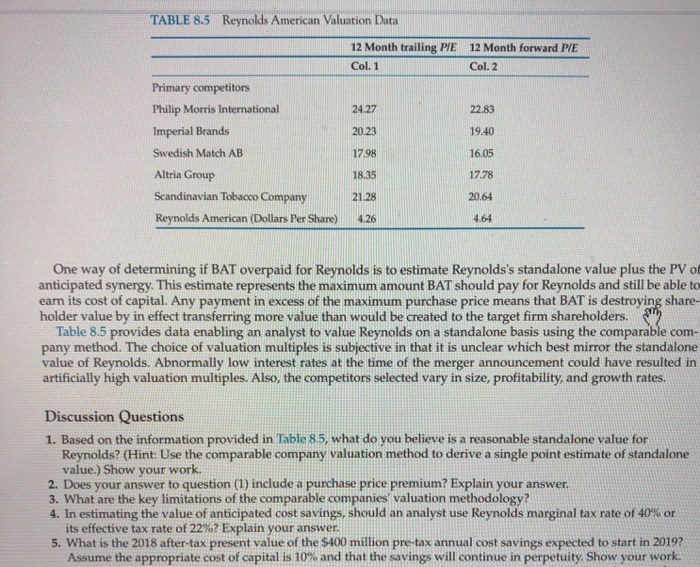

Question: TABLE 8.5 Reynolds American Valuation Data 12 Month trailing PE 12 Month forward PIE Col. 1 Col. 2 Primary competitors Philip Morris International Imperial Brands

TABLE 8.5 Reynolds American Valuation Data 12 Month trailing PE 12 Month forward PIE Col. 1 Col. 2 Primary competitors Philip Morris International Imperial Brands Swedish Match AB 24.27 20.23 17.98 22.83 19.40 16.05 17.78 20.64 Altria Group Scandinavian Tobacco Company Reynolds American (Dollars Per Share) 4.64 One way of determining if BAT overpaid for Reynolds is to estimate Reynolds's standalone value plus the PV o anticipated synergy. This estimate represents the maximum amount BAT should pay for Reynolds and still be able to earn its cost of capital. Any payment in excess of the maximum purchase price means that BAT is destroying share- holder value by in effect transferring more value than would be created to the target firm shareholders. 2 Table 8.5 provides data enabling an analyst to value Reynolds on a standalone basis using the comparable com- pany method. The choice of valuation multiples is subjective value of Reynolds. Abnormally low interest rates at the time of the merger announcement could have resulted in artificially high valuation multiples. Also, the competitors selected vary in size, profitability, and growth rates. Discussion Questions 1. Based on the information provided in Table 8.5, what do you believe is a reasonable standalone value for Reynolds? (Hint: Use the comparable company valuation method to derive a single point estimate of standalone value.) Show your work. 2. Does your answer to question (1) include a purchase price premium? Explain your answer. 3. What are the key limitations of the comparable companies' valuation methodology? 4. In estimating the value of anticipated cost savings, should an analyst use Reynolds marginal tax rate of 40% or its effective tax rate of 22%? Explain your answer. 5. What is the 2018 after-tax present value of the $400 million pre-tax annual cost savings expected to start in 2019? Assume the appropriate cost of capital is 10% and that the savings will continue in perpetuity. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts