Question: Table 9.1 :https://ezt.prod.mheducation.com/Media/Connect_Production/bne/slater_14e/table_9_1.htm 10 points Drill Problem 9-17 {Static} [LU 9-2111] Assume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for

Table 9.1 :https://ezt.prod.mheducation.com/Media/Connect_Production/bne/slater_14e/table_9_1.htm

![Table 9.1 :https://ezt.prod.mheducation.com/Media/Connect_Production/bne/slater_14e/table_9_1.htm 10 points Drill Problem 9-17 {Static} [LU 9-2111] Assume](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/67409cc24a292_68267409cc238b3c.jpg)

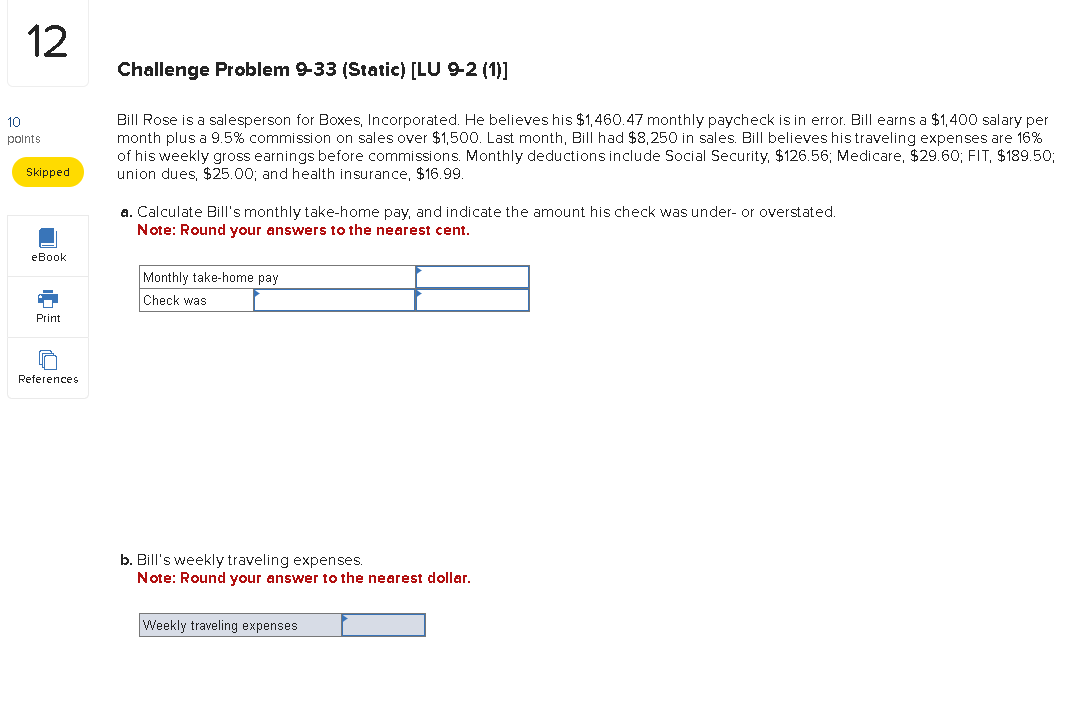

10 points Drill Problem 9-17 {Static} [LU 9-2111] Assume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. Assume payroll period: weekly. [Use the percentage me hod to calculate FIT for thisweekly period.) [Use "able 9.1). Note: Do not round intermediate calculations. Round your final answers to the nearest cent. eBook Pm Employee Marital status Gross pay FIT Securi Medicare Net pay Mike Rice M, lingjaintly $ 2,000 6 Word Problem 9-21 (Static) [LU 9-2 (1)] 10 Rhonda Brennan found her first job after graduating from college through the classifieds of the Miami Herald. She was delighted when points the offer came through at $18.50 per hour. She completed her W-4 stating that she is married filing jointly. Her company will pay her biweekly for 80 hours (assume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare). Calculate her take-home pay for her first check. (Use Table 9.1) ebook Note: Round your answer to the nearest cent. Net pay HintWord Problem 9-27 {Static} [LU 9-2 {1}] 10 Richard Gaziano is a manager for Health Care, Incorporated. Health Care deducts Social Security, Medicare, and FIT [by percentage points method) from his earnings. Assume a rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. Before this payroll, Richard is $1,000 below the maximum level for Social Security earnings. Richard is married, filingjointly and is paid weekly. What is Richard's net pay for the week if he earns $1,300? [Use Table 9.11 Note: Round your answer to the nearest cent. 6 Answer is complete but not entirely correct. Net pay $ 1,083.55 6 10 Challenge Problem 9-32 (Static) [LU 9-2 (1)] 10 The San Bernardino County Fair hires about 150 people during fair time. California has a state income tax of 9%. Sandy Denny earns points $13.00 per hour; George Barney earns $14.00 per hour. They both worked 39 hours this week. Both are married; however, Sandy files jointly and George files separately. Assume a rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT (use the Table 9.1), Social Security tax, state income tax, and Medicare have been taken out? eBook Note: Round your answer to the nearest cent. Sandy's net pay after FIT Print References b. What is George's net pay after FIT (use the Table 9.1), Social Security tax, state income tax, and Medicare have been taken out? Note: Round your answer to the nearest cent. George's net pay after FIT c. What is the difference between Sandy's net pay and George's net pay? Note: Round your answer to the nearest cent. Difference in net pay11 Challenge Problem 9-33 (Algo) [LU 9-2 (1)] 10 Bill Rose is a salesperson for Boxes, Incorporated. He believes his $1,098.85 monthly paycheck is in error. Bill earns a $1,200 salary per points month plus a 7.5% commission on sales over $1,500. Last month, Bill had $5,600 in sales. Bill believes his traveling expenses are 18% of his weekly gross earnings before commissions. Monthly deductions include Social Security, $93.47; Medicare, $21.86; FIT, $115.52; union dues, $25; and health insurance, $16.99. Book a. Calculate Bill's monthly take-home pay, and indicate the amount his check was under- or overstated. Note: Round your answers to the nearest cent. Print Monthly take-home pay Check was | understated by References b. Bill's weekly traveling expenses. Note: Round your answer to the nearest dollar. Weekly traveling expenses12 Challenge Problem 9-33 (Static) [LU 9-2 (1)] 10 Bill Rose is a salesperson for Boxes, Incorporated. He believes his $1,460.47 monthly paycheck is in error. Bill earns a $1,400 salary per points month plus a 9.5% commission on sales over $1,500. Last month, Bill had $8,250 in sales. Bill believes his traveling expenses are 16% of his weekly gross earnings before commissions. Monthly deductions include Social Security, $126.56; Medicare, $29.60; FIT, $189.50; Skipped union dues, $25.00; and health insurance, $16.99. a. Calculate Bill's monthly take-home pay, and indicate the amount his check was under- or overstated. Note: Round your answers to the nearest cent. Book Monthly take-home pay Check was Print References b. Bill's weekly traveling expenses. Note: Round your answer to the nearest dollar. Weekly traveling expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts