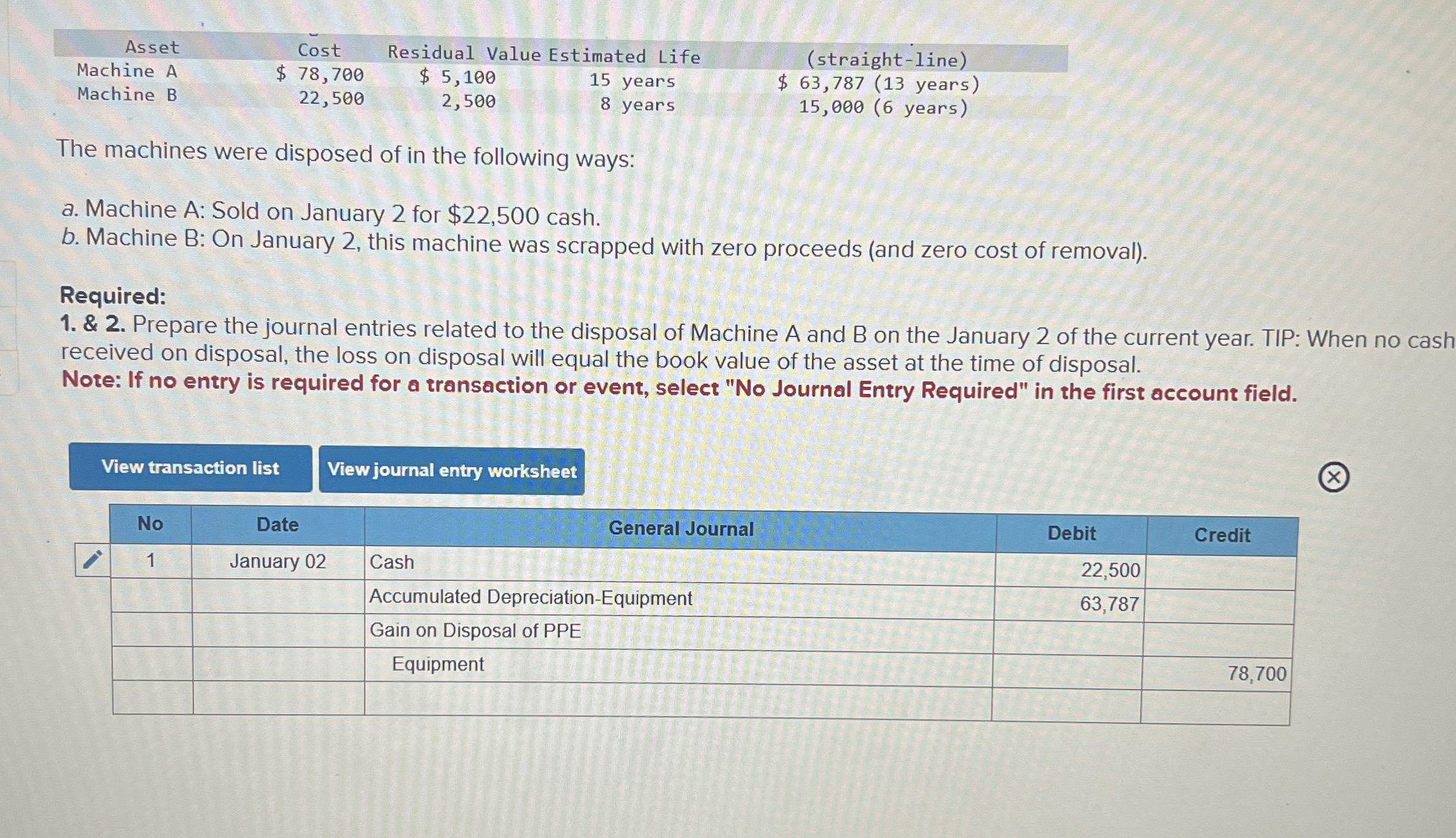

Question: table [ [ Asset , Cost,Residual Value Estimated Life, ( straight - line ) , ] , [ Machine A , $ 7 8

tableAssetCost,Residual Value Estimated Life,straightlineMachine A$$ years,$ yearsMachine B years, years

The machines were disposed of in the following ways:

a Machine A: Sold on January for $ cash.

b Machine B: On January this machine was scrapped with zero proceeds and zero cost of removal

Required:

& Prepare the journal entries related to the disposal of Machine A and on the January of the current year. TIP: When no cash received on disposal, the loss on disposal will equal the book value of the asset at the time of disposal.

Note: If no entry is required for a transaction or event, select No Journal Entry Required" in the first account field.

tableNoDate,General Journal,Debit,CreditJanuary Cash,Accumulated DepreciationEquipment,Gain on Disposal of PPE,,Equipment,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock