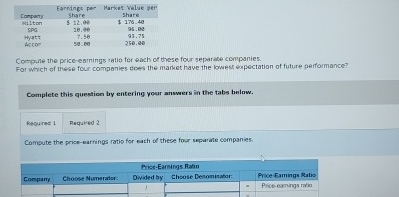

Question: table [ [ Compuns , Earnings per Share,Market velue ger Share ] , [ wilton , 3 1 2 . 9 9 , $

tableCompunsEarnings per Share,Market velue ger Sharewilton$ SPGHyattArcer

Compute the priceearnings tatio for each of these four separate companies.

For which of these four componies does the market have the lowest expectation of future performance?

Complete this question by entering your answers in the tabs below.

keoured

Compute the priceearrings ratio for each of these four separate companies.

tablePriceEarnings RataCompanyChoose Numerator:,Owided byChoose Dentominabor:,,PriceEamings RatioPriceeamings raiso

Complete this question by entering your answers in the tabs below.

Compute the priceearnings ratio for each of these four separate companies.

tablePriceEaminas RatioCompanyChoose Numerator:,Divided byChoose Denominator:,,PriceEarmings RatioPriceearnings ratioHitonSPGHyatI,,Accorl

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock