Question: Table: Current Bond Available Par Value Time to Maturity Coupon rate Yield to Maturity Coupon Payment dates Call features Year Issued $1000 7 years 8%

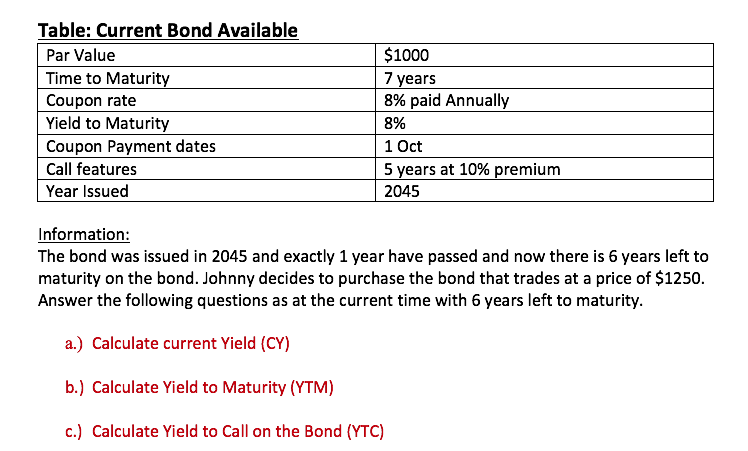

Table: Current Bond Available Par Value Time to Maturity Coupon rate Yield to Maturity Coupon Payment dates Call features Year Issued $1000 7 years 8% paid Annually 8% 1 Oct 5 years at 10% premium 2045 Information: The bond was issued in 2045 and exactly 1 year have passed and now there is 6 years left to maturity on the bond. Johnny decides to purchase the bond that trades at a price of $1250. Answer the following questions as at the current time with 6 years left to maturity. a.) Calculate current Yield (CY) b.) Calculate Yield to Maturity (YTM) c.) Calculate Yield to Call on the Bond (YTC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts