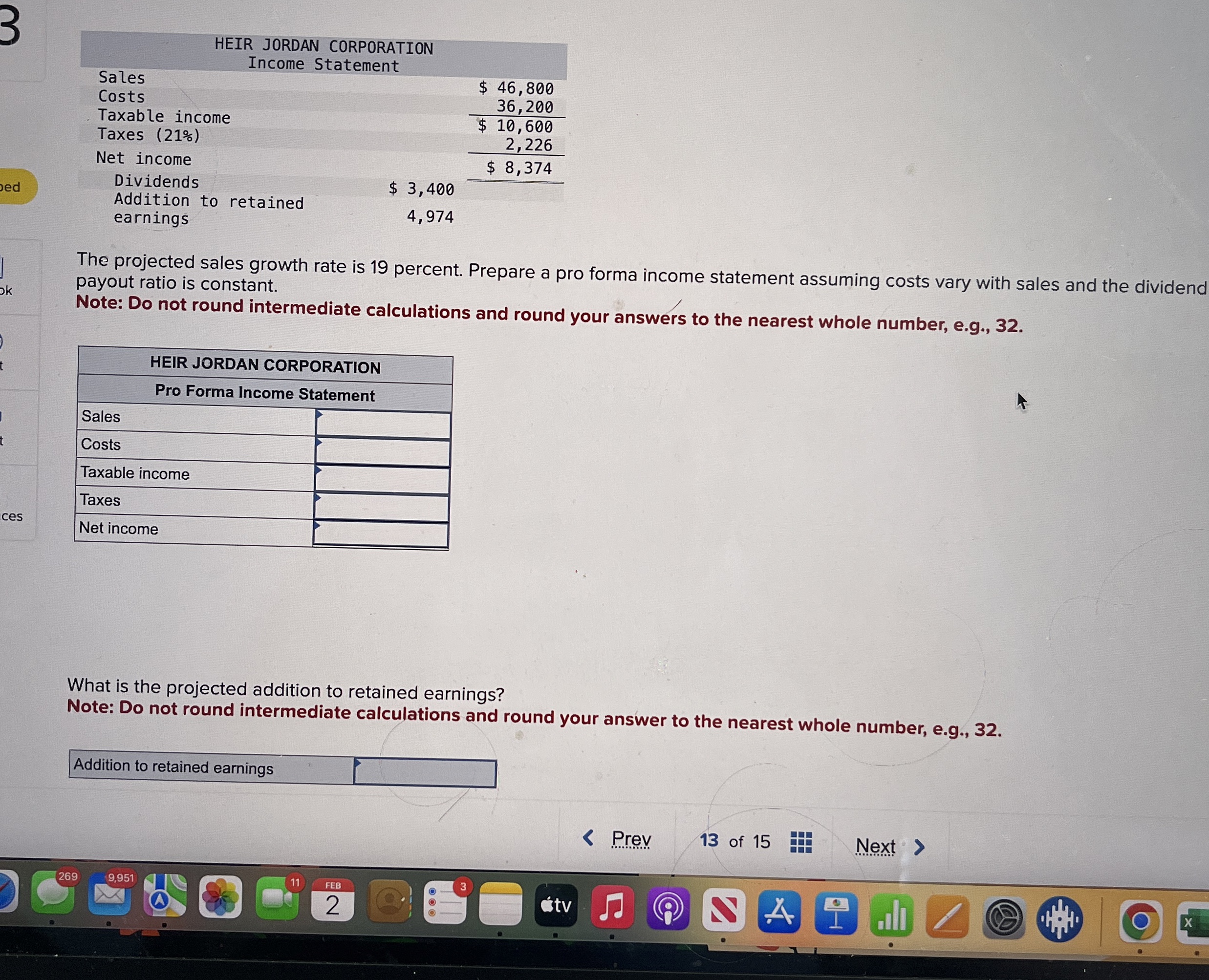

Question: table [ [ HEIR JORDAN CORPORATION Income Statement ] , [ ] , [ Sales Stome Statement $ 4 6 , 8 0 0

tableHEIR JORDAN CORPORATION Income StatementSales Stome Statement $ CostsTaxes Taxable income,Net income,tableDividendsAddition to retained earnings$

The projected sales growth rate is percent. Prepare a pro forma income statement assuming costs vary with sales and the dividend payout ratio is constant.

Note: Do not round intermediate calculations and round your answers to the nearest whole number, eg

tableHEIR JORDAN CORPORATIONPro Forma Income Statement,SalesCostsTaxable income,TaxesNet income,

What is the projected addition to retained earnings?

Note: Do not round intermediate calculations and round your answer to the nearest whole number, eg

Addition to retained earnings

Prev

of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock