Question: table [ [ IIm received a travel allowance from nis employer amounting to R IU UUV IOI Ule Curleit year ur assessment. He uses

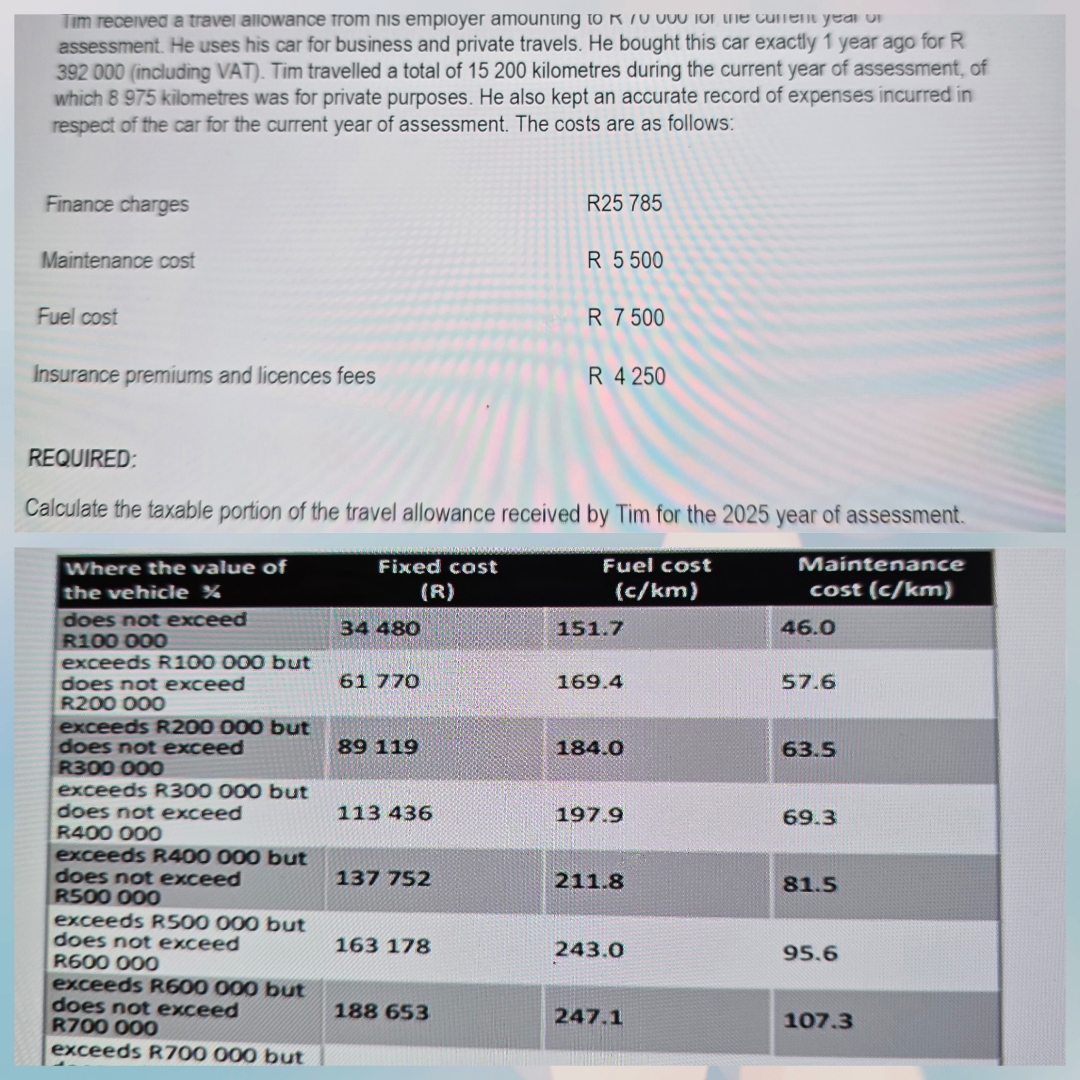

tableIIm received a travel allowance from nis employer amounting to R IU UUV IOI Ule Curleit year ur assessment. He uses his car for business and private travels. He bought this car exactly year ago for including VAT Tim travelled a total of kilometres during the current year of assessment, of which kilometres was for private purposes. He also kept an accurate record of expenses incurred in respect of the car for the current year of assessment. The costs are as follows:Finance charges,,RMaintenance costR Fuel costR Insurance premiums and licences fees,,R REQUIRED:Calculate the taxable portion of the travel allowance received by Tim for the year of assessment.tableWhere the value ofFixed cost the vehicle RFuel cost ckmMaintenance cost ckmdoes not exceed Rexceeds R but does not exceed Rexceeds R but does not exceed Rexceeds R but does not exceed Rexceeds R but does not exceed Rexceeds R but does not exceed Rexceeds R but does not exceed Rexceeds R but,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock