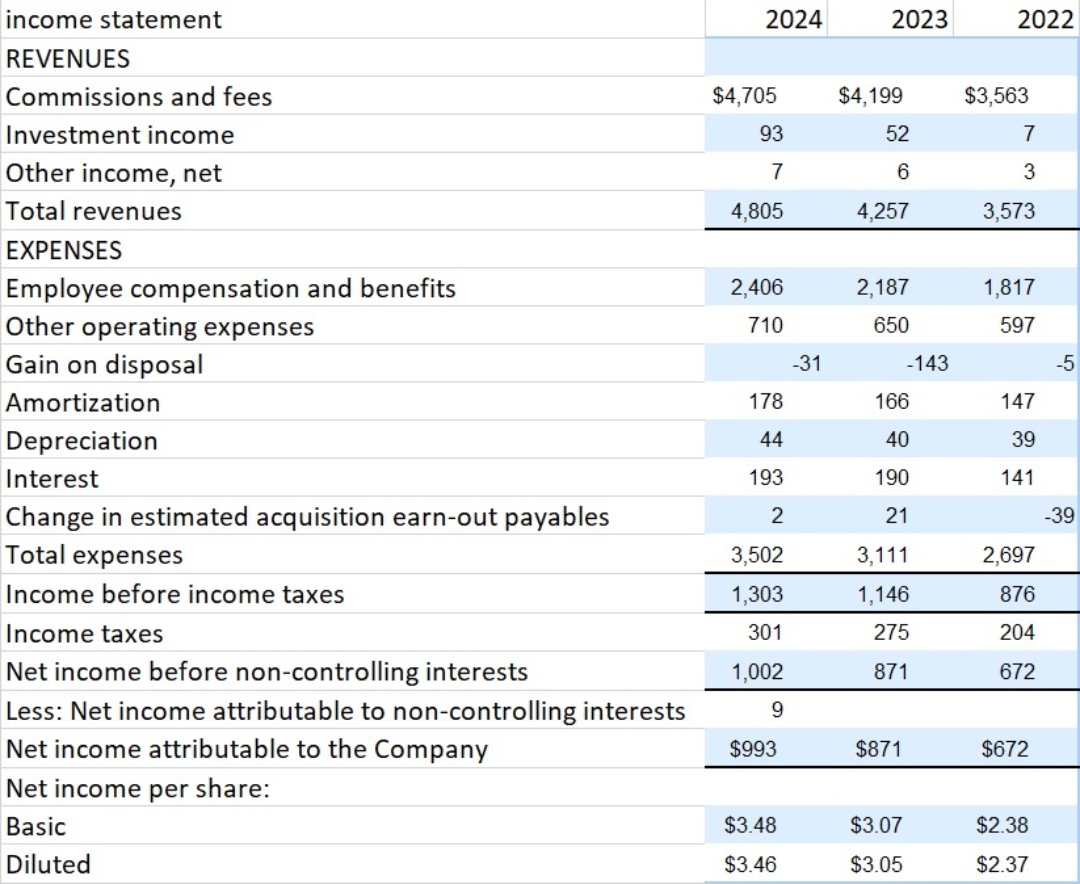

Question: table [ [ income statement, 2 0 2 4 , 2 0 2 3 , 2 0 2 2 ] , [ REVENUES ,

tableincome statement,REVENUESCommissions and fees,$$$Investment income,Other income, net,Total revenues,EXPENSESEmployee compensation and benefits,Other operating expenses,Gain on disposal,AmortizationDepreciationInterestChange in estimated acquisition earnout payables,Total expenses,Income before income taxes,Income taxes,Net income before noncontrolling interests,Less: Net income attributable to noncontrolling interests,Net income attributable to the Company,$$$Net income per share:Basic$$$Diluted$$$

balance sheetCurrent Assets:Cash and cash equivalentsFiduciary cashShortterm investmentsCommission, fees and other receivablesFiduciary receivablesReinsurance recoverablePrepaid reinsurance premiumsOther current assetsTotal current assetsFixed assets, netOperating lease assetsGoodwilIAmortizable intangible assets, netInvestmentsOther assetsTotal assetsCurrent Liabilities:Fiduciary liabilitiesLosses and loss adjustment reserveUnearned premiumsAccounts payableAccrued expenses and other liabilitiesCurrent portion of longterm debtTotal current liabilitiesLongterm debt less unamortized discount and debt issuanceOperating lease liabilitiesDeferred income taxes, netOther liabilitiesShareholders' Equity:Common stock, par value $ per share; authorized shaAdditional paidin capitalTreasury stock, at cost shares at and Accumulated other comprehensive lossNoncontrolling interestsRetained earningsTotal shareholders' equityTotal liabilities and shareholders' equity$$$$

Cash flows from operating activities:Net income before noncontrolling interestsAdjustments to reconcile net income before noncontrolling interests to net cash provided by operating activities:AmortizationDepreciationNoncash stockbased compensationChange in estimated acquisition earnout payablesDeferred incomne taxesNet gain on salesdisposals of investments, businesses, fixed assets and customer accountsPayments on acquisition earnouts in excess of original estimated payablesOtherChanges in operating assets and liabilities, net of effect from acquisitions and divestitures:Commissions, fees and other receivables increase decreaseReinsurance recoverable increase decreasePrepaid reinsurance premiums increase decreaseOther assets increase decreaseLosses and loss adjustment reserve increase decreaseUnearned premiums increase decreaseAccounts payable increase decreaseAccrued expenses and other liabilities increase decreaseOther liabilities increase decreaseNet cash provided by operating activitiesCash flows from investing activities:Additions to fixed assetsPayments for businesses acquired, net of cash acquiredcash tlowProceeds from sales of businesses, fixed assets and customer accountsPurchases of investmentsProceeds from sales of investmentsNet cash used in investing activitiesCash flows from financing activities:Fiduciary receivables and liabilities, netPayments on acquisition earnoutsProceeds from longterm debtPayments on longterm debtDeferred debt issuance costsBorrowings on revolving credit facilityPayments on revolving credit facilitiesIssuances of common stock for employee stock benefit plansRepurchase shares to fund tax withholdings for noncash stockbased compensationPurchase of treasury stockCash dividends paidOther financing activitiesNet cash used in provided by financing activitiesEffect of foreign exchange rate changes on cash and cash equivalents inclusive of fiduciary cashNet increase in cash and cash equivalents inclusive of fiduciary cashCash and cash equivalents inclusive of fiduciary cash at beginning of periodCash and cash equivalents inclusive of fiduciary cash at end of period$$S$S$Make a statement model upto estimated years by using excel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock