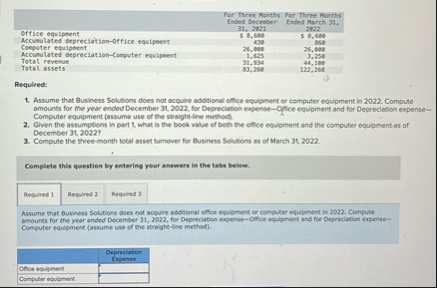

Question: table [ [ Office equipeent,Far Three Months Ended Decenber,For Three Nonths Ended March 3 1 , 2 mz ] , [ , 5 8

tableOffice equipeent,Far Three Months Ended Decenber,For Three Nonths Ended March mz$ Accumulated Sepreciationffice equipment,Computer equipent,Accunulated depreciationComputer equipment,Total revenue,Total assets,

Required:

Assume that Business Solutions does not acquire additional office equipenent or computer equipment in Compute amounts for the year ended December for Depreclation expenseGFice equipment and for Depreciation expenseComputer equipment fassume use of the straightline method

Given the assumplions in part what is the book value of booh the oflice equipment and the computer equipment as of December

Compute the threemonth total asset lumover for Business Solutions as of March

Complete this question by entering yeur answers in the tabs balev.

Required

Required

Assume that bubiness Solutions does not acpuire additional office equpment or computer equipment in Compute amounts for the year ended December for Depreciation expenseCifice esulpment and for Depreciacion expentseComputer equipment assume use of the straightline method

tabletableDepreciationExpenseOflice equipment,Computer equigenent,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock