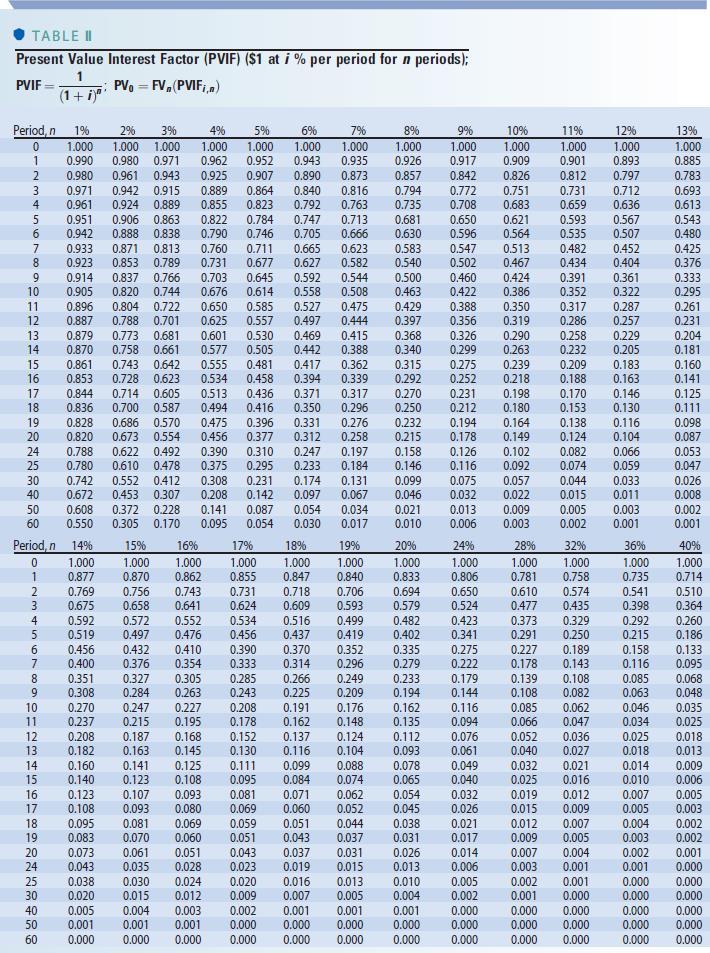

Question: TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF : PV= FV,(PVIF;,n) (1 + i) 7% 1.000 0.935

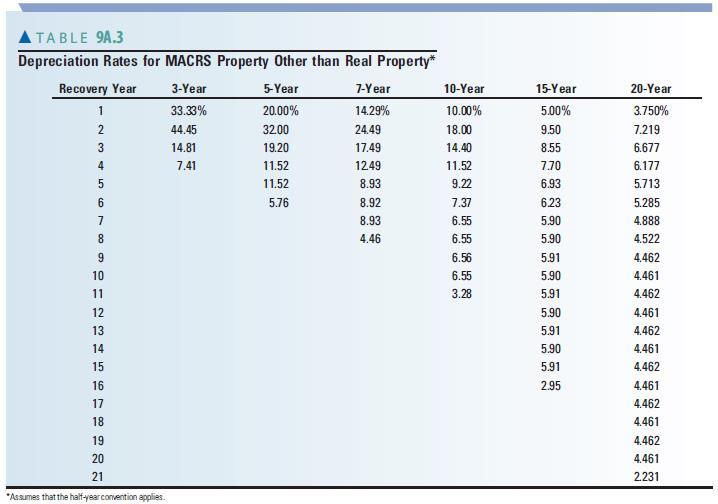

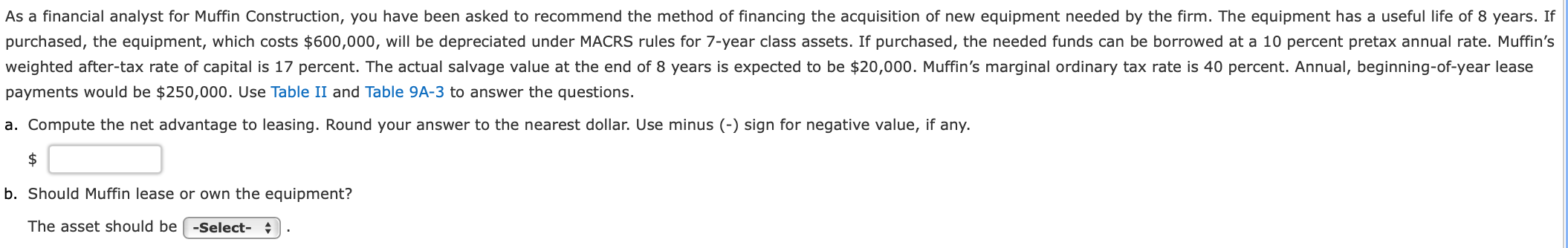

TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF : PV= FV,(PVIF;,n) (1 + i)" 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 8% WC Period, 1% 2% 3% 4% 5% 6% 0 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 0.889 0.855 0.823 0.792 5 0.951 0.906 0.863 0.822 0.784 0.747 6 0.942 0.888 0.838 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.923 0.853 0.789 0.731 0.677 0.627 9 0.914 0.837 0.766 0.703 0.645 0.592 10 0.905 0.820 0.744 0.676 0.614 0.558 11 0.896 0.804 0.722 0.650 0.585 0.527 12 0.887 0.788 0.701 0.625 0.557 0.497 13 0.879 0.773 0.681 0.601 0.530 0.469 14 0.870 0.758 0.661 0.577 0.505 0.442 15 0.861 0.743 0.642 0.555 0.481 0.417 16 0.853 0.728 0.623 0.534 0.458 0.394 17 0.844 0.714 0.605 0.513 0.436 0.371 18 0.836 0.700 0.587 0.494 0.416 0.350 19 0.828 0.686 0.570 0.475 0.396 0.331 20 0.820 0.673 0.554 0.456 0.377 0.312 24 0.788 0.622 0.492 0.390 0.310 0.247 25 0.780 0.610 0.478 0.375 0.295 0.233 30 0.742 0.552 0.412 0.308 0.231 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 50 0.608 0.372 0.228 0.141 0.087 0.054 0.550 0.305 0.170 0.095 0.054 0.030 Period, n 14% 15% 16% 17% 18% 0 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 2 0.769 0.756 0.743 0.731 0.718 3 0.675 0.658 0.641 0.624 0.609 4 0.592 0.572 0.552 0.534 0.516 5 0.519 0.497 0.476 0.456 0.437 6 0.456 0.432 0.410 0.390 0.370 7 0.400 0.376 0.354 0.333 0.314 8 0.351 0.327 0.305 0.285 0.266 9 0.308 0.284 0.263 0.243 0.225 10 0.270 0.247 0.227 0.208 0.191 11 0.237 0.215 0.195 0.178 0.162 12 0.208 0.187 0.168 0.152 0.137 13 0.182 0.163 0.145 0.130 0.116 14 0.160 0.141 0.125 0.111 0.099 15 0.140 0.123 0.108 0.095 0.084 16 0.123 0.107 0.093 0.081 0.071 17 0.108 0.093 0.080 0.069 0.060 18 0.095 0.081 0.069 0.059 0.051 19 0.083 0.070 0.060 0.051 0.043 20 0.073 0.061 0.051 0.043 0.037 24 0.043 0.035 0.028 0.023 0.019 25 0.038 0.030 0.024 0.020 0.016 30 0.020 0.015 0.012 0.009 0.007 40 0.005 0.004 0.003 0.002 0.001 50 0.001 0.001 0.001 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 9% 10% 1.000 1.000 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.252 0.218 0.231 0.198 0.212 0.180 0.194 0.164 0.178 0.149 0.126 0.102 0.116 0.092 0.075 0.057 0.032 0.022 0.013 0.009 0.006 0.003 24% 28% 1.000 1.000 0.806 0.781 0.650 0.610 0.524 0.477 0.423 0.373 0.341 0.291 0.275 0.227 0.222 0.178 0.179 0.139 0.144 0.108 0.116 0.085 0.094 0.066 0.076 0.052 0.061 0.040 0.049 0.032 0.040 0.025 0.032 0.019 0.026 0.015 0.021 0.012 0.017 0.009 0.014 0.007 0.006 0.003 0.005 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 ONMONDO O 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 10-Year 15-Year 5.00% 9.50 8.55 7.70 6.93 TABLE 94.3 Depreciation Rates for MACRS Property Other than Real Property* Recovery Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 3 14.81 19.20 17.49 4 7.41 11.52 1249 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 9 10 11 12 13 14 15 16 17 18 19 20 21 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 6.23 5.90 5.90 5.91 5.90 5.91 20-Year 3.750% 7.219 6.677 6.177 5713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 5.90 5.91 5.90 5.91 2.95 *Assumes that the half year convention applies. As a financial analyst for Muffin Construction, you have been asked to recommend the method of financing the acquisition of new equipment needed by the firm. The equipment has a useful life of 8 years. If purchased, the equipment, which costs $600,000, will be depreciated under MACRS rules for 7-year class assets. If purchased, the needed funds can be borrowed at a 10 percent pretax annual rate. Muffin's weighted after-tax rate of capital is 17 percent. The actual salvage value at the end of 8 years is expected to be $20,000. Muffin's marginal ordinary tax rate is 40 percent. Annual, beginning-of-year lease payments would be $250,000. Use Table II and Table 9A-3 to answer the questions. a. Compute the net advantage to leasing. Round your answer to the nearest dollar. Use minus (-) sign for negative value, if any. $ b. Should Muffin lease or own the equipment? The asset should be -Select- 4 TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF : PV= FV,(PVIF;,n) (1 + i)" 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 8% WC Period, 1% 2% 3% 4% 5% 6% 0 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 0.889 0.855 0.823 0.792 5 0.951 0.906 0.863 0.822 0.784 0.747 6 0.942 0.888 0.838 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.923 0.853 0.789 0.731 0.677 0.627 9 0.914 0.837 0.766 0.703 0.645 0.592 10 0.905 0.820 0.744 0.676 0.614 0.558 11 0.896 0.804 0.722 0.650 0.585 0.527 12 0.887 0.788 0.701 0.625 0.557 0.497 13 0.879 0.773 0.681 0.601 0.530 0.469 14 0.870 0.758 0.661 0.577 0.505 0.442 15 0.861 0.743 0.642 0.555 0.481 0.417 16 0.853 0.728 0.623 0.534 0.458 0.394 17 0.844 0.714 0.605 0.513 0.436 0.371 18 0.836 0.700 0.587 0.494 0.416 0.350 19 0.828 0.686 0.570 0.475 0.396 0.331 20 0.820 0.673 0.554 0.456 0.377 0.312 24 0.788 0.622 0.492 0.390 0.310 0.247 25 0.780 0.610 0.478 0.375 0.295 0.233 30 0.742 0.552 0.412 0.308 0.231 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 50 0.608 0.372 0.228 0.141 0.087 0.054 0.550 0.305 0.170 0.095 0.054 0.030 Period, n 14% 15% 16% 17% 18% 0 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 2 0.769 0.756 0.743 0.731 0.718 3 0.675 0.658 0.641 0.624 0.609 4 0.592 0.572 0.552 0.534 0.516 5 0.519 0.497 0.476 0.456 0.437 6 0.456 0.432 0.410 0.390 0.370 7 0.400 0.376 0.354 0.333 0.314 8 0.351 0.327 0.305 0.285 0.266 9 0.308 0.284 0.263 0.243 0.225 10 0.270 0.247 0.227 0.208 0.191 11 0.237 0.215 0.195 0.178 0.162 12 0.208 0.187 0.168 0.152 0.137 13 0.182 0.163 0.145 0.130 0.116 14 0.160 0.141 0.125 0.111 0.099 15 0.140 0.123 0.108 0.095 0.084 16 0.123 0.107 0.093 0.081 0.071 17 0.108 0.093 0.080 0.069 0.060 18 0.095 0.081 0.069 0.059 0.051 19 0.083 0.070 0.060 0.051 0.043 20 0.073 0.061 0.051 0.043 0.037 24 0.043 0.035 0.028 0.023 0.019 25 0.038 0.030 0.024 0.020 0.016 30 0.020 0.015 0.012 0.009 0.007 40 0.005 0.004 0.003 0.002 0.001 50 0.001 0.001 0.001 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 9% 10% 1.000 1.000 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.252 0.218 0.231 0.198 0.212 0.180 0.194 0.164 0.178 0.149 0.126 0.102 0.116 0.092 0.075 0.057 0.032 0.022 0.013 0.009 0.006 0.003 24% 28% 1.000 1.000 0.806 0.781 0.650 0.610 0.524 0.477 0.423 0.373 0.341 0.291 0.275 0.227 0.222 0.178 0.179 0.139 0.144 0.108 0.116 0.085 0.094 0.066 0.076 0.052 0.061 0.040 0.049 0.032 0.040 0.025 0.032 0.019 0.026 0.015 0.021 0.012 0.017 0.009 0.014 0.007 0.006 0.003 0.005 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 ONMONDO O 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 10-Year 15-Year 5.00% 9.50 8.55 7.70 6.93 TABLE 94.3 Depreciation Rates for MACRS Property Other than Real Property* Recovery Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 3 14.81 19.20 17.49 4 7.41 11.52 1249 5 11.52 8.93 6 5.76 8.92 7 8.93 8 4.46 9 10 11 12 13 14 15 16 17 18 19 20 21 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 6.23 5.90 5.90 5.91 5.90 5.91 20-Year 3.750% 7.219 6.677 6.177 5713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 5.90 5.91 5.90 5.91 2.95 *Assumes that the half year convention applies. As a financial analyst for Muffin Construction, you have been asked to recommend the method of financing the acquisition of new equipment needed by the firm. The equipment has a useful life of 8 years. If purchased, the equipment, which costs $600,000, will be depreciated under MACRS rules for 7-year class assets. If purchased, the needed funds can be borrowed at a 10 percent pretax annual rate. Muffin's weighted after-tax rate of capital is 17 percent. The actual salvage value at the end of 8 years is expected to be $20,000. Muffin's marginal ordinary tax rate is 40 percent. Annual, beginning-of-year lease payments would be $250,000. Use Table II and Table 9A-3 to answer the questions. a. Compute the net advantage to leasing. Round your answer to the nearest dollar. Use minus (-) sign for negative value, if any. $ b. Should Muffin lease or own the equipment? The asset should be -Select- 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts