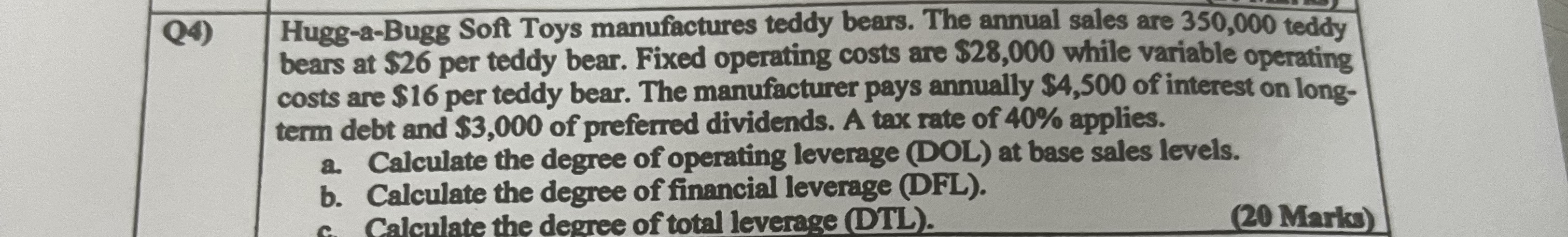

Question: table [ [ Q 4 ) , table [ [ Hugg - a - Bugg Soft Toys manufactures teddy bears. The annual sales

tableQtableHuggaBugg Soft Toys manufactures teddy bears. The annual sales are teddybears at $ per teddy bear. Fixed operating costs are $ while variable operatingcosts are $ per teddy bear. The manufacturer pays annually $ of interest on longterm debt and $ of preferred dividends. A tax rate of applies.a Calculate the degree of operating leverage DOL at base sales levels.b Calculate the degree of financial leverage DFLof total leverage DTL Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock