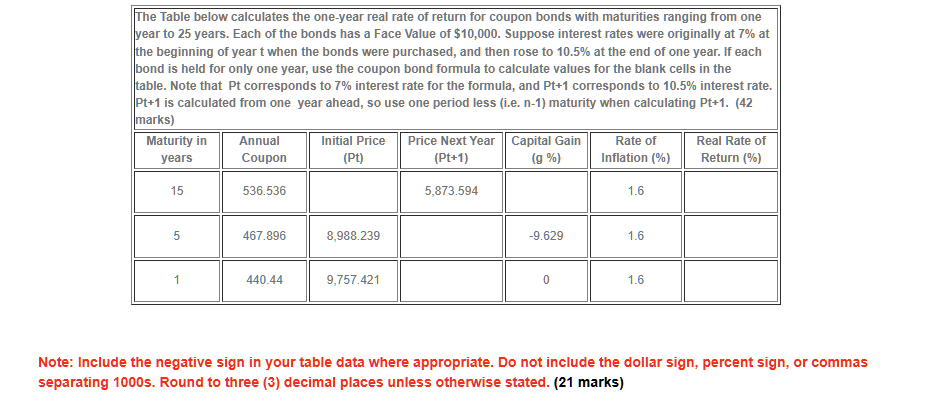

Question: table [ [ The Table below calculates the one - year real rate of return for coupon bonds with maturities ranging from one year

tableThe Table below calculates the oneyear real rate of return for coupon bonds with maturities ranging from one year to years. Each of the bonds has a Face Value of $ Suppose interest rates were originally at at the beginning of year t when the bonds were purchased, and then rose to at the end of one year. If each bond is held for only one year, use the coupon bond formula to calculate values for the blank cells in the table. Note that Pt corresponds to interest rate for the formula, and Pt corresponds to interest rate. Pt is calculated from one year ahead, so use one period less ie n maturity when calculating Pt marksMaturity in years,tableAnnualCoupontableInitial PricePtPrice Next Year PtCapital Gain g Rate of Part : Calculate the purchase price Pt for the year bond:

Part : Calculate the sale price for the year bond:

Part : Calculate the sale price for the year bond:

Part : Calculate the capital gain g on the year bond:

Part : Calculate the real rate of return RRET on the year bond:

Part : Calculate the real rate of return RRET on the year bond:

Part : Calculate the real rate of return RRET on the year bond:

Inflation tableReal Rate ofReturn

Note: Include the negative sign in your table data where appropriate. Do not include the dollar sign, percent sign, or commas separating s Round to three decimal places unless otherwise stated. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock