Question: table [ [ TIME , table [ [ R W F = xQuestion 1 : ( 2 0 points ) Dr . Poseidon,

tableTIMEtablexQuestion : points

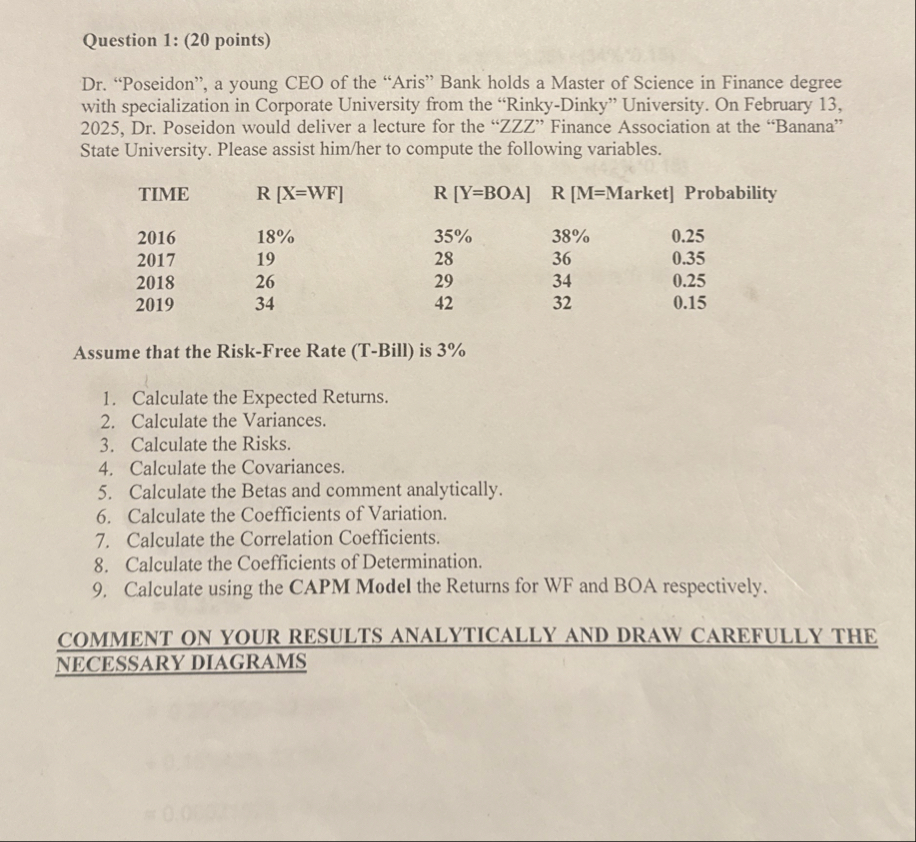

Dr "Poseidon", a young CEO of the "Aris" Bank holds a Master of Science in Finance degree with specialization in Corporate University from the "RinkyDinky" University. On February Dr Poseidon would deliver a lecture for the ZZZ Finance Association at the "Banana" State University. Please assist himher to compute the following variables.

tableTIMER XWFR YBOAR MMarket Probability,

Assume that the RiskFree Rate TBill is

Calculate the Expected Returns.

Calculate the Variances.

Calculate the Risks.

Calculate the Covariances.

Calculate the Betas and comment analytically.

Calculate the Coefficients of Variation.

Calculate the Correlation Coefficients.

Calculate the Coefficients of Determination.

Calculate using the CAPM Model the Returns for WF and BOA respectively.

COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAW CAREFULLY THE NECESSARY DIAGRAMS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock