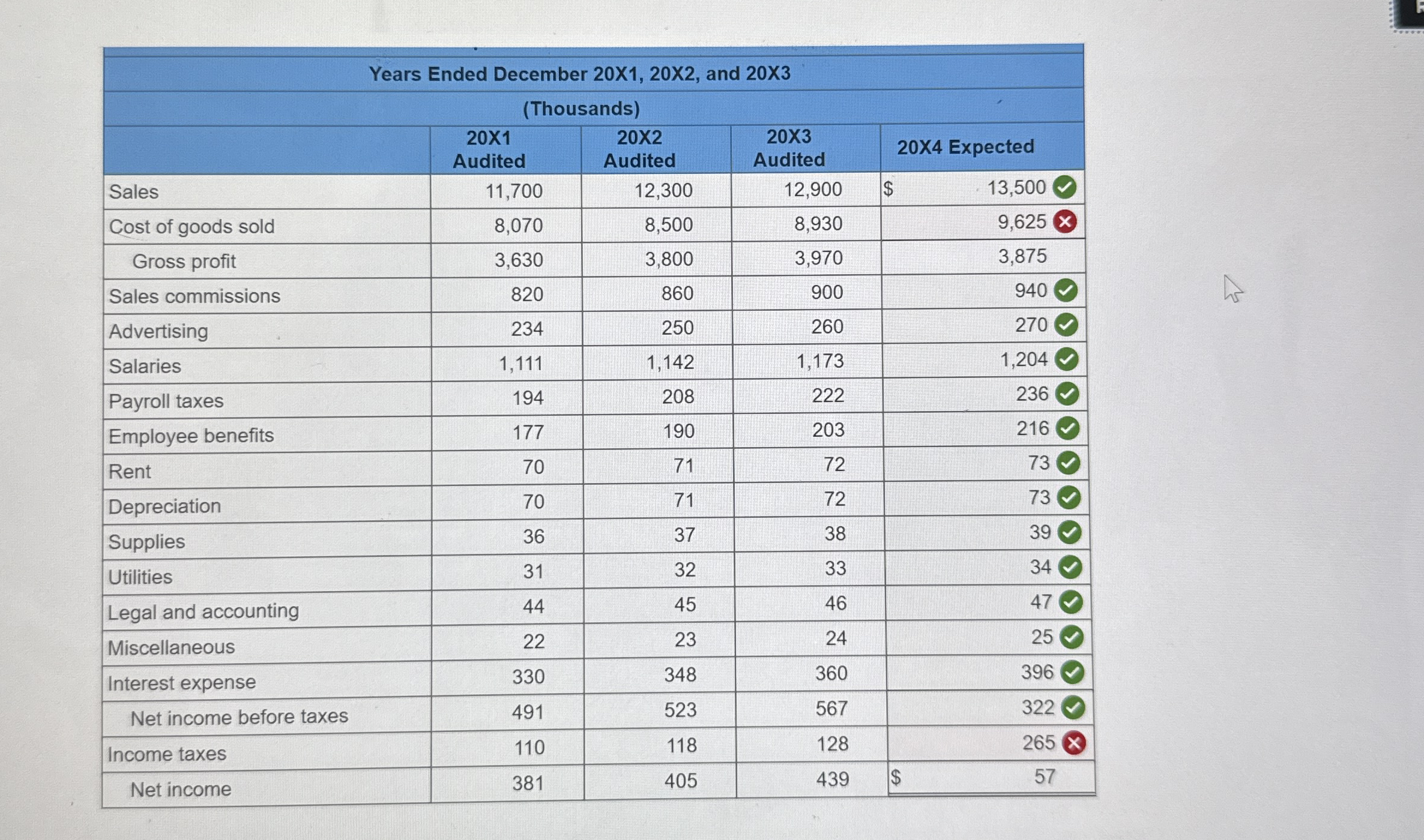

Question: table [ [ Years Ended December 2 0 X 1 , 2 0 X 2 , and 2 0 X 3 ] , [

tableYears Ended December XX and XThousandsX Audited,X Audited,X Audited,X ExpectedSales$ Cost of goods sold,Gross profit,Sales commissions,AdvertisingSalariesPayroll taxes,Employee benefits,RentDepreciationSuppliesUtilitiesLegal and accounting,MiscellaneousInterest expense,Net income before taxes,Income taxes,Net income,$

tableSuppliesUtilitiesLegal and accounting,MiscellaneousInterest expense,Net income before taxes,Income taxes,Net income,$

c Uden's unaudited financial statements for the current year show a percent gross profit rate. Assuming that this represents a misstatement from the amount that you developed as an expectation, calculate the estimated effect of this misstatement on net income before taxes for X

Note: Enter your answers in thousands.

Answer is complete but not entirely correct.

Expected misstatement

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock